Finfluencers leverage social media platforms to provide accessible financial tips and market insights, often targeting younger audiences seeking quick, digestible advice. Wealth managers offer personalized, comprehensive financial planning and investment strategies tailored to high-net-worth individuals aiming for long-term wealth preservation and growth. Discover the unique benefits each approach offers to enhance your financial journey.

Why it is important

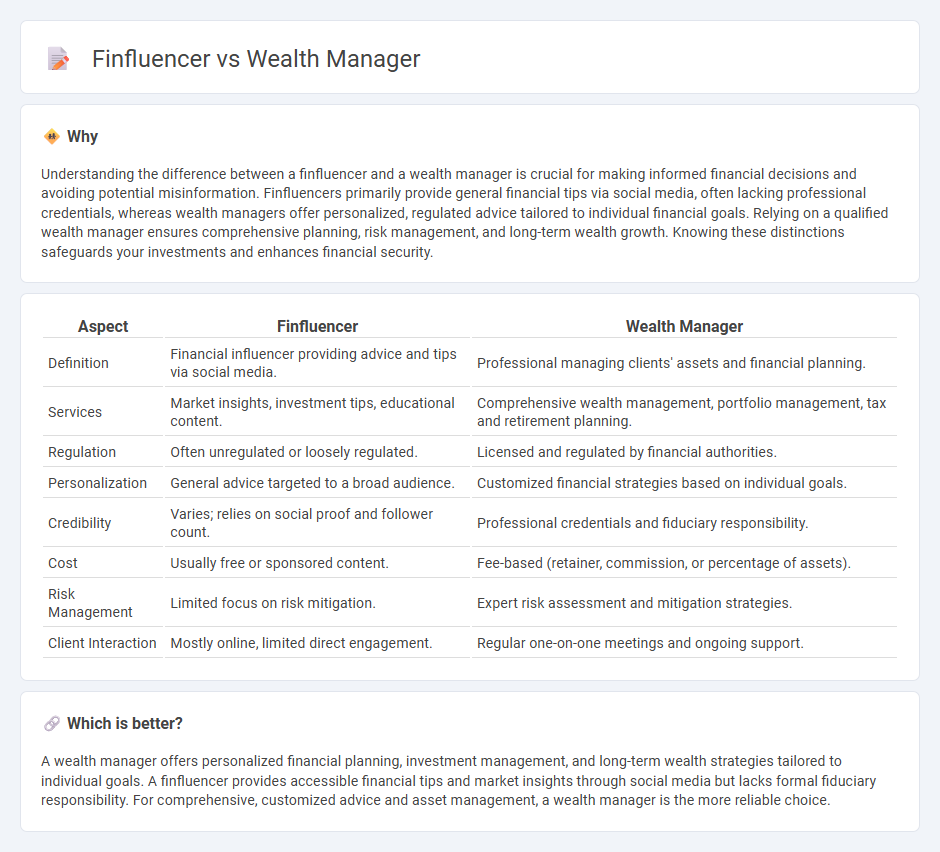

Understanding the difference between a finfluencer and a wealth manager is crucial for making informed financial decisions and avoiding potential misinformation. Finfluencers primarily provide general financial tips via social media, often lacking professional credentials, whereas wealth managers offer personalized, regulated advice tailored to individual financial goals. Relying on a qualified wealth manager ensures comprehensive planning, risk management, and long-term wealth growth. Knowing these distinctions safeguards your investments and enhances financial security.

Comparison Table

| Aspect | Finfluencer | Wealth Manager |

|---|---|---|

| Definition | Financial influencer providing advice and tips via social media. | Professional managing clients' assets and financial planning. |

| Services | Market insights, investment tips, educational content. | Comprehensive wealth management, portfolio management, tax and retirement planning. |

| Regulation | Often unregulated or loosely regulated. | Licensed and regulated by financial authorities. |

| Personalization | General advice targeted to a broad audience. | Customized financial strategies based on individual goals. |

| Credibility | Varies; relies on social proof and follower count. | Professional credentials and fiduciary responsibility. |

| Cost | Usually free or sponsored content. | Fee-based (retainer, commission, or percentage of assets). |

| Risk Management | Limited focus on risk mitigation. | Expert risk assessment and mitigation strategies. |

| Client Interaction | Mostly online, limited direct engagement. | Regular one-on-one meetings and ongoing support. |

Which is better?

A wealth manager offers personalized financial planning, investment management, and long-term wealth strategies tailored to individual goals. A finfluencer provides accessible financial tips and market insights through social media but lacks formal fiduciary responsibility. For comprehensive, customized advice and asset management, a wealth manager is the more reliable choice.

Connection

Finfluencers leverage social media platforms to educate and influence audiences on personal finance topics, often driving interest in wealth management services. Wealth managers rely on the engagement and trust built by finfluencers to attract clients seeking professional financial planning and investment advice. Collaboration between finfluencers and wealth managers enhances financial literacy while expanding client outreach through digital channels.

Key Terms

**Wealth Manager:**

Wealth managers provide personalized financial planning, investment management, and retirement strategies tailored to individual client goals and risk profiles. Their expertise combines market knowledge, regulatory compliance, and fiduciary responsibility to ensure long-term wealth preservation and growth. Explore how a professional wealth manager can optimize your financial future with expert guidance.

Asset Allocation

Wealth managers provide personalized asset allocation strategies based on comprehensive financial analysis and long-term goals, ensuring balanced risk and growth potential tailored to individual investor profiles. Finfluencers often offer generalized asset allocation tips driven by trending investment ideas and market sentiment, which may lack in-depth customization and risk assessment. Discover more about how professional wealth management compares with influencer advice in optimizing your portfolio's asset allocation.

Fiduciary Duty

Wealth managers uphold a fiduciary duty, legally requiring them to act in their clients' best financial interests, ensuring personalized strategies and transparent advice. Finfluencers, while influential in financial trends and education, lack a formal fiduciary responsibility and their recommendations may prioritize engagement over individual client needs. Explore how fiduciary duty impacts financial guidance for more informed decisions.

Source and External Links

What Is a Wealth Manager? - SmartAsset - A wealth manager is a specialized financial professional who offers comprehensive services including investment management, retirement planning, tax strategies, and estate planning, typically for individuals with $1 million or more in assets, providing holistic and personalized financial guidance.

What Do Private Wealth Managers Do? - CFA Institute - Private wealth managers serve high-net-worth individuals by managing investments, planning estates and retirement, and providing tax services, often advancing from assistant roles to lead advisors managing client portfolios with personalized relationship management.

Wealth Management: What It Is, Costs, Minimums - NerdWallet - Wealth management involves holistic financial services for affluent clients, with fees typically ranging from 0.25% to 2% of assets under management and account minimums often starting at $500,000 or higher, depending on the firm and service tier.

dowidth.com

dowidth.com