Liquid staking enables users to earn staking rewards while maintaining token liquidity by issuing derivative tokens, whereas Delegated Proof of Stake (DPoS) relies on token holders voting for trusted delegates to validate transactions and secure the blockchain. Liquid staking solutions like Lido and Rocket Pool minimize lock-up periods, enhancing capital efficiency compared to traditional DPoS systems such as EOS and Tron, which prioritize decentralization through elected representatives. Explore the key differences and benefits of these consensus mechanisms to optimize your decentralized finance strategy.

Why it is important

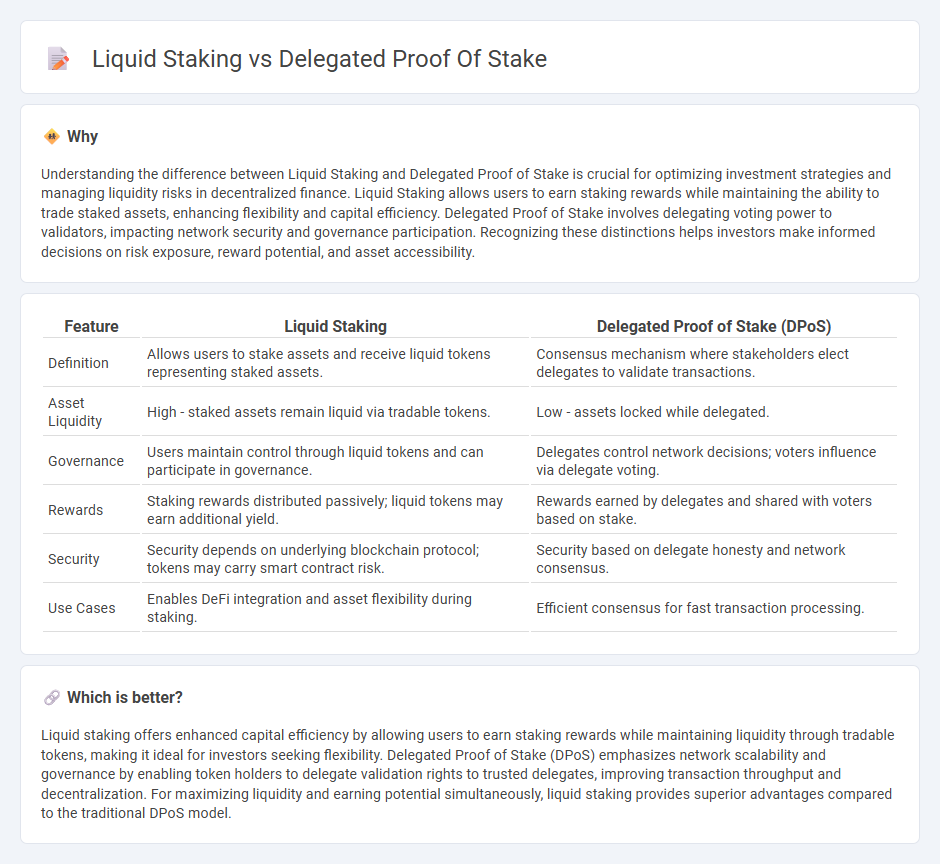

Understanding the difference between Liquid Staking and Delegated Proof of Stake is crucial for optimizing investment strategies and managing liquidity risks in decentralized finance. Liquid Staking allows users to earn staking rewards while maintaining the ability to trade staked assets, enhancing flexibility and capital efficiency. Delegated Proof of Stake involves delegating voting power to validators, impacting network security and governance participation. Recognizing these distinctions helps investors make informed decisions on risk exposure, reward potential, and asset accessibility.

Comparison Table

| Feature | Liquid Staking | Delegated Proof of Stake (DPoS) |

|---|---|---|

| Definition | Allows users to stake assets and receive liquid tokens representing staked assets. | Consensus mechanism where stakeholders elect delegates to validate transactions. |

| Asset Liquidity | High - staked assets remain liquid via tradable tokens. | Low - assets locked while delegated. |

| Governance | Users maintain control through liquid tokens and can participate in governance. | Delegates control network decisions; voters influence via delegate voting. |

| Rewards | Staking rewards distributed passively; liquid tokens may earn additional yield. | Rewards earned by delegates and shared with voters based on stake. |

| Security | Security depends on underlying blockchain protocol; tokens may carry smart contract risk. | Security based on delegate honesty and network consensus. |

| Use Cases | Enables DeFi integration and asset flexibility during staking. | Efficient consensus for fast transaction processing. |

Which is better?

Liquid staking offers enhanced capital efficiency by allowing users to earn staking rewards while maintaining liquidity through tradable tokens, making it ideal for investors seeking flexibility. Delegated Proof of Stake (DPoS) emphasizes network scalability and governance by enabling token holders to delegate validation rights to trusted delegates, improving transaction throughput and decentralization. For maximizing liquidity and earning potential simultaneously, liquid staking provides superior advantages compared to the traditional DPoS model.

Connection

Liquid staking enhances the Delegated Proof of Stake (DPoS) mechanism by allowing token holders to stake assets while retaining liquidity through derivative tokens. In a DPoS system, delegators elect validators to secure the network, and liquid staking enables these delegators to continue participating in DeFi activities without losing staking rewards. This integration increases network security and capital efficiency by combining transparent validator selection with flexible asset management.

Key Terms

Validators

Delegated Proof of Stake (DPoS) relies on token holders selecting validators to secure the network and validate transactions, while Liquid Staking enables users to stake assets and receive liquid tokens representing their staked position, allowing for greater flexibility in asset utilization. Validators in DPoS have a direct role in block production and governance, whereas in Liquid Staking, they operate within a protocol that facilitates staking liquidity and often delegates validation responsibilities. Explore the intricacies of validator roles in both models to better understand their impact on network security and user participation.

Governance

Delegated Proof of Stake (DPoS) enables token holders to vote for delegates who secure the network and make governance decisions, concentrating influence in a smaller group of elected representatives. Liquid staking allows users to stake assets while maintaining liquidity through derivative tokens, often providing more direct participation in governance and flexible voting rights. Explore the intricate dynamics between DPoS and liquid staking governance models to understand their impact on decentralization and voter engagement.

Liquidity

Delegated Proof of Stake (DPoS) enables token holders to delegate their staking rights to validators, maintaining network security while users retain liquidity by easily transferring or trading tokens. Liquid staking transforms staked assets into liquid tokens, allowing users to participate in DeFi activities without sacrificing staking rewards or locking funds. Explore how liquid staking enhances liquidity compared to DPoS for more efficient capital utilization.

Source and External Links

What is Delegated Proof of Stake (DPoS)? - Coinbase - DPoS is a consensus mechanism evolved from Proof of Stake (PoS) where users vote and elect delegates to validate blocks, aiming for a more democratic and efficient process but criticized for favoring the wealthy and requiring active user participation.

Delegated Proof of Stake (DPoS) - Bitcoinwiki - DPoS is a fast, efficient, and flexible consensus model based on technology-driven democracy, where token holders vote for delegates or witnesses who produce and validate blocks, initially created by Daniel Larimer for BitShares and used in blockchains like EOS.

What Is Delegated Proof-of-Stake (DPoS)? - Ledger - DPoS is a variation of PoS where participants elect delegates to validate blockchain blocks, offering a scalable, democratic, and energy-efficient approach to reaching consensus across a blockchain network.

dowidth.com

dowidth.com