Synthetic risk transfer involves the transfer of credit risk using financial derivatives such as credit default swaps, enabling banks to manage exposure without transferring actual loans. Risk participation entails sharing actual loan risks between financial institutions through participations, affecting balance sheets and capital requirements. Explore the nuances of these risk management techniques to optimize financial stability and regulatory compliance.

Why it is important

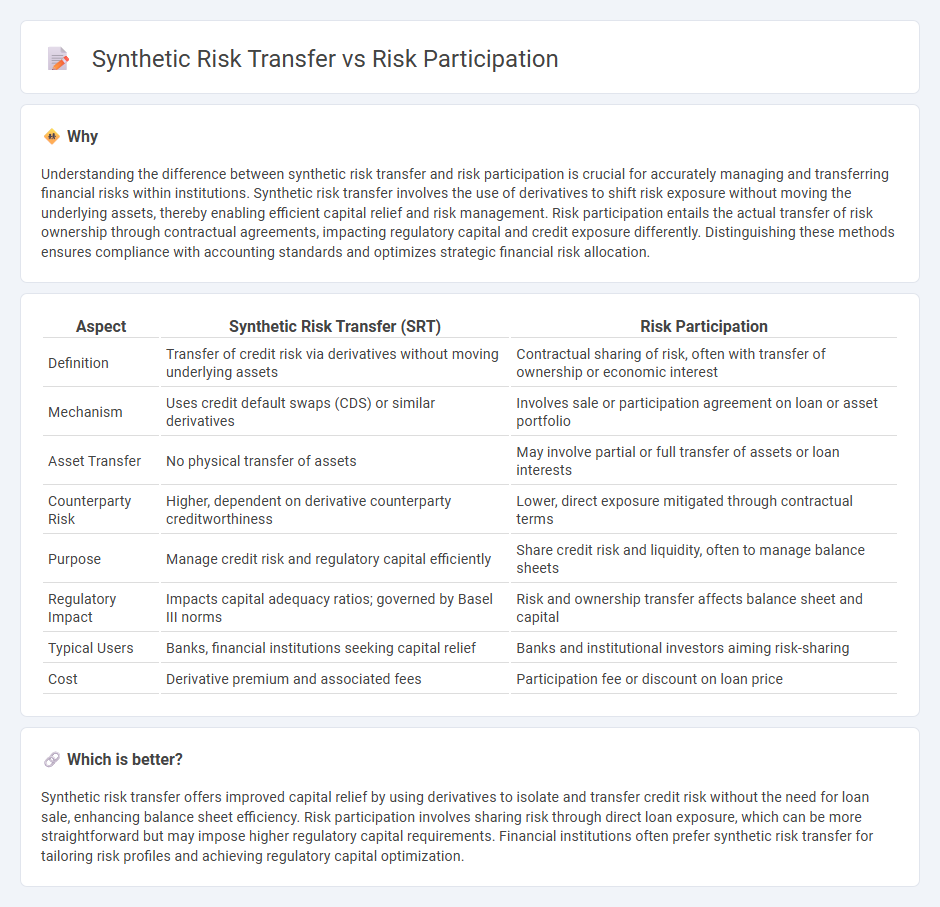

Understanding the difference between synthetic risk transfer and risk participation is crucial for accurately managing and transferring financial risks within institutions. Synthetic risk transfer involves the use of derivatives to shift risk exposure without moving the underlying assets, thereby enabling efficient capital relief and risk management. Risk participation entails the actual transfer of risk ownership through contractual agreements, impacting regulatory capital and credit exposure differently. Distinguishing these methods ensures compliance with accounting standards and optimizes strategic financial risk allocation.

Comparison Table

| Aspect | Synthetic Risk Transfer (SRT) | Risk Participation |

|---|---|---|

| Definition | Transfer of credit risk via derivatives without moving underlying assets | Contractual sharing of risk, often with transfer of ownership or economic interest |

| Mechanism | Uses credit default swaps (CDS) or similar derivatives | Involves sale or participation agreement on loan or asset portfolio |

| Asset Transfer | No physical transfer of assets | May involve partial or full transfer of assets or loan interests |

| Counterparty Risk | Higher, dependent on derivative counterparty creditworthiness | Lower, direct exposure mitigated through contractual terms |

| Purpose | Manage credit risk and regulatory capital efficiently | Share credit risk and liquidity, often to manage balance sheets |

| Regulatory Impact | Impacts capital adequacy ratios; governed by Basel III norms | Risk and ownership transfer affects balance sheet and capital |

| Typical Users | Banks, financial institutions seeking capital relief | Banks and institutional investors aiming risk-sharing |

| Cost | Derivative premium and associated fees | Participation fee or discount on loan price |

Which is better?

Synthetic risk transfer offers improved capital relief by using derivatives to isolate and transfer credit risk without the need for loan sale, enhancing balance sheet efficiency. Risk participation involves sharing risk through direct loan exposure, which can be more straightforward but may impose higher regulatory capital requirements. Financial institutions often prefer synthetic risk transfer for tailoring risk profiles and achieving regulatory capital optimization.

Connection

Synthetic risk transfer involves transferring credit risk through derivatives like credit default swaps, enabling financial institutions to manage exposure without selling actual assets. Risk participation allows one party to take on a portion of another's risk through contractual agreements, often complementing synthetic risk transfer by distributing risk among multiple participants. Both mechanisms enhance risk management strategies by reallocating credit risk efficiently across markets.

Key Terms

Credit Risk Sharing

Risk participation involves transferring credit risk by having one party purchase a portion of the lender's loan exposure, maintaining the original loan contract with the borrower, while synthetic risk transfer uses credit derivatives such as credit default swaps to transfer risk without changing the loan ownership. Credit risk sharing through risk participation often supports balance sheet management with less complexity, whereas synthetic risk transfer offers greater flexibility and customization of credit risk profiles. Explore detailed comparisons and applications of credit risk sharing techniques for optimized financial risk management.

Funded vs. Unfunded Structures

Risk participation involves funded structures where the participant provides actual capital to assume a portion of the risk, reflecting a direct financial stake in the underlying assets. Synthetic risk transfer typically uses unfunded structures via derivatives or guarantees, allowing risk transfer without upfront capital deployment, thereby optimizing capital efficiency for the risk originator. Explore further to understand the strategic applications and regulatory implications of funded versus unfunded risk transfer mechanisms.

Credit Default Swaps (CDS)

Risk participation involves a direct contractual arrangement where a risk participant assumes a portion of credit risk from the original lender, whereas synthetic risk transfer uses derivatives such as Credit Default Swaps (CDS) to transfer credit risk without the underlying asset changing hands. CDS allows investors to hedge or speculate on credit risk by paying periodic premiums in exchange for protection against default or credit events on a reference entity. Explore how these mechanisms influence credit risk management and capital optimization strategies in financial markets.

Source and External Links

Master Risk Participation Agreements In Trade Finance - Risk participation is a lending where a lender transfers its interest or loan risk to another institution through a Master Risk Participation Agreement, allowing risk sharing and economic benefits to the participant, commonly used in international trade finance to reduce lender exposure.

Risk Participation - Risk participation involves defining the status, risk amount, and risk rate between funding and risk participants in lending contracts, with options to activate or cancel participation, and includes compensation pay-outs computed on agreed rates.

Proposed Guarantees, Loans, and Risk Participation ... - Risk participation agreements in trade finance allow entities like the Asian Development Bank to share risk (up to 85%) with partner financial institutions, providing coverage in trade-related credit risk on a rolling basis with set exposure limits and tenors.

dowidth.com

dowidth.com