Insurtech revolutionizes the insurance industry through digital innovations such as AI-driven risk assessment and automated claims processing, enhancing customer experience and operational efficiency. Proptech transforms real estate by leveraging technologies like blockchain for transparent transactions and IoT for smart property management, driving smarter investment decisions and improved asset utilization. Explore how these fintech subsets redefine financial landscapes and investment opportunities.

Why it is important

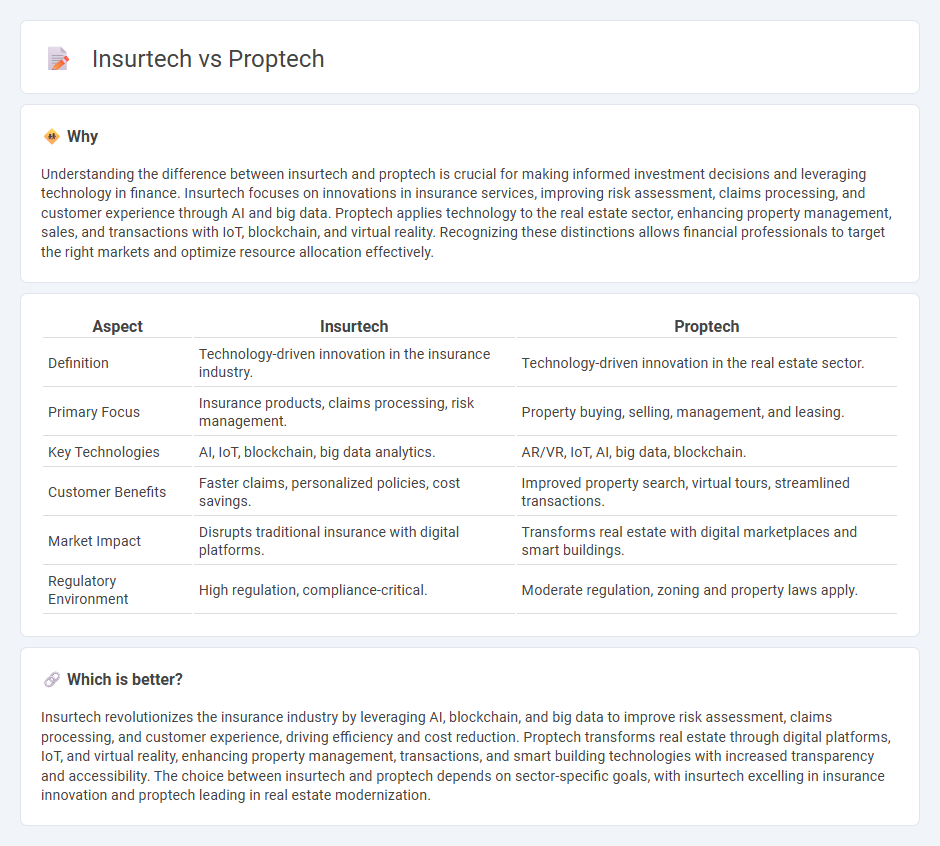

Understanding the difference between insurtech and proptech is crucial for making informed investment decisions and leveraging technology in finance. Insurtech focuses on innovations in insurance services, improving risk assessment, claims processing, and customer experience through AI and big data. Proptech applies technology to the real estate sector, enhancing property management, sales, and transactions with IoT, blockchain, and virtual reality. Recognizing these distinctions allows financial professionals to target the right markets and optimize resource allocation effectively.

Comparison Table

| Aspect | Insurtech | Proptech |

|---|---|---|

| Definition | Technology-driven innovation in the insurance industry. | Technology-driven innovation in the real estate sector. |

| Primary Focus | Insurance products, claims processing, risk management. | Property buying, selling, management, and leasing. |

| Key Technologies | AI, IoT, blockchain, big data analytics. | AR/VR, IoT, AI, big data, blockchain. |

| Customer Benefits | Faster claims, personalized policies, cost savings. | Improved property search, virtual tours, streamlined transactions. |

| Market Impact | Disrupts traditional insurance with digital platforms. | Transforms real estate with digital marketplaces and smart buildings. |

| Regulatory Environment | High regulation, compliance-critical. | Moderate regulation, zoning and property laws apply. |

Which is better?

Insurtech revolutionizes the insurance industry by leveraging AI, blockchain, and big data to improve risk assessment, claims processing, and customer experience, driving efficiency and cost reduction. Proptech transforms real estate through digital platforms, IoT, and virtual reality, enhancing property management, transactions, and smart building technologies with increased transparency and accessibility. The choice between insurtech and proptech depends on sector-specific goals, with insurtech excelling in insurance innovation and proptech leading in real estate modernization.

Connection

Insurtech and proptech intersect through their shared use of advanced technology to optimize risk assessment and asset management in real estate finance. Insurtech leverages data analytics and IoT sensors to enhance property insurance underwriting, while proptech employs these innovations to improve property valuation, monitoring, and transaction efficiency. Together, they drive digital transformation in financial services by integrating insurance solutions with smart property management.

Key Terms

Digital Platforms

Proptech leverages digital platforms to streamline real estate transactions, property management, and tenant experiences through tools such as virtual tours, online leasing, and automated maintenance requests. Insurtech focuses on digital platforms that enhance insurance processes by enabling real-time claims processing, personalized policy management, and risk assessment using AI and big data analytics. Explore how these innovative platforms are transforming their industries and discover opportunities for integration and growth.

Risk Assessment

Proptech leverages advanced data analytics, IoT sensors, and AI to enhance property risk assessment by evaluating structural integrity, environmental hazards, and market dynamics. Insurtech focuses on real-time risk prediction through algorithms analyzing claims data, customer behavior, and external risk factors to optimize underwriting and pricing models. Explore in-depth how these technologies transform risk assessment across real estate and insurance sectors.

Automated Underwriting

Automated underwriting in proptech leverages AI and big data to streamline property risk assessment, enhancing accuracy and efficiency in real estate transactions. In insurtech, automated underwriting uses predictive analytics and machine learning to evaluate insurance risks, accelerating policy issuance and improving customer experience. Explore the latest advancements and applications of automated underwriting in both industries to understand their impact on risk management.

Source and External Links

A guide to PropTech (and how it's shaking up real estate) - PropTech is the use of technology to help businesses and individuals manage real estate, streamlining stages like researching, buying, and selling, and connecting buyers, sellers, lenders, and landlords through various platforms, with major segments including smart homes, sharing real estate, and real estate FinTech.

The Potential of Proptech: Revolutionizing Real Estate Through Technology - PropTech broadly encompasses technology tools used to facilitate all aspects of real estate from research to management, is considered a specialized branch of FinTech, and has seen rapid investment growth with projected market size expanding from $35 billion in 2022 to $133 billion by 2032 globally.

Proptech: Everything You Need to Know (With 28 Examples) - Built In - Proptech emerged in the 1980s with early computing tools and accelerated in the 2000s through companies like Zillow and Redfin, raising over $43 billion globally from 2012 to 2020 and rapidly adopting technology especially amid the COVID-19 pandemic to innovate across residential, commercial, and industrial real estate sectors.

dowidth.com

dowidth.com