Cyber insurance protects businesses from data breaches, ransomware attacks, and other cyber threats by covering financial losses and recovery costs. Liability insurance offers coverage for legal claims arising from bodily injury, property damage, or negligence in business operations. Explore how each policy safeguards your enterprise against distinct risks and legal exposures.

Why it is important

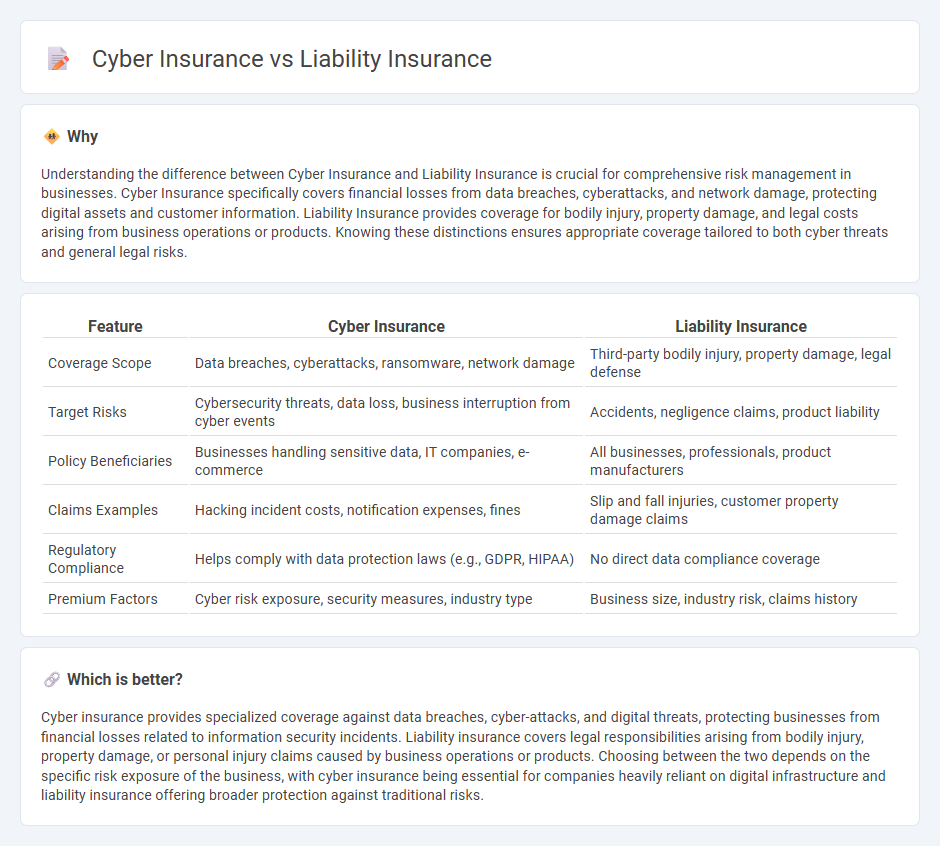

Understanding the difference between Cyber Insurance and Liability Insurance is crucial for comprehensive risk management in businesses. Cyber Insurance specifically covers financial losses from data breaches, cyberattacks, and network damage, protecting digital assets and customer information. Liability Insurance provides coverage for bodily injury, property damage, and legal costs arising from business operations or products. Knowing these distinctions ensures appropriate coverage tailored to both cyber threats and general legal risks.

Comparison Table

| Feature | Cyber Insurance | Liability Insurance |

|---|---|---|

| Coverage Scope | Data breaches, cyberattacks, ransomware, network damage | Third-party bodily injury, property damage, legal defense |

| Target Risks | Cybersecurity threats, data loss, business interruption from cyber events | Accidents, negligence claims, product liability |

| Policy Beneficiaries | Businesses handling sensitive data, IT companies, e-commerce | All businesses, professionals, product manufacturers |

| Claims Examples | Hacking incident costs, notification expenses, fines | Slip and fall injuries, customer property damage claims |

| Regulatory Compliance | Helps comply with data protection laws (e.g., GDPR, HIPAA) | No direct data compliance coverage |

| Premium Factors | Cyber risk exposure, security measures, industry type | Business size, industry risk, claims history |

Which is better?

Cyber insurance provides specialized coverage against data breaches, cyber-attacks, and digital threats, protecting businesses from financial losses related to information security incidents. Liability insurance covers legal responsibilities arising from bodily injury, property damage, or personal injury claims caused by business operations or products. Choosing between the two depends on the specific risk exposure of the business, with cyber insurance being essential for companies heavily reliant on digital infrastructure and liability insurance offering broader protection against traditional risks.

Connection

Cyber insurance and liability insurance are interconnected through their focus on managing risks arising from digital threats and legal responsibilities. Cyber insurance specifically covers financial losses related to cyberattacks, data breaches, and network disruptions, while liability insurance protects businesses from claims due to third-party injuries or property damage, including those caused by cyber incidents. Together, these policies provide comprehensive risk management by addressing both the technological vulnerabilities and potential legal consequences of cyber-related events.

Key Terms

Coverage Scope

Liability insurance primarily covers legal claims arising from bodily injury, property damage, and personal injury, while cyber insurance addresses risks related to data breaches, cyberattacks, and digital asset loss. Cyber insurance policies often include coverage for incident response, regulatory fines, and business interruption caused by cyber incidents. Explore in-depth comparisons of coverage scope to select the optimal insurance for your risk profile.

Risk Type

Liability insurance primarily covers legal claims arising from bodily injury, property damage, and personal injury caused by negligence or accidents, protecting businesses from financial losses due to third-party lawsuits. Cyber insurance specifically addresses risks related to data breaches, cyberattacks, and online threats, offering coverage for data restoration, cyber extortion, and liability arising from compromised digital assets. Explore more to understand which insurance best mitigates your unique business risks.

Claims Process

Liability insurance claims typically involve third-party property damage or bodily injury and require detailed documentation to establish fault and policy coverage. Cyber insurance claims focus on incidents like data breaches, ransomware attacks, and system interruptions, often necessitating forensic investigations and coordination with cybersecurity experts. Explore the nuances of claims processes between liability and cyber insurance to better protect your business assets.

Source and External Links

What is Liability Car Insurance Coverage? - State Farm(r) - Liability car insurance financially protects you if you are responsible for bodily injury or property damage to others during an accident and is required by law in most states.

Liability Insurance - General Coverage for Your Business - GEICO - General liability insurance protects businesses from claims related to bodily injury, property damage, advertising injury, and legal defense costs arising from normal business operations.

General Liability Insurance: Get a Free Quote | Hiscox - General liability insurance covers small businesses for claims of bodily injury, property damage, and personal or advertising injury caused by business activities or employees.

dowidth.com

dowidth.com