Quantitative tightening (QT) reduces central bank balance sheets by selling securities or letting them mature, aiming to curb inflation and normalize monetary policy. Yield curve control (YCC) caps long-term interest rates through bond purchases, ensuring borrowing costs remain stable while supporting economic growth. Explore how these contrasting monetary tools impact financial markets and economic stability.

Why it is important

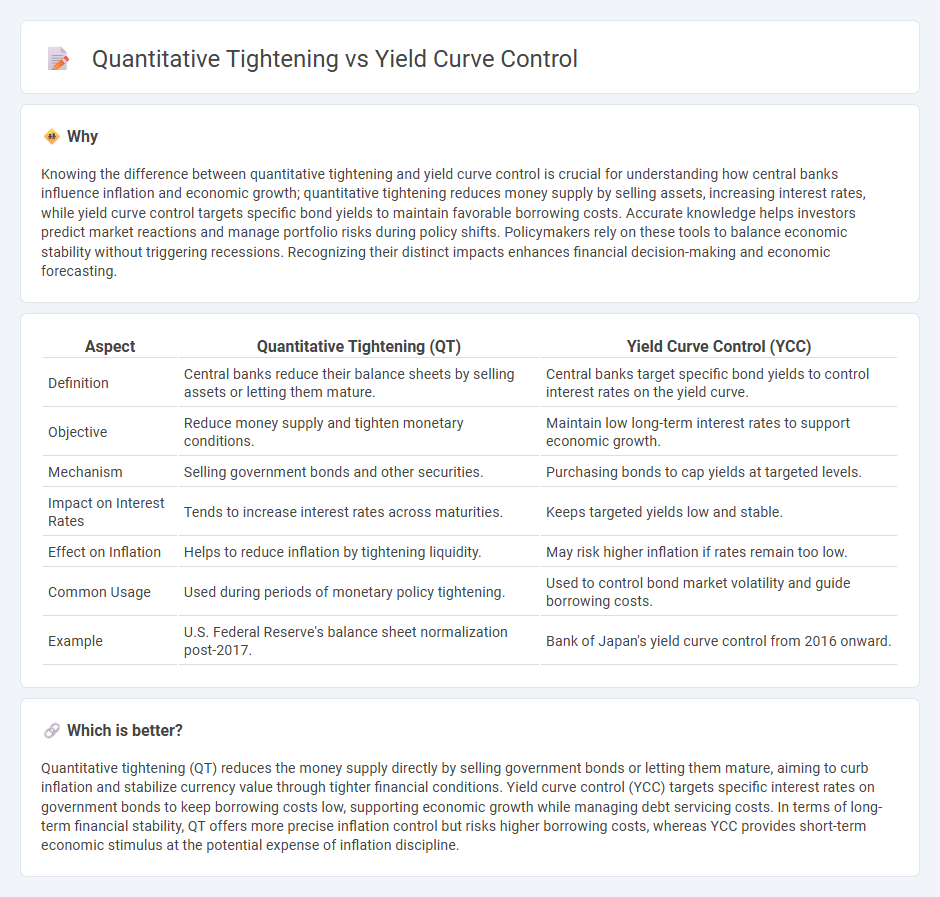

Knowing the difference between quantitative tightening and yield curve control is crucial for understanding how central banks influence inflation and economic growth; quantitative tightening reduces money supply by selling assets, increasing interest rates, while yield curve control targets specific bond yields to maintain favorable borrowing costs. Accurate knowledge helps investors predict market reactions and manage portfolio risks during policy shifts. Policymakers rely on these tools to balance economic stability without triggering recessions. Recognizing their distinct impacts enhances financial decision-making and economic forecasting.

Comparison Table

| Aspect | Quantitative Tightening (QT) | Yield Curve Control (YCC) |

|---|---|---|

| Definition | Central banks reduce their balance sheets by selling assets or letting them mature. | Central banks target specific bond yields to control interest rates on the yield curve. |

| Objective | Reduce money supply and tighten monetary conditions. | Maintain low long-term interest rates to support economic growth. |

| Mechanism | Selling government bonds and other securities. | Purchasing bonds to cap yields at targeted levels. |

| Impact on Interest Rates | Tends to increase interest rates across maturities. | Keeps targeted yields low and stable. |

| Effect on Inflation | Helps to reduce inflation by tightening liquidity. | May risk higher inflation if rates remain too low. |

| Common Usage | Used during periods of monetary policy tightening. | Used to control bond market volatility and guide borrowing costs. |

| Example | U.S. Federal Reserve's balance sheet normalization post-2017. | Bank of Japan's yield curve control from 2016 onward. |

Which is better?

Quantitative tightening (QT) reduces the money supply directly by selling government bonds or letting them mature, aiming to curb inflation and stabilize currency value through tighter financial conditions. Yield curve control (YCC) targets specific interest rates on government bonds to keep borrowing costs low, supporting economic growth while managing debt servicing costs. In terms of long-term financial stability, QT offers more precise inflation control but risks higher borrowing costs, whereas YCC provides short-term economic stimulus at the potential expense of inflation discipline.

Connection

Quantitative tightening (QT) reduces central bank balance sheets by selling government bonds, which can lead to rising interest rates and impact the shape of the yield curve. Yield curve control (YCC) involves central banks targeting specific interest rates on government bonds to anchor long-term borrowing costs, counteracting market-driven yield fluctuations. Both tools influence bond yields and liquidity, with QT tightening financial conditions while YCC aims to stabilize borrowing costs and economic growth.

Key Terms

Interest Rates

Yield curve control targets specific interest rates on government bonds to stabilize borrowing costs and support economic growth, while quantitative tightening reduces the central bank's balance sheet by selling bonds or letting them mature, leading to higher interest rates. Both tools influence long-term interest rates but differ in approach: yield curve control caps rates, whereas quantitative tightening allows market-driven rate increases. Explore how these monetary policies shape interest rate dynamics further.

Central Bank Balance Sheet

Yield curve control (YCC) involves a central bank targeting specific interest rates on government bonds to influence long-term borrowing costs, effectively shaping the yield curve while maintaining asset holdings on its balance sheet. Quantitative tightening (QT) reduces the central bank's balance sheet by selling assets or allowing them to mature without reinvestment, which raises interest rates by decreasing liquidity. Explore how these contrasting strategies impact monetary policy and financial markets in greater detail.

Government Bond Purchases/Sales

Yield curve control (YCC) involves central banks purchasing government bonds to target specific yields along the yield curve, thus influencing long-term interest rates and supporting economic stability. Quantitative tightening (QT) refers to the deliberate sale or runoff of government bonds from central bank balance sheets, aimed at reducing liquidity and curbing inflationary pressures. Explore how these contrasting approaches affect bond markets and monetary policy outcomes to deepen your understanding.

Source and External Links

What Is Yield Curve Control? | St. Louis Fed - Yield curve control (YCC) is a monetary policy in which a central bank targets and enforces specific interest rates at certain maturities along the yield curve, usually by committing to buy or sell government bonds to keep yields within a predetermined range.

What is yield curve control? - Brookings Institution - Under YCC, a central bank such as the Federal Reserve actively targets a longer-term interest rate and pledges to buy sufficient long-term bonds to prevent that rate from rising above its desired level.

Understanding Yield Curve Control: A Guide for Investors - YouTube - YCC involves a central bank intervening in bond markets to cap yields at certain points on the yield curve, thereby influencing borrowing costs and providing economic stimulus by ensuring interest rates remain at targeted levels.

dowidth.com

dowidth.com