Fractional shares allow investors to buy less than one whole share, enabling portfolio diversification with limited capital. Whole shares require purchasing at least one full unit of a stock, often posing a higher initial investment barrier. Explore the differences between fractional and whole shares to optimize your investment strategy.

Why it is important

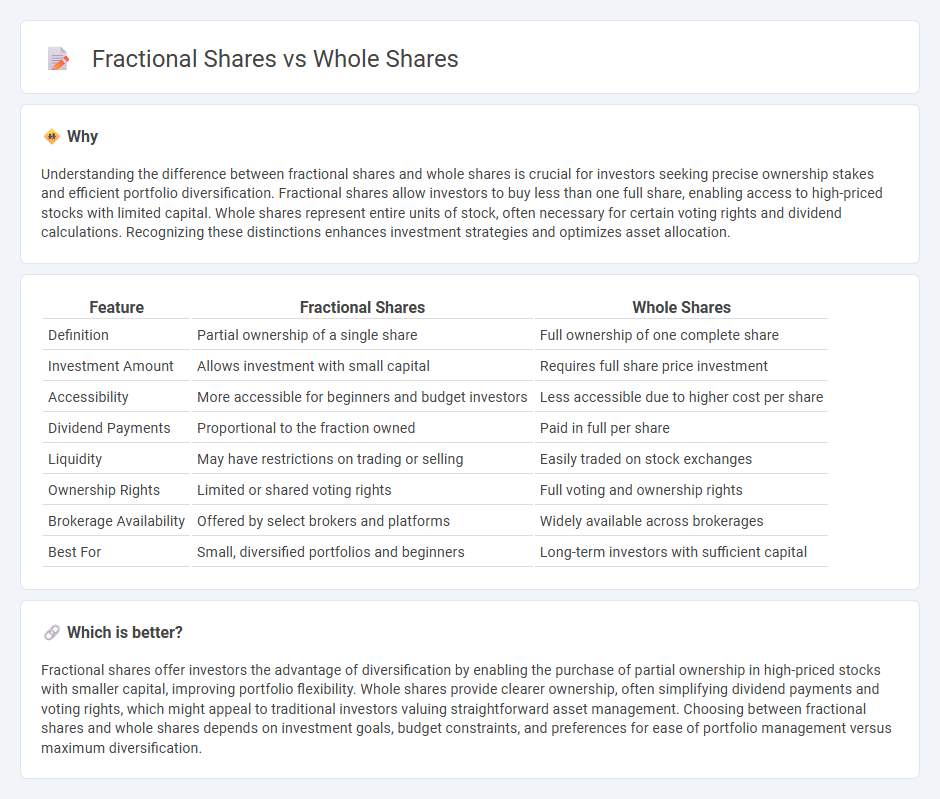

Understanding the difference between fractional shares and whole shares is crucial for investors seeking precise ownership stakes and efficient portfolio diversification. Fractional shares allow investors to buy less than one full share, enabling access to high-priced stocks with limited capital. Whole shares represent entire units of stock, often necessary for certain voting rights and dividend calculations. Recognizing these distinctions enhances investment strategies and optimizes asset allocation.

Comparison Table

| Feature | Fractional Shares | Whole Shares |

|---|---|---|

| Definition | Partial ownership of a single share | Full ownership of one complete share |

| Investment Amount | Allows investment with small capital | Requires full share price investment |

| Accessibility | More accessible for beginners and budget investors | Less accessible due to higher cost per share |

| Dividend Payments | Proportional to the fraction owned | Paid in full per share |

| Liquidity | May have restrictions on trading or selling | Easily traded on stock exchanges |

| Ownership Rights | Limited or shared voting rights | Full voting and ownership rights |

| Brokerage Availability | Offered by select brokers and platforms | Widely available across brokerages |

| Best For | Small, diversified portfolios and beginners | Long-term investors with sufficient capital |

Which is better?

Fractional shares offer investors the advantage of diversification by enabling the purchase of partial ownership in high-priced stocks with smaller capital, improving portfolio flexibility. Whole shares provide clearer ownership, often simplifying dividend payments and voting rights, which might appeal to traditional investors valuing straightforward asset management. Choosing between fractional shares and whole shares depends on investment goals, budget constraints, and preferences for ease of portfolio management versus maximum diversification.

Connection

Fractional shares represent a portion of a whole share, allowing investors to purchase less than one full unit of a company's stock, making investing more accessible and affordable. Whole shares denote a single complete unit of stock ownership, typically traded on stock exchanges at market price. Together, fractional and whole shares offer flexibility in portfolio construction, enabling precise investment amounts and diversification strategies.

Key Terms

Ownership

Whole shares provide investors full voting rights and dividend entitlements proportional to the number of shares held, enhancing control and profit potential in a company. Fractional shares represent a portion of a whole share, allowing investors to own part of a company without full ownership privileges, often purchased through dividend reinvestment or fractional investing platforms. Learn more about how choosing between whole and fractional shares impacts investment strategy and ownership benefits.

Liquidity

Whole shares provide greater liquidity as they can be easily bought or sold in entire units on stock exchanges, ensuring straightforward transactions and quick access to market value. Fractional shares, while offering more flexibility for investors with limited capital, may face challenges in liquidity since they often require trading through specific brokers or platforms, potentially leading to delays or restrictions. Discover more about how liquidity impacts your investment strategy with whole and fractional shares.

Trading Accessibility

Whole shares allow investors to buy full units of stock, often requiring substantial capital, while fractional shares enable the purchase of partial ownership with smaller investments, enhancing trading accessibility. Fractional shares democratize investing by lowering entry barriers and enabling diversification with limited funds. Explore how fractional shares can expand your trading opportunities and portfolio flexibility.

Source and External Links

Whole shares: Overview, definition, and example - Cobrief - Whole shares are individual, complete units of a company's stock representing full ownership units, granting voting rights and dividend entitlement, and are the traditional, most common form of stock traded in the market.

Whole Shares Definition - Law Insider - In legal contexts, whole shares refer to the total number of shares a security holder owns, often defined precisely for contractual or damages calculations involving common or preferred stock.

Fractional Shares: Investing in Stocks Without Buying a ... - Business Insider - Whole shares contrast with fractional shares, which are portions of a full share allowing investors to buy less than one complete share, typically offered by brokers for more flexible investments.

dowidth.com

dowidth.com