Loss harvesting involves selling investments at a loss to offset capital gains and reduce taxable income, optimizing after-tax returns. Tax deferral postpones tax liabilities by delaying income recognition, commonly utilized in retirement accounts to benefit from potential tax rate reductions. Discover how strategically combining loss harvesting and tax deferral can enhance your financial planning and tax efficiency.

Why it is important

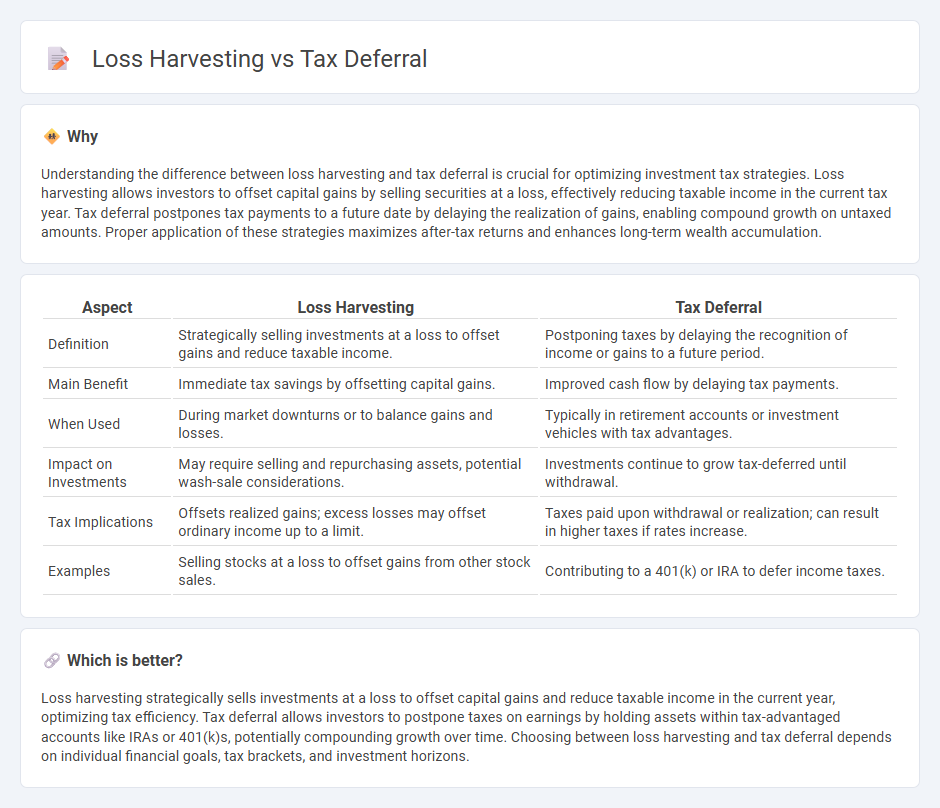

Understanding the difference between loss harvesting and tax deferral is crucial for optimizing investment tax strategies. Loss harvesting allows investors to offset capital gains by selling securities at a loss, effectively reducing taxable income in the current tax year. Tax deferral postpones tax payments to a future date by delaying the realization of gains, enabling compound growth on untaxed amounts. Proper application of these strategies maximizes after-tax returns and enhances long-term wealth accumulation.

Comparison Table

| Aspect | Loss Harvesting | Tax Deferral |

|---|---|---|

| Definition | Strategically selling investments at a loss to offset gains and reduce taxable income. | Postponing taxes by delaying the recognition of income or gains to a future period. |

| Main Benefit | Immediate tax savings by offsetting capital gains. | Improved cash flow by delaying tax payments. |

| When Used | During market downturns or to balance gains and losses. | Typically in retirement accounts or investment vehicles with tax advantages. |

| Impact on Investments | May require selling and repurchasing assets, potential wash-sale considerations. | Investments continue to grow tax-deferred until withdrawal. |

| Tax Implications | Offsets realized gains; excess losses may offset ordinary income up to a limit. | Taxes paid upon withdrawal or realization; can result in higher taxes if rates increase. |

| Examples | Selling stocks at a loss to offset gains from other stock sales. | Contributing to a 401(k) or IRA to defer income taxes. |

Which is better?

Loss harvesting strategically sells investments at a loss to offset capital gains and reduce taxable income in the current year, optimizing tax efficiency. Tax deferral allows investors to postpone taxes on earnings by holding assets within tax-advantaged accounts like IRAs or 401(k)s, potentially compounding growth over time. Choosing between loss harvesting and tax deferral depends on individual financial goals, tax brackets, and investment horizons.

Connection

Loss harvesting involves selling investments at a loss to offset gains and reduce taxable income, directly impacting tax liability. Tax deferral allows investors to postpone paying taxes on gains until a later date, enhancing compound growth potential. Together, these strategies optimize portfolio tax efficiency by minimizing immediate taxes and maximizing long-term wealth accumulation.

Key Terms

Capital Gains

Tax deferral postpones capital gains taxes by delaying the sale of investments, allowing potential growth to compound tax-free. Loss harvesting strategically sells securities at a loss to offset capital gains, reducing taxable income and optimizing tax efficiency. Explore detailed strategies to balance tax deferral and loss harvesting for maximizing your capital gains management.

Cost Basis

Tax deferral strategies delay the payment of taxes by postponing income recognition, thereby allowing investments to grow tax-deferred, while loss harvesting involves selling securities at a loss to offset gains and reduce taxable income. The cost basis in tax deferral remains the original purchase price, growing only when gains are realized, whereas loss harvesting adjusts the cost basis downward on replacement securities to reflect realized losses. Explore detailed comparisons and implications on your investment portfolio's cost basis to optimize tax strategies effectively.

Tax Liability

Tax deferral strategies delay tax payments by postponing income recognition, thereby reducing current tax liability and allowing investments to grow tax-deferred. Loss harvesting involves selling securities at a loss to offset gains, directly lowering taxable income and minimizing immediate tax liability. Explore detailed comparisons to optimize your tax strategy effectively.

Source and External Links

Tax deferral - Wikipedia - Tax deferral allows taxpayers to delay paying taxes to a future period, often leading to taxes being paid at the same or potentially lower rates later, with examples like corporations using accelerated depreciation to defer taxes.

The Benefits of Tax Deferral - Ameritas - Tax deferral is a financial strategy that postpones paying taxes on investment gains, enabling money to compound tax-deferred for stronger long-term growth, commonly used in retirement accounts like 401(k)s and IRAs.

How Tax Deferral Works | SecurityBenefit.com - Tax deferral postpones taxes on asset growth until withdrawal, often at retirement when tax rates might be lower, which helps investments compound more efficiently by avoiding annual taxes on gains.

dowidth.com

dowidth.com