Structured credit involves pooling various debt instruments into securities sold to investors, enhancing risk diversification and tailored income streams. Mezzanine financing serves as a hybrid of debt and equity, typically used by companies to finance expansion without diluting ownership, offering higher returns with subordinate claim on assets. Explore further to understand which financing strategy aligns best with your capital structure needs.

Why it is important

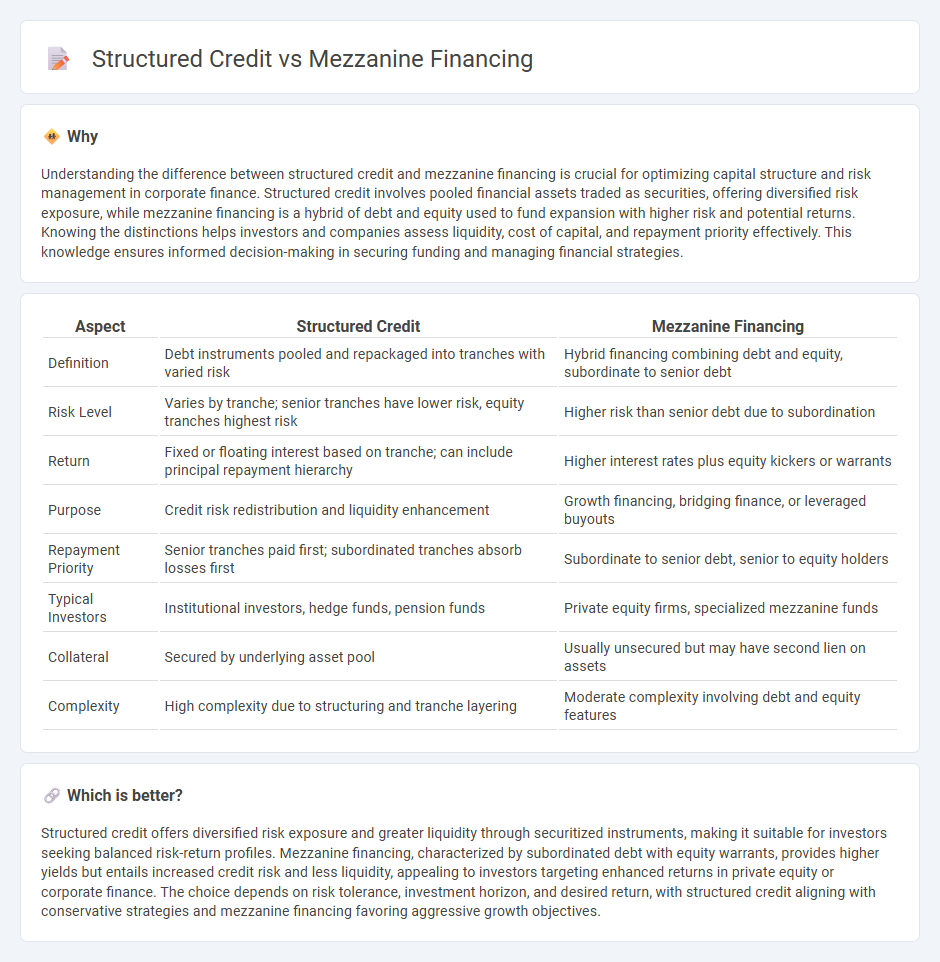

Understanding the difference between structured credit and mezzanine financing is crucial for optimizing capital structure and risk management in corporate finance. Structured credit involves pooled financial assets traded as securities, offering diversified risk exposure, while mezzanine financing is a hybrid of debt and equity used to fund expansion with higher risk and potential returns. Knowing the distinctions helps investors and companies assess liquidity, cost of capital, and repayment priority effectively. This knowledge ensures informed decision-making in securing funding and managing financial strategies.

Comparison Table

| Aspect | Structured Credit | Mezzanine Financing |

|---|---|---|

| Definition | Debt instruments pooled and repackaged into tranches with varied risk | Hybrid financing combining debt and equity, subordinate to senior debt |

| Risk Level | Varies by tranche; senior tranches have lower risk, equity tranches highest risk | Higher risk than senior debt due to subordination |

| Return | Fixed or floating interest based on tranche; can include principal repayment hierarchy | Higher interest rates plus equity kickers or warrants |

| Purpose | Credit risk redistribution and liquidity enhancement | Growth financing, bridging finance, or leveraged buyouts |

| Repayment Priority | Senior tranches paid first; subordinated tranches absorb losses first | Subordinate to senior debt, senior to equity holders |

| Typical Investors | Institutional investors, hedge funds, pension funds | Private equity firms, specialized mezzanine funds |

| Collateral | Secured by underlying asset pool | Usually unsecured but may have second lien on assets |

| Complexity | High complexity due to structuring and tranche layering | Moderate complexity involving debt and equity features |

Which is better?

Structured credit offers diversified risk exposure and greater liquidity through securitized instruments, making it suitable for investors seeking balanced risk-return profiles. Mezzanine financing, characterized by subordinated debt with equity warrants, provides higher yields but entails increased credit risk and less liquidity, appealing to investors targeting enhanced returns in private equity or corporate finance. The choice depends on risk tolerance, investment horizon, and desired return, with structured credit aligning with conservative strategies and mezzanine financing favoring aggressive growth objectives.

Connection

Structured credit and mezzanine financing are connected through their roles in complex capital structures where mezzanine debt often layers between senior debt and equity, providing higher yields with subordinated risk. Structured credit products, such as collateralized debt obligations (CDOs), frequently package mezzanine loans to diversify risk and enhance returns for investors. This synergy enables tailored financing solutions for companies seeking bridge capital or growth funding beyond traditional bank loans.

Key Terms

Subordinated Debt

Mezzanine financing typically involves subordinated debt combined with equity options, providing higher returns due to its junior claim on assets compared to senior debt. Structured credit, including tools like collateralized loan obligations (CLOs), pools subordinated debt tranches with varying risk profiles to optimize investor returns and credit ratings. Explore more about how subordinated debt functions within these financing structures to enhance portfolio performance and risk management.

Collateralized Loan Obligation (CLO)

Mezzanine financing involves subordinate debt or preferred equity that fills the gap between senior debt and equity, offering higher yields but increased risk. Structured credit, particularly Collateralized Loan Obligations (CLOs), pools diversified corporate loans into tranches with varying risk and return profiles, enhancing credit risk management. Explore the intricacies of mezzanine financing and CLOs to optimize your capital structure strategies.

Equity Kicker

Mezzanine financing often incorporates an equity kicker, granting lenders potential upside through warrants or options tied to the borrower's equity, enhancing returns beyond fixed interest payments. Structured credit, while primarily focused on debt tranches and credit derivatives, typically lacks direct equity participation, emphasizing risk redistribution rather than equity stakes. Explore the strategic advantages and risk profiles of equity kickers in mezzanine deals to better understand their impact on investor returns.

Source and External Links

What is Mezzanine Financing? - PGIM Private Capital - Mezzanine financing is a hybrid capital resource positioned between less risky senior debt and higher risk equity, used by companies to finance growth, acquisitions, or recapitalizations, and typically structured with higher interest rates than senior debt and a mixture of cash interest and equity-like features such as warrants.

What is Mezzanine Financing | BDC.ca - Mezzanine financing is a business loan that combines debt and equity characteristics, often unsecured and subordinated to senior debt, offering flexible repayment terms and treated as equity on the balance sheet which improves the borrower's leverage position.

Mezzanine Financing - Overview, Rate of Return, Benefits - Mezzanine financing fills the gap between senior debt and equity, usually consisting of unsecured debt or preferred stock with higher risk and returns, commonly paying investors 12-20% and potentially including payment-in-kind interest that accrues rather than being paid periodically.

dowidth.com

dowidth.com