Synthetic assets replicate the economic characteristics of cash instruments through derivatives, enabling exposure to underlying assets without owning them directly. These financial instruments offer benefits such as enhanced liquidity, risk management, and access to otherwise inaccessible markets. Explore the advantages and applications of synthetic assets compared to traditional cash instruments to optimize your investment strategies.

Why it is important

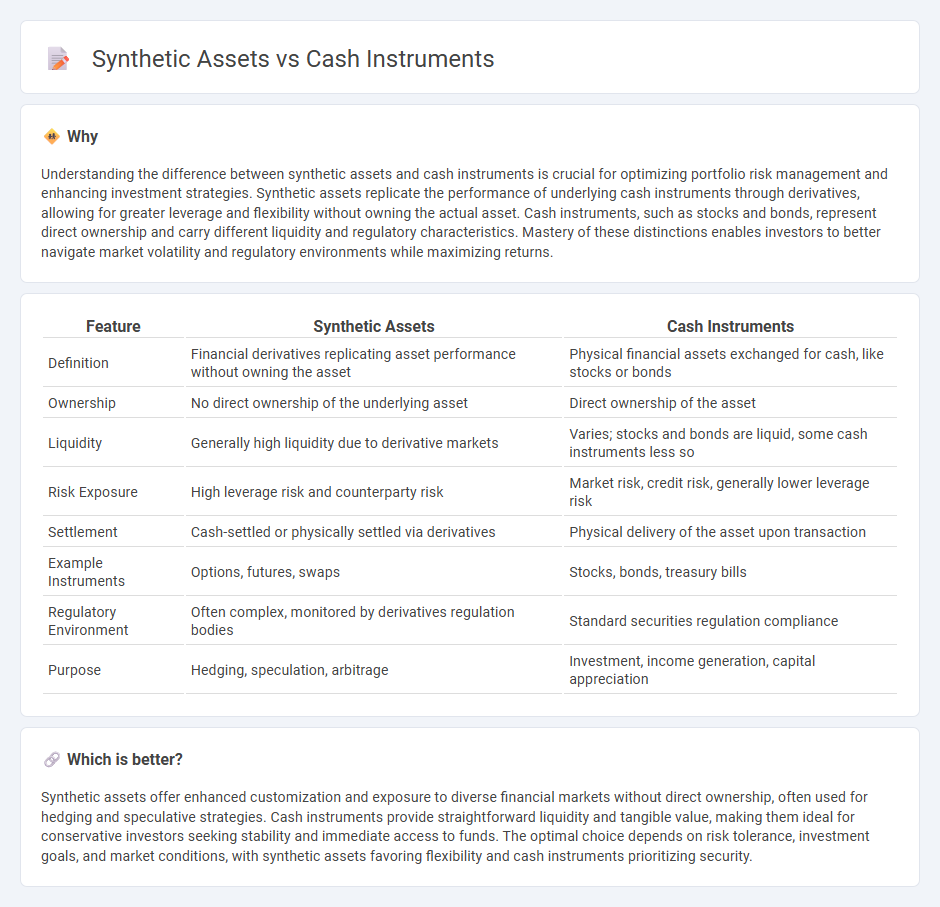

Understanding the difference between synthetic assets and cash instruments is crucial for optimizing portfolio risk management and enhancing investment strategies. Synthetic assets replicate the performance of underlying cash instruments through derivatives, allowing for greater leverage and flexibility without owning the actual asset. Cash instruments, such as stocks and bonds, represent direct ownership and carry different liquidity and regulatory characteristics. Mastery of these distinctions enables investors to better navigate market volatility and regulatory environments while maximizing returns.

Comparison Table

| Feature | Synthetic Assets | Cash Instruments |

|---|---|---|

| Definition | Financial derivatives replicating asset performance without owning the asset | Physical financial assets exchanged for cash, like stocks or bonds |

| Ownership | No direct ownership of the underlying asset | Direct ownership of the asset |

| Liquidity | Generally high liquidity due to derivative markets | Varies; stocks and bonds are liquid, some cash instruments less so |

| Risk Exposure | High leverage risk and counterparty risk | Market risk, credit risk, generally lower leverage risk |

| Settlement | Cash-settled or physically settled via derivatives | Physical delivery of the asset upon transaction |

| Example Instruments | Options, futures, swaps | Stocks, bonds, treasury bills |

| Regulatory Environment | Often complex, monitored by derivatives regulation bodies | Standard securities regulation compliance |

| Purpose | Hedging, speculation, arbitrage | Investment, income generation, capital appreciation |

Which is better?

Synthetic assets offer enhanced customization and exposure to diverse financial markets without direct ownership, often used for hedging and speculative strategies. Cash instruments provide straightforward liquidity and tangible value, making them ideal for conservative investors seeking stability and immediate access to funds. The optimal choice depends on risk tolerance, investment goals, and market conditions, with synthetic assets favoring flexibility and cash instruments prioritizing security.

Connection

Synthetic assets replicate the value and performance of cash instruments such as stocks, bonds, or currencies through derivatives like options, futures, or swaps. These financial products provide investors with exposure to underlying cash instruments without owning them directly, enabling strategies for hedging, speculation, or arbitrage. The price of synthetic assets is intrinsically linked to the movements of the corresponding cash instruments, maintaining market efficiency and liquidity.

Key Terms

Underlying Asset

Cash instruments represent direct ownership of underlying assets such as stocks, bonds, or commodities, providing tangible exposure and clear valuation based on the asset's market price. Synthetic assets derive their value from derivatives or combinations of financial contracts, replicating the payoff of the underlying asset without requiring actual ownership, which can introduce counterparty risk and complexity. Explore how understanding these differences impacts investment strategies and risk management.

Derivative

Cash instruments represent actual ownership of financial assets like stocks or bonds, enabling direct investment exposure. Synthetic assets in derivatives replicate the payoffs of underlying instruments without owning the physical asset, often created through options, futures, or swaps. Explore in-depth comparative insights and applications of cash instruments versus synthetic assets in derivatives to enhance your investment strategy knowledge.

Liquidity

Cash instruments like stocks and bonds provide direct ownership and typically exhibit higher liquidity due to their established markets and standardized trading processes. Synthetic assets, created using derivatives such as options, swaps, or futures, offer exposure to underlying assets but often face lower liquidity and higher counterparty risk because they depend on complex contractual agreements. Explore more about how liquidity dynamics differ between cash instruments and synthetic assets.

Source and External Links

Financial Instruments - Creating Opportunities for Entrepreneurs - Cash instruments are financial instruments with values directly influenced by market conditions and include securities (like stocks) and contractual monetary assets such as deposits and loans.

What Is a Financial Instrument? Types & Asset Classes - SoFi - Cash instruments are financial instruments whose value fluctuates with market changes and can be securities traded on exchanges, certificates of deposit, or loans that involve agreements between parties.

Financial Instrument - Overview, Types, Asset Classes - Cash instruments include securities and deposits or loans, all having values directly influenced by market conditions and contractual agreements between parties for monetary assets.

dowidth.com

dowidth.com