Liquid staking offers a decentralized finance (DeFi) solution that allows users to stake cryptocurrencies and still retain liquidity by receiving tokenized representations of staked assets. Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often yielding higher but more volatile returns. Explore the detailed mechanisms and risks of each strategy to optimize your crypto investment portfolio.

Why it is important

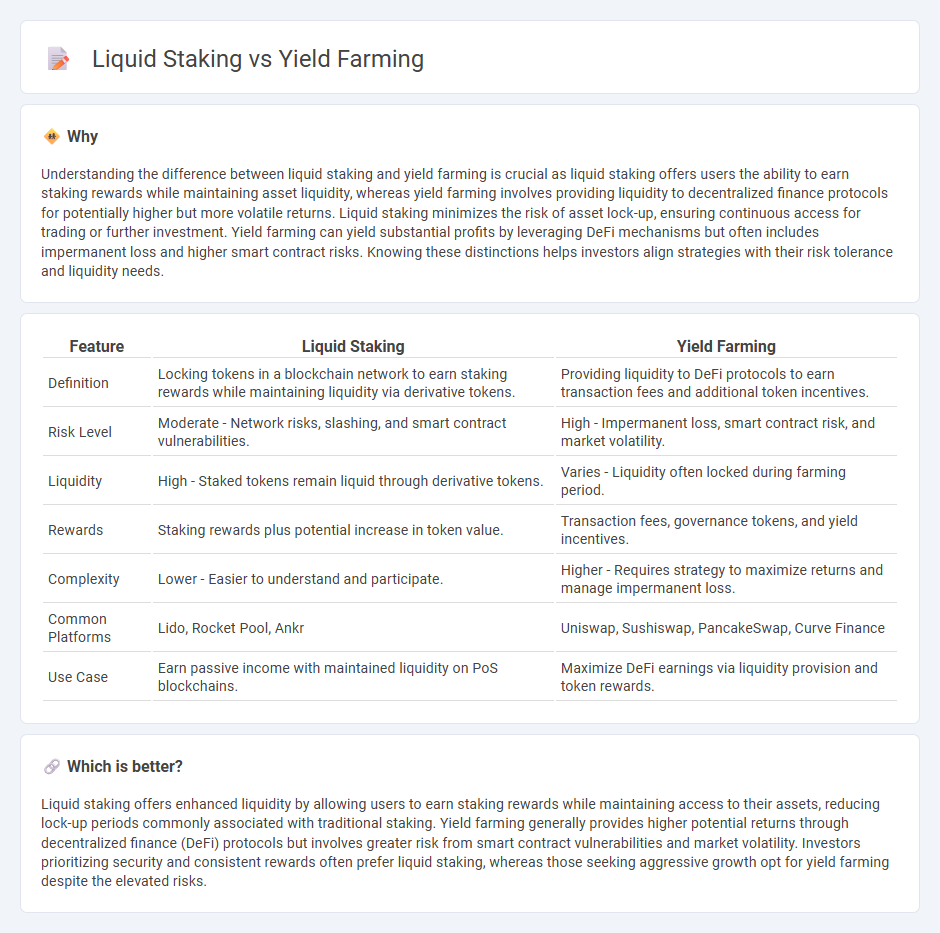

Understanding the difference between liquid staking and yield farming is crucial as liquid staking offers users the ability to earn staking rewards while maintaining asset liquidity, whereas yield farming involves providing liquidity to decentralized finance protocols for potentially higher but more volatile returns. Liquid staking minimizes the risk of asset lock-up, ensuring continuous access for trading or further investment. Yield farming can yield substantial profits by leveraging DeFi mechanisms but often includes impermanent loss and higher smart contract risks. Knowing these distinctions helps investors align strategies with their risk tolerance and liquidity needs.

Comparison Table

| Feature | Liquid Staking | Yield Farming |

|---|---|---|

| Definition | Locking tokens in a blockchain network to earn staking rewards while maintaining liquidity via derivative tokens. | Providing liquidity to DeFi protocols to earn transaction fees and additional token incentives. |

| Risk Level | Moderate - Network risks, slashing, and smart contract vulnerabilities. | High - Impermanent loss, smart contract risk, and market volatility. |

| Liquidity | High - Staked tokens remain liquid through derivative tokens. | Varies - Liquidity often locked during farming period. |

| Rewards | Staking rewards plus potential increase in token value. | Transaction fees, governance tokens, and yield incentives. |

| Complexity | Lower - Easier to understand and participate. | Higher - Requires strategy to maximize returns and manage impermanent loss. |

| Common Platforms | Lido, Rocket Pool, Ankr | Uniswap, Sushiswap, PancakeSwap, Curve Finance |

| Use Case | Earn passive income with maintained liquidity on PoS blockchains. | Maximize DeFi earnings via liquidity provision and token rewards. |

Which is better?

Liquid staking offers enhanced liquidity by allowing users to earn staking rewards while maintaining access to their assets, reducing lock-up periods commonly associated with traditional staking. Yield farming generally provides higher potential returns through decentralized finance (DeFi) protocols but involves greater risk from smart contract vulnerabilities and market volatility. Investors prioritizing security and consistent rewards often prefer liquid staking, whereas those seeking aggressive growth opt for yield farming despite the elevated risks.

Connection

Liquid staking enhances yield farming by providing staked assets that remain liquid and can be used as collateral or deposited into yield farming protocols to earn additional returns. This integration optimizes capital efficiency, allowing investors to maximize yield generation without sacrificing staking rewards or liquidity. The synergy between liquid staking tokens and yield farming strategies drives higher overall rewards in decentralized finance (DeFi) ecosystems.

Key Terms

Liquidity Provision

Yield farming involves providing liquidity to decentralized finance (DeFi) protocols by staking tokens in liquidity pools, earning rewards from transaction fees and token incentives. Liquid staking enables users to stake their tokens and receive derivative tokens that represent their staked assets, maintaining liquidity while earning staking rewards. Explore the key differences and benefits of liquidity provision in yield farming and liquid staking to optimize your crypto portfolio.

Staking Derivatives

Yield farming involves providing liquidity to DeFi protocols to earn rewards, whereas liquid staking enables token holders to stake assets while retaining liquidity through staking derivatives. Staking derivatives represent staked tokens as liquid assets, allowing users to participate in further DeFi activities without locking assets indefinitely. Discover how staking derivatives revolutionize liquidity and reward strategies in decentralized finance.

Reward Mechanisms

Yield farming offers high reward rates by incentivizing liquidity provision through variable token incentives and protocol fees, while liquid staking delivers rewards primarily via staked asset yields and network inflation without locking funds. The risk-adjusted returns differ significantly, with yield farming subject to impermanent loss and smart contract risks, whereas liquid staking emphasizes more stable, blockchain-native rewards alongside liquidity flexibility. Explore the detailed comparison of reward structures to optimize your decentralized finance strategy effectively.

Source and External Links

What Is Yield Farming? Meaning and Definition - Chainlink - Yield farming, also called liquidity mining, is a DeFi practice where users provide liquidity or other value to a protocol and earn rewards, often in native tokens, boosting liquidity and distributing governance tokens to users proportionally to their contributions.

What is yield farming and how does it work? - Coinbase - Yield farming involves allocating digital assets to DeFi protocols as liquidity providers to earn rewards typically paid in governance tokens, aiming to incentivize and sustain DeFi platforms but carrying risks like impermanent loss and smart contract vulnerabilities.

Yield Farming Explained: Your Complete Beginner's Guide - Yield farming is a DeFi strategy to earn rewards through providing liquidity to DEXs or lending protocols, receiving fees and governance tokens, with complexities requiring understanding of risk factors such as impermanent loss and smart contract flaws.

dowidth.com

dowidth.com