Yield farming offers high returns by staking cryptocurrencies in decentralized finance (DeFi) platforms, leveraging liquidity pools and smart contracts. Dividend investing involves purchasing shares of companies that regularly distribute profits as dividends, providing steady income and potential stock appreciation. Explore the key differences and benefits of yield farming versus dividend investing to optimize your financial strategy.

Why it is important

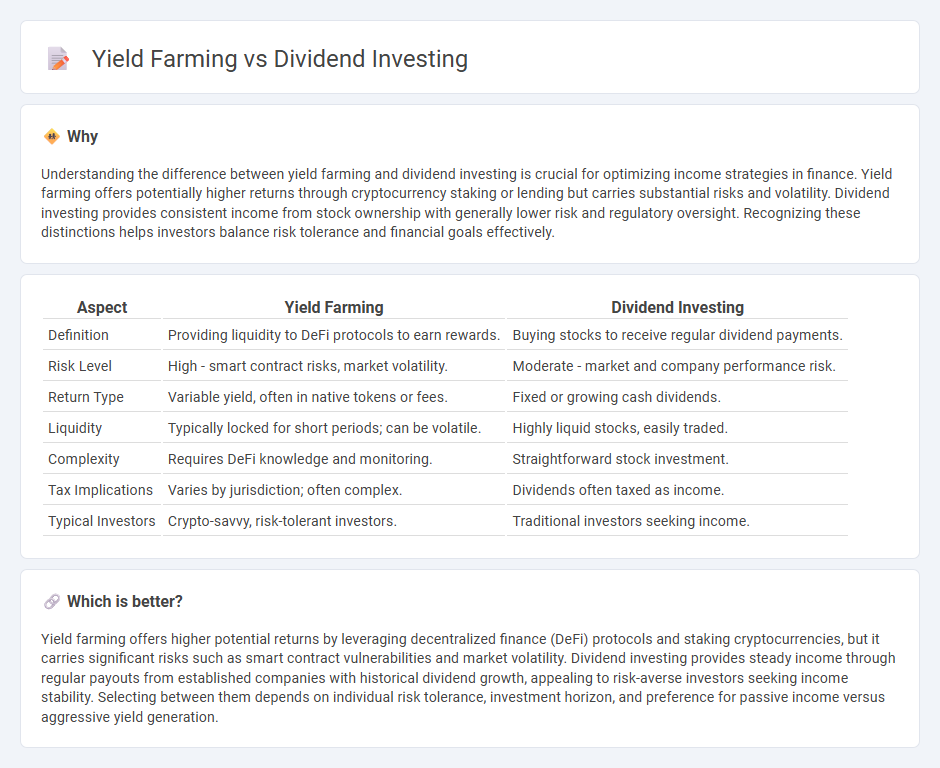

Understanding the difference between yield farming and dividend investing is crucial for optimizing income strategies in finance. Yield farming offers potentially higher returns through cryptocurrency staking or lending but carries substantial risks and volatility. Dividend investing provides consistent income from stock ownership with generally lower risk and regulatory oversight. Recognizing these distinctions helps investors balance risk tolerance and financial goals effectively.

Comparison Table

| Aspect | Yield Farming | Dividend Investing |

|---|---|---|

| Definition | Providing liquidity to DeFi protocols to earn rewards. | Buying stocks to receive regular dividend payments. |

| Risk Level | High - smart contract risks, market volatility. | Moderate - market and company performance risk. |

| Return Type | Variable yield, often in native tokens or fees. | Fixed or growing cash dividends. |

| Liquidity | Typically locked for short periods; can be volatile. | Highly liquid stocks, easily traded. |

| Complexity | Requires DeFi knowledge and monitoring. | Straightforward stock investment. |

| Tax Implications | Varies by jurisdiction; often complex. | Dividends often taxed as income. |

| Typical Investors | Crypto-savvy, risk-tolerant investors. | Traditional investors seeking income. |

Which is better?

Yield farming offers higher potential returns by leveraging decentralized finance (DeFi) protocols and staking cryptocurrencies, but it carries significant risks such as smart contract vulnerabilities and market volatility. Dividend investing provides steady income through regular payouts from established companies with historical dividend growth, appealing to risk-averse investors seeking income stability. Selecting between them depends on individual risk tolerance, investment horizon, and preference for passive income versus aggressive yield generation.

Connection

Yield farming and dividend investing both focus on generating passive income through asset ownership, yet yield farming operates within decentralized finance (DeFi) by staking cryptocurrencies to earn interest or tokens, whereas dividend investing involves acquiring traditional equity shares that pay periodic dividends. Both strategies aim to maximize returns by leveraging assets, but yield farming typically presents higher risk and volatility compared to the more stable, regulated dividend-paying stocks. Investors seeking consistent income streams analyze metrics like annual percentage yield (APY) for yield farming and dividend yield ratios for dividend investing to optimize portfolio performance.

Key Terms

**Dividend Investing:**

Dividend investing involves purchasing stocks from companies that regularly distribute a portion of their earnings as dividends, providing steady passive income and potential for capital appreciation. Key metrics to evaluate dividend investments include dividend yield, payout ratio, and dividend growth rate, which help assess income reliability and sustainability. Explore comprehensive strategies and tools to maximize your dividend portfolio's long-term growth and income potential.

Dividend Yield

Dividend investing focuses on generating regular income through dividend yield, which is the annual dividend payment divided by the stock's current price, representing a stable return on investment. Yield farming, in contrast, involves earning returns by providing liquidity to decentralized finance (DeFi) protocols, often resulting in higher but more volatile yields. Explore the differences between these strategies to understand which aligns best with your financial goals.

Ex-Dividend Date

Dividend investing centers on purchasing stocks before the ex-dividend date to capture dividend payouts, a strategy that relies on company earnings and stable payouts for passive income. Yield farming involves staking or lending cryptocurrency assets in decentralized finance protocols to earn interest or new tokens, with returns varying based on market demand and smart contract conditions. Explore the nuances of ex-dividend dates and yield farming mechanisms to optimize your income-generating investments.

Source and External Links

Is Dividend Investing Worth It? The Complete Guide - Dividend investing involves purchasing stocks that pay regular dividends, providing income and potential capital gains by investing in well-established companies that share earnings with shareholders.

What is Dividend Investing & Qualified Dividends | Equifax - Dividend investing is buying stocks that pay regular dividends, offering returns through dividend payments plus potential stock price appreciation, typically from stable, large companies.

How dividends work: A comprehensive guide to dividend investing - Dividends are usually paid quarterly, and reinvesting dividends through plans can compound returns by automatically buying more shares, increasing both ownership and future dividend income.

dowidth.com

dowidth.com