Collateralized reinsurance provides a secure method for insurers to transfer risk by using collateral to guarantee payment obligations, enhancing trust and financial stability. Retrocession involves reinsurers passing on portions of their risk to other reinsurers, diversifying risk portfolios and reducing exposure. Explore detailed differences and applications to optimize risk management strategies.

Why it is important

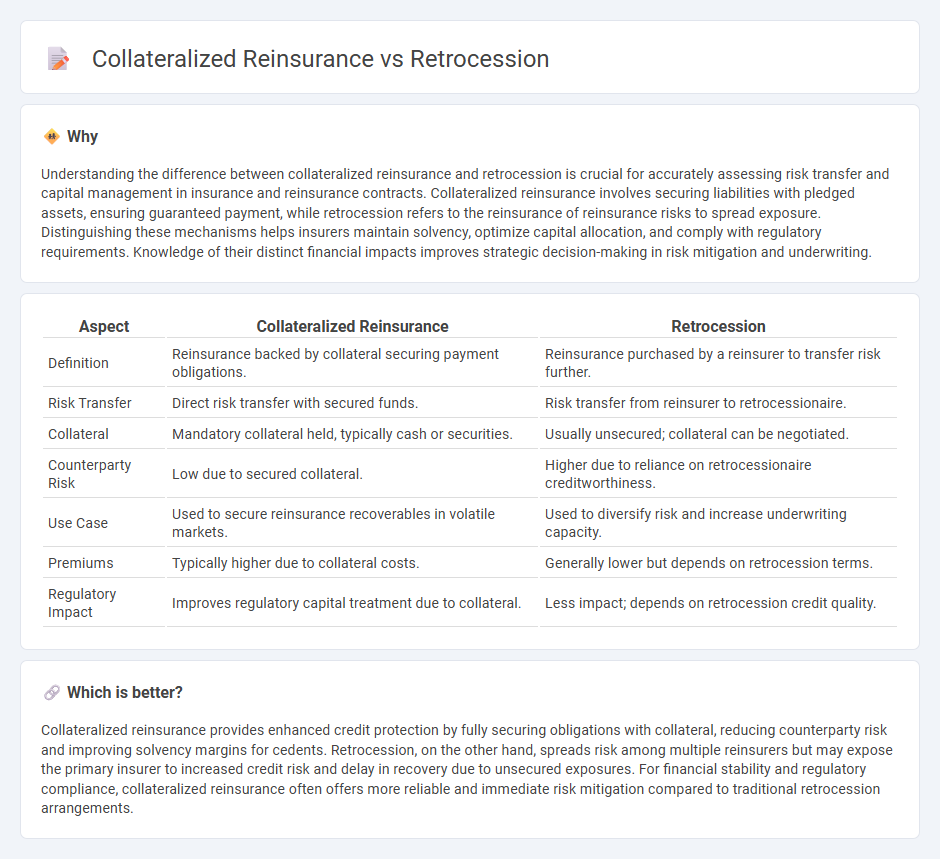

Understanding the difference between collateralized reinsurance and retrocession is crucial for accurately assessing risk transfer and capital management in insurance and reinsurance contracts. Collateralized reinsurance involves securing liabilities with pledged assets, ensuring guaranteed payment, while retrocession refers to the reinsurance of reinsurance risks to spread exposure. Distinguishing these mechanisms helps insurers maintain solvency, optimize capital allocation, and comply with regulatory requirements. Knowledge of their distinct financial impacts improves strategic decision-making in risk mitigation and underwriting.

Comparison Table

| Aspect | Collateralized Reinsurance | Retrocession |

|---|---|---|

| Definition | Reinsurance backed by collateral securing payment obligations. | Reinsurance purchased by a reinsurer to transfer risk further. |

| Risk Transfer | Direct risk transfer with secured funds. | Risk transfer from reinsurer to retrocessionaire. |

| Collateral | Mandatory collateral held, typically cash or securities. | Usually unsecured; collateral can be negotiated. |

| Counterparty Risk | Low due to secured collateral. | Higher due to reliance on retrocessionaire creditworthiness. |

| Use Case | Used to secure reinsurance recoverables in volatile markets. | Used to diversify risk and increase underwriting capacity. |

| Premiums | Typically higher due to collateral costs. | Generally lower but depends on retrocession terms. |

| Regulatory Impact | Improves regulatory capital treatment due to collateral. | Less impact; depends on retrocession credit quality. |

Which is better?

Collateralized reinsurance provides enhanced credit protection by fully securing obligations with collateral, reducing counterparty risk and improving solvency margins for cedents. Retrocession, on the other hand, spreads risk among multiple reinsurers but may expose the primary insurer to increased credit risk and delay in recovery due to unsecured exposures. For financial stability and regulatory compliance, collateralized reinsurance often offers more reliable and immediate risk mitigation compared to traditional retrocession arrangements.

Connection

Collateralized reinsurance and retrocession are interconnected risk transfer mechanisms within the finance and insurance sectors, where collateralized reinsurance involves posting collateral to secure reinsurance obligations, enhancing creditworthiness and reducing counterparty risk. Retrocession, on the other hand, entails a reinsurer ceding part of its risk portfolio to another reinsurer, often utilizing collateralized reinsurance arrangements to ensure payment security and maintain liquidity. Both strategies optimize capital management and risk dispersion among insurers and reinsurers.

Key Terms

Risk Transfer

Retrocession involves the transfer of reinsurance risk from a reinsurer to another reinsurer, effectively spreading the exposure and mitigating potential large losses. Collateralized reinsurance uses posted collateral to secure the risk transfer, ensuring that the ceding company has guaranteed access to funds for claims payment, enhancing financial stability. Explore the nuances of these risk transfer mechanisms to understand their impact on reinsurance portfolio management.

Collateral

Collateral in collateralized reinsurance serves as a financial guarantee to secure recovery of claims, reducing credit risk for the ceding company by fully segregating funds. Unlike retrocession, which transfers risk between insurers without mandatory collateral, collateralized reinsurance requires posting assets or letters of credit, enhancing creditworthiness and claim payment assurance. Explore detailed comparisons and practical examples to better understand the strategic benefits of collateralized reinsurance.

Ceding Insurer

The ceding insurer in retrocession transfers a portion of its existing reinsurance risk to a retrocessionaire to further spread exposure, enhancing capital efficiency and reducing volatility. In collateralized reinsurance, the ceding insurer benefits from secured payments through dedicated collateral, ensuring guaranteed recoverables regardless of the reinsurer's credit quality. Explore detailed strategies on optimizing risk transfer and capital preservation for ceding insurers in reinsurance contracts.

Source and External Links

Retrocession Meaning & Definition - Retrocession is a practice in the reinsurance industry where a reinsurer transfers part of its risk to another reinsurer to manage exposure and maintain solvency.

District of Columbia retrocession - Retrocession here refers to the act of returning land previously ceded to the U.S. federal government, notably the return of Alexandria to Virginia in the 19th century.

Retrocession (kickback) - In Swiss finance, retrocessions are kickback commissions received by financial intermediaries after purchasing products, often criticized for conflicts of interest and lacking transparency.

dowidth.com

dowidth.com