Special Purpose Acquisition Companies (SPACs) offer an alternative to traditional debt financing by enabling companies to raise capital through public markets without immediate debt obligations, often appealing for growth-stage firms seeking quicker access to funds. Unlike debt financing, which requires scheduled repayments along with interest, SPACs allow target companies to merge with a publicly listed entity, potentially providing more flexible capital structures and reducing balance sheet leverage. Explore the differences between SPACs and debt financing to determine the optimal funding strategy for your business needs.

Why it is important

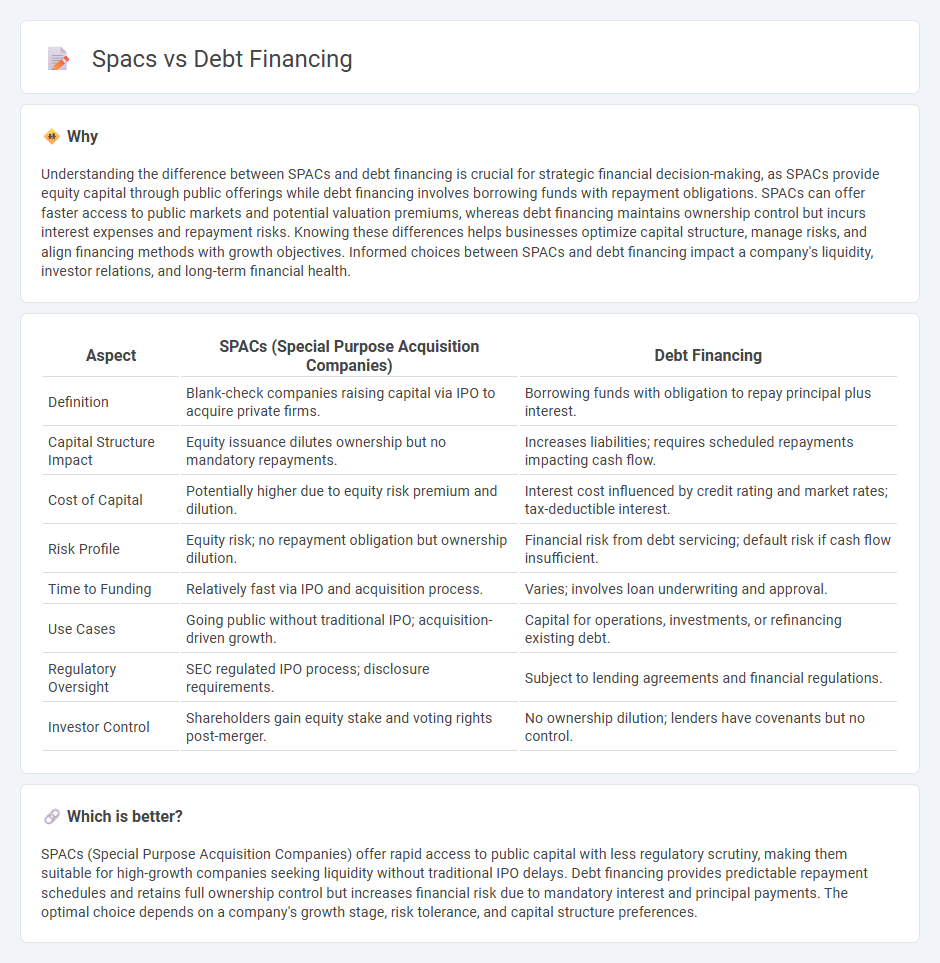

Understanding the difference between SPACs and debt financing is crucial for strategic financial decision-making, as SPACs provide equity capital through public offerings while debt financing involves borrowing funds with repayment obligations. SPACs can offer faster access to public markets and potential valuation premiums, whereas debt financing maintains ownership control but incurs interest expenses and repayment risks. Knowing these differences helps businesses optimize capital structure, manage risks, and align financing methods with growth objectives. Informed choices between SPACs and debt financing impact a company's liquidity, investor relations, and long-term financial health.

Comparison Table

| Aspect | SPACs (Special Purpose Acquisition Companies) | Debt Financing |

|---|---|---|

| Definition | Blank-check companies raising capital via IPO to acquire private firms. | Borrowing funds with obligation to repay principal plus interest. |

| Capital Structure Impact | Equity issuance dilutes ownership but no mandatory repayments. | Increases liabilities; requires scheduled repayments impacting cash flow. |

| Cost of Capital | Potentially higher due to equity risk premium and dilution. | Interest cost influenced by credit rating and market rates; tax-deductible interest. |

| Risk Profile | Equity risk; no repayment obligation but ownership dilution. | Financial risk from debt servicing; default risk if cash flow insufficient. |

| Time to Funding | Relatively fast via IPO and acquisition process. | Varies; involves loan underwriting and approval. |

| Use Cases | Going public without traditional IPO; acquisition-driven growth. | Capital for operations, investments, or refinancing existing debt. |

| Regulatory Oversight | SEC regulated IPO process; disclosure requirements. | Subject to lending agreements and financial regulations. |

| Investor Control | Shareholders gain equity stake and voting rights post-merger. | No ownership dilution; lenders have covenants but no control. |

Which is better?

SPACs (Special Purpose Acquisition Companies) offer rapid access to public capital with less regulatory scrutiny, making them suitable for high-growth companies seeking liquidity without traditional IPO delays. Debt financing provides predictable repayment schedules and retains full ownership control but increases financial risk due to mandatory interest and principal payments. The optimal choice depends on a company's growth stage, risk tolerance, and capital structure preferences.

Connection

Special Purpose Acquisition Companies (SPACs) and debt financing intersect as SPACs often secure debt to fund acquisitions, providing leverage beyond initial equity capital. Debt financing allows SPACs to increase their purchasing power, enabling larger or more complex deals that enhance shareholder value. This connection highlights the strategic use of debt instruments alongside equity in SPAC-driven mergers and acquisitions to optimize capital structure.

Key Terms

Leverage

Debt financing typically involves borrowing funds with fixed obligations, allowing companies to leverage balance sheets to amplify returns while retaining ownership control; leverage ratios such as debt-to-equity are key metrics in assessing risk. Special Purpose Acquisition Companies (SPACs) use equity financing, often resulting in less leverage and diluted ownership, but they offer faster access to public markets compared to traditional IPOs. Explore in-depth analyses of leverage implications in debt financing versus SPACs to optimize capital structure decisions.

Equity Dilution

Debt financing preserves ownership by avoiding equity dilution, allowing founders and existing shareholders to maintain control while leveraging borrowed capital. Special Purpose Acquisition Companies (SPACs), however, typically result in equity dilution as new shares are issued to public investors during the merger process, affecting the ownership percentage of original stakeholders. Explore the advantages and trade-offs of debt financing versus SPACs to optimize your capital structure strategy.

Special Purpose Acquisition Company (SPAC)

Special Purpose Acquisition Companies (SPACs) offer an alternative to traditional debt financing by raising capital through initial public offerings without immediate business operations, allowing for flexible acquisition targets. Unlike debt financing that involves borrowing funds with fixed repayment terms and interest, SPACs provide equity investments without repayment obligations, attracting risk-tolerant investors seeking growth opportunities. Explore the strategic advantages and risks of SPACs compared to debt financing to better understand their impact on corporate funding options.

Source and External Links

Debt Financing - Overview, Options, Pros and Cons - This webpage provides an overview of debt financing, including its options like bank loans and bonds, and discusses its pros and cons.

Debt Financing: Definition & How It Works - This article explains how debt financing works, comparing it to equity financing, and discusses varieties like SBA loans and bonds.

Advantages and Disadvantages of Debt Financing - This blog post outlines the advantages and disadvantages of debt financing, including its impact on ownership and repayment obligations compared to equity financing.

dowidth.com

dowidth.com