Decentralized finance (DeFi) revolutionizes traditional banking by enabling peer-to-peer financial transactions on blockchain networks, eliminating intermediaries and enhancing transparency. Neobanks operate exclusively online, offering user-friendly digital banking services with lower fees and faster processing compared to conventional banks. Discover how these financial innovations reshape access to banking and investment opportunities.

Why it is important

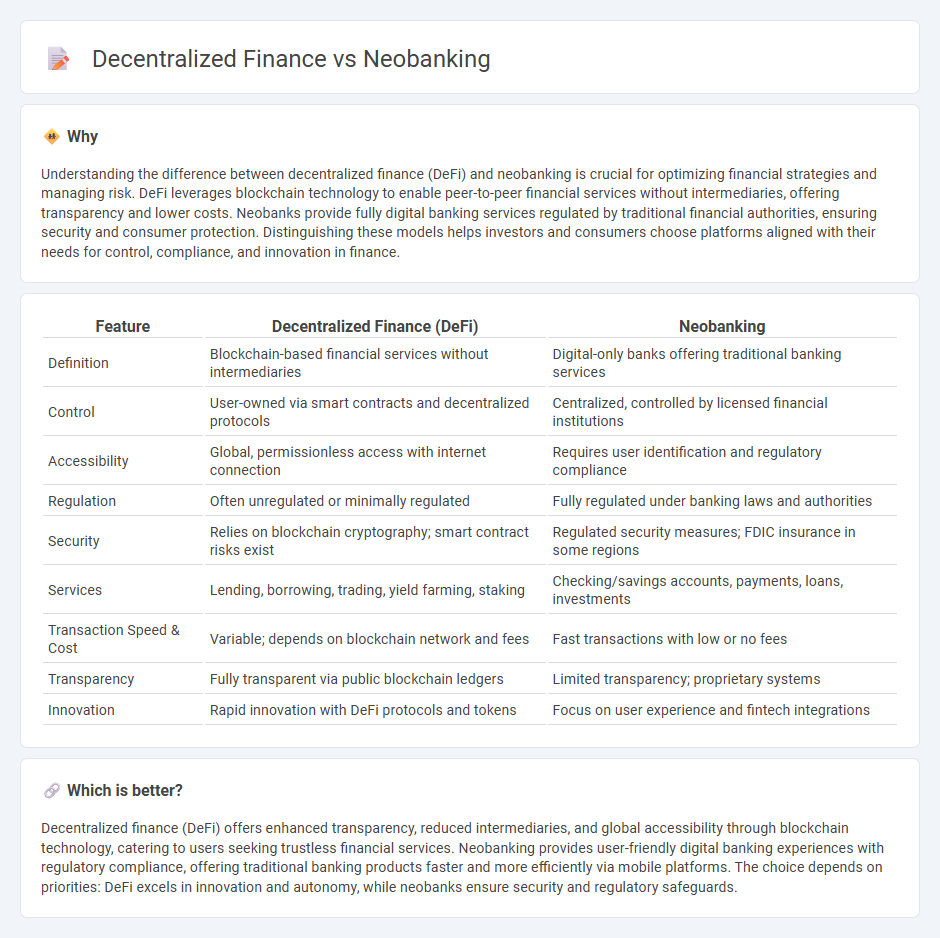

Understanding the difference between decentralized finance (DeFi) and neobanking is crucial for optimizing financial strategies and managing risk. DeFi leverages blockchain technology to enable peer-to-peer financial services without intermediaries, offering transparency and lower costs. Neobanks provide fully digital banking services regulated by traditional financial authorities, ensuring security and consumer protection. Distinguishing these models helps investors and consumers choose platforms aligned with their needs for control, compliance, and innovation in finance.

Comparison Table

| Feature | Decentralized Finance (DeFi) | Neobanking |

|---|---|---|

| Definition | Blockchain-based financial services without intermediaries | Digital-only banks offering traditional banking services |

| Control | User-owned via smart contracts and decentralized protocols | Centralized, controlled by licensed financial institutions |

| Accessibility | Global, permissionless access with internet connection | Requires user identification and regulatory compliance |

| Regulation | Often unregulated or minimally regulated | Fully regulated under banking laws and authorities |

| Security | Relies on blockchain cryptography; smart contract risks exist | Regulated security measures; FDIC insurance in some regions |

| Services | Lending, borrowing, trading, yield farming, staking | Checking/savings accounts, payments, loans, investments |

| Transaction Speed & Cost | Variable; depends on blockchain network and fees | Fast transactions with low or no fees |

| Transparency | Fully transparent via public blockchain ledgers | Limited transparency; proprietary systems |

| Innovation | Rapid innovation with DeFi protocols and tokens | Focus on user experience and fintech integrations |

Which is better?

Decentralized finance (DeFi) offers enhanced transparency, reduced intermediaries, and global accessibility through blockchain technology, catering to users seeking trustless financial services. Neobanking provides user-friendly digital banking experiences with regulatory compliance, offering traditional banking products faster and more efficiently via mobile platforms. The choice depends on priorities: DeFi excels in innovation and autonomy, while neobanks ensure security and regulatory safeguards.

Connection

Decentralized finance (DeFi) and neobanking intersect through their shared goal of enhancing accessibility to financial services via digital platforms. DeFi leverages blockchain technology to offer decentralized financial products, while neobanks provide user-friendly, app-based banking services without traditional branches. This synergy fosters innovative, transparent, and inclusive financial ecosystems that empower users globally.

Key Terms

Digital Wallets

Digital wallets in neobanking offer streamlined payment solutions integrated with traditional financial services, enhancing user convenience and security through centralized control. In contrast, decentralized finance (DeFi) digital wallets provide users with direct access to blockchain-based assets and smart contracts, promoting transparency and autonomy without intermediaries. Explore the key differences and benefits of digital wallets in neobanking and DeFi to understand their impact on modern financial ecosystems.

Smart Contracts

Smart contracts drive automation within decentralized finance (DeFi), enabling trustless lending, borrowing, and asset swaps on blockchain networks, contrasting with neobanks that rely on centralized platforms for financial services. Neobanking offers user-friendly interfaces and regulatory compliance, while DeFi's smart contracts provide transparency and programmability without intermediaries. Explore the evolving impact of smart contracts on modern finance to understand their transformative potential.

Regulatory Compliance

Neobanking operates under strict regulatory compliance frameworks established by financial authorities, ensuring consumer protection and adherence to anti-money laundering (AML) and know-your-customer (KYC) requirements. Decentralized finance (DeFi) functions on blockchain technology, often lacking centralized oversight, which poses challenges for regulatory enforcement and introduces risks related to fraud and security. Explore how regulatory landscapes impact the evolution and adoption of neobanking and DeFi platforms for a deeper understanding.

Source and External Links

Neo Banking 101: All you need to know - Neobanks are fully digital, branchless banks that leverage AI and automation to offer personalized, low-fee, and quick financial services accessible 24/7 through mobile apps, especially appealing to tech-savvy and underbanked customers.

What are neobanks, and how do they work? - Neobanks are online-only financial institutions providing services like checking and savings accounts, loans, and payments via user-friendly apps, often partnering with traditional banks for regulatory compliance and generating revenue through fees, subscriptions, and interest.

What is a Neobank? How It Works, Examples, Pros & Cons - Neobanks are fintech companies offering specialized, cost-effective digital banking products--such as accounts, cards, and international transfers--primarily through mobile apps, with business models focused on low overhead and partnership-based infrastructure.

dowidth.com

dowidth.com