Perpetual futures contracts allow traders to hold positions indefinitely without an expiry date, unlike traditional futures that settle on a predetermined date. These contracts use a funding rate mechanism to anchor prices to the spot market, providing continuous price discovery and reducing rollover risks. Explore the differences between perpetual and traditional futures to optimize your trading strategy.

Why it is important

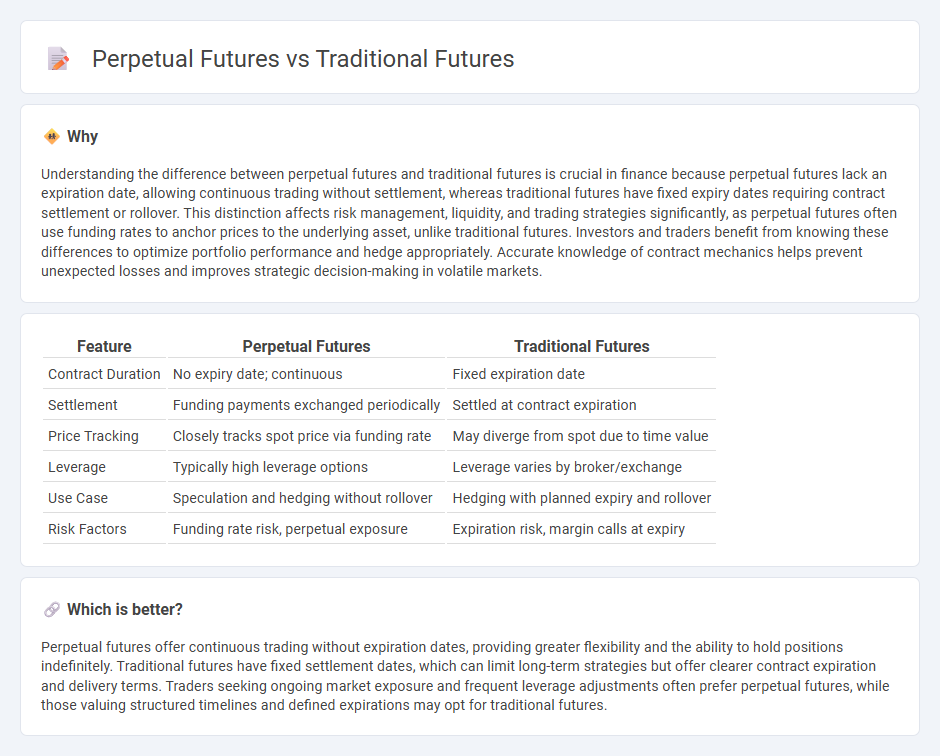

Understanding the difference between perpetual futures and traditional futures is crucial in finance because perpetual futures lack an expiration date, allowing continuous trading without settlement, whereas traditional futures have fixed expiry dates requiring contract settlement or rollover. This distinction affects risk management, liquidity, and trading strategies significantly, as perpetual futures often use funding rates to anchor prices to the underlying asset, unlike traditional futures. Investors and traders benefit from knowing these differences to optimize portfolio performance and hedge appropriately. Accurate knowledge of contract mechanics helps prevent unexpected losses and improves strategic decision-making in volatile markets.

Comparison Table

| Feature | Perpetual Futures | Traditional Futures |

|---|---|---|

| Contract Duration | No expiry date; continuous | Fixed expiration date |

| Settlement | Funding payments exchanged periodically | Settled at contract expiration |

| Price Tracking | Closely tracks spot price via funding rate | May diverge from spot due to time value |

| Leverage | Typically high leverage options | Leverage varies by broker/exchange |

| Use Case | Speculation and hedging without rollover | Hedging with planned expiry and rollover |

| Risk Factors | Funding rate risk, perpetual exposure | Expiration risk, margin calls at expiry |

Which is better?

Perpetual futures offer continuous trading without expiration dates, providing greater flexibility and the ability to hold positions indefinitely. Traditional futures have fixed settlement dates, which can limit long-term strategies but offer clearer contract expiration and delivery terms. Traders seeking ongoing market exposure and frequent leverage adjustments often prefer perpetual futures, while those valuing structured timelines and defined expirations may opt for traditional futures.

Connection

Perpetual futures and traditional futures are connected through their role in financial derivatives trading, providing investors with tools to speculate on asset price movements without owning the underlying asset. Both contracts involve margin trading and leverage, allowing for amplified exposure to market fluctuations, but perpetual futures differ by having no expiry date, enabling continuous positions. Traditional futures settle on a predetermined date, while perpetual futures utilize funding rates to anchor prices to the spot market, maintaining contract value alignment.

Key Terms

Expiry Date

Traditional futures contracts have a fixed expiry date when the contract must be settled, allowing traders to plan their positions around this predetermined timeline. Perpetual futures lack an expiry date, enabling continuous trading without the need to roll over contracts, which provides greater flexibility and reduces settlement risk. Explore the distinct advantages of each by delving deeper into their structural differences and trading implications.

Funding Rate

Traditional futures contracts have fixed expiration dates and settle at predetermined times, often requiring initial margin and marking to market, while perpetual futures lack expiration and adjust their prices through a funding rate mechanism to tether the contract price to the spot market. The funding rate, typically exchanged between long and short position holders every few hours, acts as a balancing tool to prevent significant price divergence between perpetual futures and the underlying asset, impacting traders' costs and potential profits. Explore more to understand how funding rates influence risk management and trading strategies in different futures markets.

Settlement

Traditional futures contracts settle on a predetermined expiration date, requiring traders to either close positions or accept delivery of the underlying asset. In contrast, perpetual futures lack an expiration date and use a funding rate mechanism to anchor contract prices to the spot market continuously. Explore how these settlement differences impact trading strategies and risk management in futures markets.

Source and External Links

The Basics of Trading Futures Contracts | Charles Schwab - Traditional futures contracts are legally binding agreements to buy or sell a standardized asset at a specific date or month in the future, originally developed to manage risk in commodity markets like grains, with trading evolving from physical exchanges like the Chicago Board of Trade to electronic platforms today.

Futures contract - Wikipedia - Traditional futures originated from early rice and grain markets, with the first standardized futures contracts emerging in the 19th century in Chicago; these contracts allowed for the standardized exchange of commodities and later expanded to financial instruments such as currencies and stock indexes.

How Perpetual Futures Differs from Traditional Futures and Why It ... - Traditional futures contracts obligate the buyer and seller to transact an asset at a predetermined price at a future date, are standardized regardless of parties involved, and are widely used in commodities, energy, currencies, and securities for hedging or speculative leverage.

dowidth.com

dowidth.com