Carbon trading allows companies to buy and sell emission allowances to meet regulatory caps, incentivizing reductions in greenhouse gases. Renewable energy certificates (RECs) represent proof that electricity was generated from renewable sources, enabling organizations to claim green energy usage without direct production. Explore the differences and benefits of carbon trading and RECs to better understand their impact on sustainable finance.

Why it is important

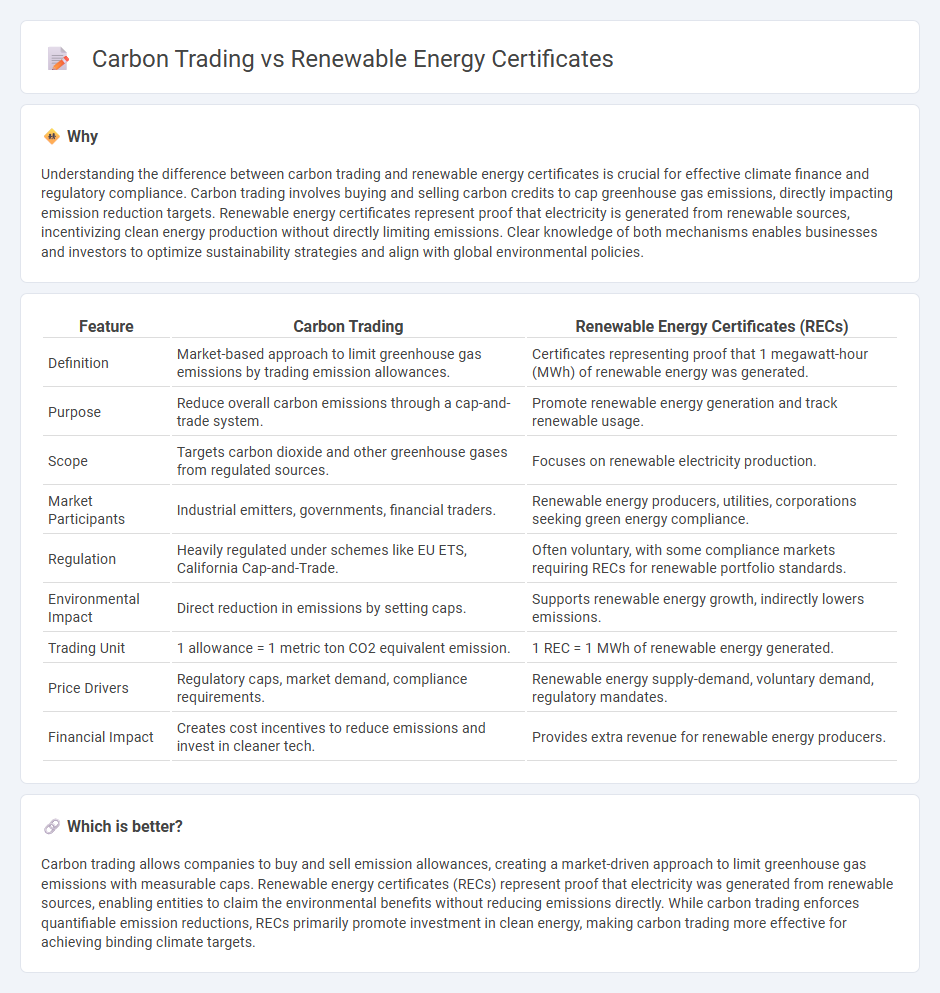

Understanding the difference between carbon trading and renewable energy certificates is crucial for effective climate finance and regulatory compliance. Carbon trading involves buying and selling carbon credits to cap greenhouse gas emissions, directly impacting emission reduction targets. Renewable energy certificates represent proof that electricity is generated from renewable sources, incentivizing clean energy production without directly limiting emissions. Clear knowledge of both mechanisms enables businesses and investors to optimize sustainability strategies and align with global environmental policies.

Comparison Table

| Feature | Carbon Trading | Renewable Energy Certificates (RECs) |

|---|---|---|

| Definition | Market-based approach to limit greenhouse gas emissions by trading emission allowances. | Certificates representing proof that 1 megawatt-hour (MWh) of renewable energy was generated. |

| Purpose | Reduce overall carbon emissions through a cap-and-trade system. | Promote renewable energy generation and track renewable usage. |

| Scope | Targets carbon dioxide and other greenhouse gases from regulated sources. | Focuses on renewable electricity production. |

| Market Participants | Industrial emitters, governments, financial traders. | Renewable energy producers, utilities, corporations seeking green energy compliance. |

| Regulation | Heavily regulated under schemes like EU ETS, California Cap-and-Trade. | Often voluntary, with some compliance markets requiring RECs for renewable portfolio standards. |

| Environmental Impact | Direct reduction in emissions by setting caps. | Supports renewable energy growth, indirectly lowers emissions. |

| Trading Unit | 1 allowance = 1 metric ton CO2 equivalent emission. | 1 REC = 1 MWh of renewable energy generated. |

| Price Drivers | Regulatory caps, market demand, compliance requirements. | Renewable energy supply-demand, voluntary demand, regulatory mandates. |

| Financial Impact | Creates cost incentives to reduce emissions and invest in cleaner tech. | Provides extra revenue for renewable energy producers. |

Which is better?

Carbon trading allows companies to buy and sell emission allowances, creating a market-driven approach to limit greenhouse gas emissions with measurable caps. Renewable energy certificates (RECs) represent proof that electricity was generated from renewable sources, enabling entities to claim the environmental benefits without reducing emissions directly. While carbon trading enforces quantifiable emission reductions, RECs primarily promote investment in clean energy, making carbon trading more effective for achieving binding climate targets.

Connection

Carbon trading enables companies to buy and sell carbon emission allowances, incentivizing reductions in greenhouse gases, while renewable energy certificates (RECs) represent proof of renewable energy generation that supports carbon offset goals. Both mechanisms create financial incentives for businesses to invest in low-carbon technologies and cleaner energy sources, driving market-based solutions for climate action. Integration of carbon markets with renewable energy certificates enhances transparency and accountability in meeting emission reduction targets.

Key Terms

Additionality

Renewable energy certificates (RECs) represent proof that one megawatt-hour of electricity was generated from a renewable energy resource, emphasizing environmental attributes without necessarily ensuring additional emissions reductions. Carbon trading markets, such as cap-and-trade systems, focus on setting a cap on total emissions and allow companies to buy or sell allowances, prioritizing additionality by requiring that emission reductions are real, measurable, and beyond business-as-usual scenarios. Explore how these mechanisms impact climate goals and market dynamics to understand their roles in sustainable energy transition.

Cap-and-trade

Cap-and-trade systems set a legal limit on greenhouse gas emissions, allowing companies to buy and sell emission allowances to meet regulatory requirements efficiently. Renewable Energy Certificates (RECs) represent proof that electricity was generated from a renewable energy resource, promoting clean energy adoption but do not directly limit emissions like cap-and-trade programs. Explore the intricacies of how cap-and-trade promotes emission reductions compared to REC markets to better understand sustainable environmental strategies.

Green attributes

Renewable Energy Certificates (RECs) represent the environmental benefits of generating one megawatt-hour of electricity from renewable sources, highlighting green attributes that verify clean energy consumption. Carbon trading, or cap-and-trade systems, focus on limiting greenhouse gas emissions by allowing entities to buy or sell emission allowances, emphasizing carbon reduction credits rather than direct renewable energy use. Explore detailed comparisons to understand how each mechanism supports sustainable energy goals and carbon neutrality.

Source and External Links

Renewable Energy Certificate (United States) - Renewable Energy Certificates (RECs) are tradable, non-tangible certificates in the U.S. that prove 1 megawatt-hour (MWh) of electricity was generated from renewable resources and fed into the grid, used in compliance markets under Renewable Portfolio Standards and voluntary markets where consumers choose to buy green energy.

Renewable Energy Credits (RECs): What You Need To Know - RECs represent the environmental attributes of renewable energy generation, with each credit corresponding to 1 MWh produced, allowing buyers to claim renewable generation even when the physical electricity they consume comes from the broader grid.

Renewable Energy Certificates (RECs) | US EPA - A REC is a market-based instrument that conveys property rights to the environmental and social benefits of renewable electricity generation, issued for each MWh delivered to the grid, and including detailed data on the renewable source and project.

dowidth.com

dowidth.com