Crop insurance protects farmers against losses due to natural disasters, pests, or adverse weather conditions, ensuring financial stability for agricultural operations. Flood insurance specifically covers property damage caused by flooding, a common risk in flood-prone areas that standard homeowners insurance may not include. Explore the differences in coverage, eligibility, and benefits to determine the most suitable option for your needs.

Why it is important

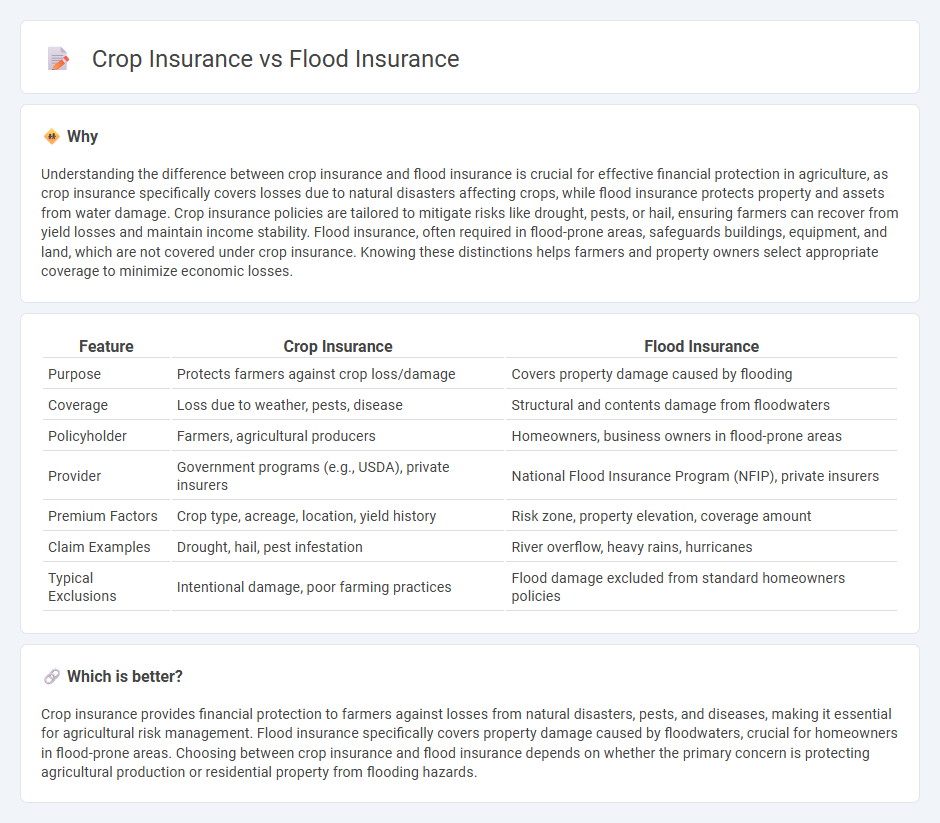

Understanding the difference between crop insurance and flood insurance is crucial for effective financial protection in agriculture, as crop insurance specifically covers losses due to natural disasters affecting crops, while flood insurance protects property and assets from water damage. Crop insurance policies are tailored to mitigate risks like drought, pests, or hail, ensuring farmers can recover from yield losses and maintain income stability. Flood insurance, often required in flood-prone areas, safeguards buildings, equipment, and land, which are not covered under crop insurance. Knowing these distinctions helps farmers and property owners select appropriate coverage to minimize economic losses.

Comparison Table

| Feature | Crop Insurance | Flood Insurance |

|---|---|---|

| Purpose | Protects farmers against crop loss/damage | Covers property damage caused by flooding |

| Coverage | Loss due to weather, pests, disease | Structural and contents damage from floodwaters |

| Policyholder | Farmers, agricultural producers | Homeowners, business owners in flood-prone areas |

| Provider | Government programs (e.g., USDA), private insurers | National Flood Insurance Program (NFIP), private insurers |

| Premium Factors | Crop type, acreage, location, yield history | Risk zone, property elevation, coverage amount |

| Claim Examples | Drought, hail, pest infestation | River overflow, heavy rains, hurricanes |

| Typical Exclusions | Intentional damage, poor farming practices | Flood damage excluded from standard homeowners policies |

Which is better?

Crop insurance provides financial protection to farmers against losses from natural disasters, pests, and diseases, making it essential for agricultural risk management. Flood insurance specifically covers property damage caused by floodwaters, crucial for homeowners in flood-prone areas. Choosing between crop insurance and flood insurance depends on whether the primary concern is protecting agricultural production or residential property from flooding hazards.

Connection

Crop insurance and flood insurance are interconnected as both provide financial protection against natural disasters that impact agricultural productivity. Crop insurance specifically covers losses due to events like droughts, floods, and extreme weather, while flood insurance protects properties and assets from water damage caused by flooding. Together, these insurance types help farmers mitigate economic risks related to unpredictable environmental conditions.

Key Terms

Covered Perils

Flood insurance specifically covers damages caused by flooding, including rising water from heavy rainfall, storm surges, and flash floods, protecting residential and commercial properties. Crop insurance primarily addresses losses due to natural disasters like drought, excessive rainfall, hail, and pest infestations, ensuring financial stability for farmers. Explore detailed differences and coverage specifics to determine the best protection for your needs.

Policyholder

Flood insurance primarily protects property owners and renters against water damage caused by flooding, covering structural losses and personal belongings. Crop insurance serves farmers by mitigating financial risks from crop yield reductions due to natural disasters, pests, or price fluctuations, ensuring income stability. Explore detailed comparisons to understand which policy best safeguards your assets and livelihood.

Claims Process

Flood insurance claims generally require detailed documentation including proof of flood damage through photos, repair estimates, and official flood maps, with adjusters conducting on-site inspections to verify losses. Crop insurance claims involve assessing loss of yield or revenue using field reports, satellite data, and farmer records, often necessitating timely reporting to ensure compensation based on USDA guidelines. Explore the specifics of each claims process to better protect your assets against natural disasters.

Source and External Links

Flood Insurance | FEMA.gov - The National Flood Insurance Program (NFIP), managed by FEMA and offered through a network of insurers, provides separate flood insurance policies for property owners, renters, and businesses to cover structures and contents, with coverage required in high-risk areas for those with government-backed mortgages.

Flood Insurance Resources - California Department of Insurance - NFIP policies generally cover direct physical loss from floods, including overflow of inland or tidal waters, rapid surface runoff, and mudflows, but exclude damage from earth movement even if caused by flooding.

Get a Flood Insurance Quote Now | GEICO - GEICO offers NFIP-backed flood insurance quotes through its agents, with policies that cover damages excluded by standard homeowners insurance and rates tailored to your specific location.

dowidth.com

dowidth.com