Liability driven investing (LDI) focuses on aligning assets with future liabilities to minimize risk and ensure cash flow stability, often used by pension funds and insurance companies. Growth investing targets capital appreciation through equities and high-growth assets, emphasizing long-term value increase despite higher volatility. Explore the key differences and strategic applications of LDI versus growth investing to optimize your portfolio management.

Why it is important

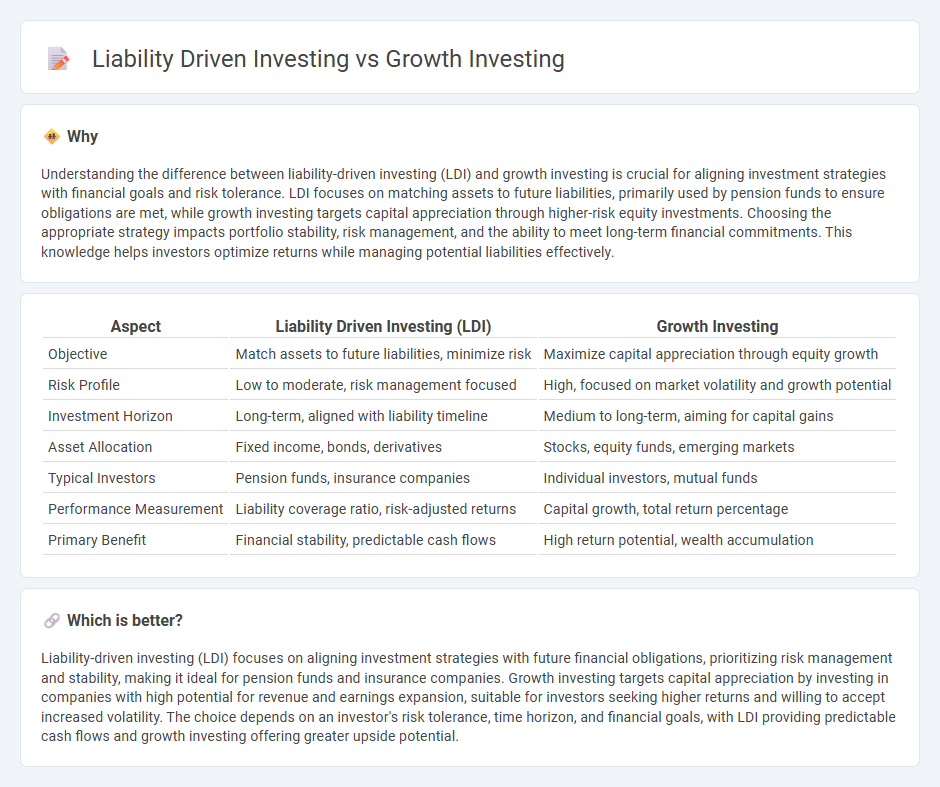

Understanding the difference between liability-driven investing (LDI) and growth investing is crucial for aligning investment strategies with financial goals and risk tolerance. LDI focuses on matching assets to future liabilities, primarily used by pension funds to ensure obligations are met, while growth investing targets capital appreciation through higher-risk equity investments. Choosing the appropriate strategy impacts portfolio stability, risk management, and the ability to meet long-term financial commitments. This knowledge helps investors optimize returns while managing potential liabilities effectively.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Growth Investing |

|---|---|---|

| Objective | Match assets to future liabilities, minimize risk | Maximize capital appreciation through equity growth |

| Risk Profile | Low to moderate, risk management focused | High, focused on market volatility and growth potential |

| Investment Horizon | Long-term, aligned with liability timeline | Medium to long-term, aiming for capital gains |

| Asset Allocation | Fixed income, bonds, derivatives | Stocks, equity funds, emerging markets |

| Typical Investors | Pension funds, insurance companies | Individual investors, mutual funds |

| Performance Measurement | Liability coverage ratio, risk-adjusted returns | Capital growth, total return percentage |

| Primary Benefit | Financial stability, predictable cash flows | High return potential, wealth accumulation |

Which is better?

Liability-driven investing (LDI) focuses on aligning investment strategies with future financial obligations, prioritizing risk management and stability, making it ideal for pension funds and insurance companies. Growth investing targets capital appreciation by investing in companies with high potential for revenue and earnings expansion, suitable for investors seeking higher returns and willing to accept increased volatility. The choice depends on an investor's risk tolerance, time horizon, and financial goals, with LDI providing predictable cash flows and growth investing offering greater upside potential.

Connection

Liability-driven investing (LDI) and growth investing intersect through the strategic allocation of assets to balance risk and return while meeting future financial obligations. LDI focuses on managing financial liabilities by matching assets with debt profiles, whereas growth investing emphasizes capital appreciation through equity exposure. Integrating growth stocks within an LDI framework can enhance portfolio returns and help fulfill long-term liabilities, especially in pension fund management.

Key Terms

**Growth Investing:**

Growth investing targets companies with high earnings potential and above-average revenue expansion, emphasizing capital appreciation over dividends. Investors seek sectors like technology, healthcare, and consumer discretionary, where innovation fuels rapid stock price increases. Explore detailed strategies and risk profiles to optimize your growth investment portfolio.

Capital Appreciation

Growth investing emphasizes capital appreciation by targeting stocks with high potential for earnings expansion and market outperformance. Liability Driven Investing (LDI) focuses on matching assets with future liabilities, prioritizing stability and risk management over aggressive growth. Explore more about choosing the right strategy to align your financial goals and risk tolerance.

Earnings Growth

Earnings growth is central to growth investing, where investors target companies demonstrating robust revenue and profit expansion potential, aiming to maximize capital appreciation. Liability-driven investing (LDI) prioritizes aligning assets with future liabilities, focusing on stable income streams rather than rapid earnings growth to ensure long-term financial obligations are met. Discover more about how earnings growth influences portfolio strategies in different investment frameworks.

Source and External Links

Growth investing: What it is and how to build a high-growth portfolio - Growth investing targets companies with above-average growth potential, benefiting from compounding returns and capitalizing on innovation-driven market trends.

Growth investing - Wikipedia - Growth investing focuses on capital appreciation by investing in companies that demonstrate above-average growth, even if their stock prices seem expensive relative to traditional valuation metrics.

Investing for growth opportunities - BlackRock - Growth investing involves seeking companies with strong earnings potential for above-average revenue and profit growth, fitting investors with long-term wealth accumulation goals and tolerance for risk.

dowidth.com

dowidth.com