Cyber risk underwriting evaluates threats related to digital security breaches, data theft, and cyberattacks, focusing on assessing vulnerabilities in information technology systems and the potential financial impact on businesses. Travel underwriting concentrates on risks associated with trip cancellations, medical emergencies, and geopolitical disruptions affecting travelers' safety and trip continuity. Explore the nuances of these underwriting approaches to understand how insurers tailor policies for distinct risk environments.

Why it is important

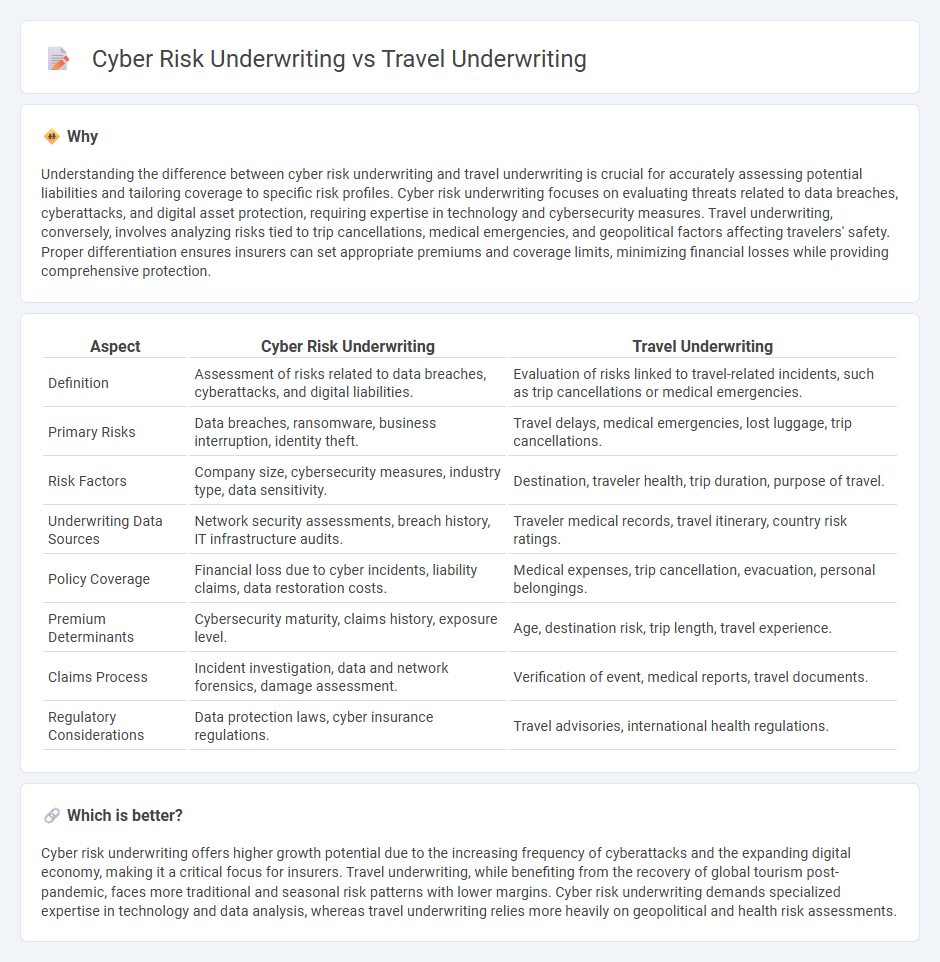

Understanding the difference between cyber risk underwriting and travel underwriting is crucial for accurately assessing potential liabilities and tailoring coverage to specific risk profiles. Cyber risk underwriting focuses on evaluating threats related to data breaches, cyberattacks, and digital asset protection, requiring expertise in technology and cybersecurity measures. Travel underwriting, conversely, involves analyzing risks tied to trip cancellations, medical emergencies, and geopolitical factors affecting travelers' safety. Proper differentiation ensures insurers can set appropriate premiums and coverage limits, minimizing financial losses while providing comprehensive protection.

Comparison Table

| Aspect | Cyber Risk Underwriting | Travel Underwriting |

|---|---|---|

| Definition | Assessment of risks related to data breaches, cyberattacks, and digital liabilities. | Evaluation of risks linked to travel-related incidents, such as trip cancellations or medical emergencies. |

| Primary Risks | Data breaches, ransomware, business interruption, identity theft. | Travel delays, medical emergencies, lost luggage, trip cancellations. |

| Risk Factors | Company size, cybersecurity measures, industry type, data sensitivity. | Destination, traveler health, trip duration, purpose of travel. |

| Underwriting Data Sources | Network security assessments, breach history, IT infrastructure audits. | Traveler medical records, travel itinerary, country risk ratings. |

| Policy Coverage | Financial loss due to cyber incidents, liability claims, data restoration costs. | Medical expenses, trip cancellation, evacuation, personal belongings. |

| Premium Determinants | Cybersecurity maturity, claims history, exposure level. | Age, destination risk, trip length, travel experience. |

| Claims Process | Incident investigation, data and network forensics, damage assessment. | Verification of event, medical reports, travel documents. |

| Regulatory Considerations | Data protection laws, cyber insurance regulations. | Travel advisories, international health regulations. |

Which is better?

Cyber risk underwriting offers higher growth potential due to the increasing frequency of cyberattacks and the expanding digital economy, making it a critical focus for insurers. Travel underwriting, while benefiting from the recovery of global tourism post-pandemic, faces more traditional and seasonal risk patterns with lower margins. Cyber risk underwriting demands specialized expertise in technology and data analysis, whereas travel underwriting relies more heavily on geopolitical and health risk assessments.

Connection

Cyber risk underwriting and travel underwriting intersect through the evaluation of digital vulnerabilities impacting travelers, such as data breaches or cyber-attacks on travel reservation systems. Both underwriting processes assess exposure to financial losses linked to cybersecurity threats, including identity theft, ransomware, and privacy violations affecting travel-related services. Integrating cyber risk analytics with travel insurance underwriting enhances risk mitigation by addressing emerging threats in increasingly digital and connected travel environments.

Key Terms

**Travel Underwriting:**

Travel underwriting assesses potential risks related to trip cancellations, medical emergencies, and travel disruptions using data from historical claims, destination risk profiles, and traveler behavior. It involves analyzing factors such as geographic hazards, traveler demographics, and trip duration to accurately price insurance policies. Explore more to understand how travel underwriting safeguards both insurers and travelers against unpredictable travel risks.

Pre-existing Medical Conditions

Travel underwriting carefully assesses pre-existing medical conditions to determine coverage eligibility and premium rates, as these conditions can significantly impact claim likelihood during trips. Cyber risk underwriting, however, focuses on underwriting exposures related to information security, thus pre-existing medical conditions have little relevance in this domain. Explore how these differences shape underwriting strategies and risk management approaches in specialized insurance lines.

Trip Cancellation Coverage

Travel underwriting specializes in assessing risks related to trip cancellations, considering factors such as destination instability, health concerns, and travel disruptions. Cyber risk underwriting, although focused on digital threats like data breaches and ransomware, may occasionally intersect with travel coverage when trip cancellations result from cyber incidents affecting travel infrastructure. Discover more about the distinctions and overlaps in trip cancellation coverage between travel and cyber risk underwriting.

Source and External Links

Travel Insurance Underwriters - Underwriters in travel insurance evaluate risks such as trip cancellation and medical emergencies, using data to set premiums and determine coverage, ensuring financial stability and claims approval reliability.

Travel Insurance Underwriters | TravelInsurance.com - Travel insurance underwriters assess the risk of travel events and decide premium rates and coverage, also validating claims to manage risk and ensure adequate protection for the policyholder.

Global Underwriters Insurance - VisitorsCoverage - Global Underwriters is a leading underwriter providing international travel, health, and special risk insurance worldwide, with comprehensive products for individuals and groups on business or vacation.

dowidth.com

dowidth.com