Bucket investing segments assets into separate portfolios tailored for specific time horizons and risk levels, enhancing diversification and capital preservation. Thematic investing focuses on capitalizing on long-term trends by targeting sectors or themes such as renewable energy, technology innovation, or demographic shifts, aligning investments with future growth drivers. Explore the advantages and strategies behind bucket investing and thematic investing to optimize your financial portfolio.

Why it is important

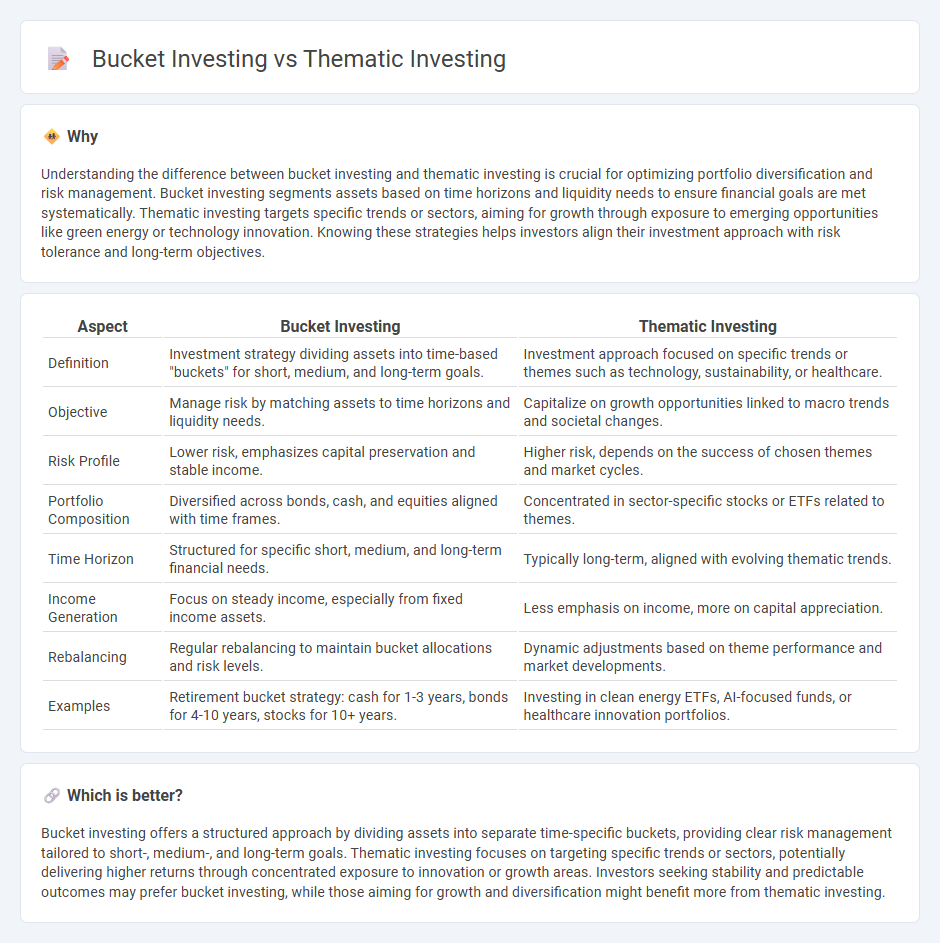

Understanding the difference between bucket investing and thematic investing is crucial for optimizing portfolio diversification and risk management. Bucket investing segments assets based on time horizons and liquidity needs to ensure financial goals are met systematically. Thematic investing targets specific trends or sectors, aiming for growth through exposure to emerging opportunities like green energy or technology innovation. Knowing these strategies helps investors align their investment approach with risk tolerance and long-term objectives.

Comparison Table

| Aspect | Bucket Investing | Thematic Investing |

|---|---|---|

| Definition | Investment strategy dividing assets into time-based "buckets" for short, medium, and long-term goals. | Investment approach focused on specific trends or themes such as technology, sustainability, or healthcare. |

| Objective | Manage risk by matching assets to time horizons and liquidity needs. | Capitalize on growth opportunities linked to macro trends and societal changes. |

| Risk Profile | Lower risk, emphasizes capital preservation and stable income. | Higher risk, depends on the success of chosen themes and market cycles. |

| Portfolio Composition | Diversified across bonds, cash, and equities aligned with time frames. | Concentrated in sector-specific stocks or ETFs related to themes. |

| Time Horizon | Structured for specific short, medium, and long-term financial needs. | Typically long-term, aligned with evolving thematic trends. |

| Income Generation | Focus on steady income, especially from fixed income assets. | Less emphasis on income, more on capital appreciation. |

| Rebalancing | Regular rebalancing to maintain bucket allocations and risk levels. | Dynamic adjustments based on theme performance and market developments. |

| Examples | Retirement bucket strategy: cash for 1-3 years, bonds for 4-10 years, stocks for 10+ years. | Investing in clean energy ETFs, AI-focused funds, or healthcare innovation portfolios. |

Which is better?

Bucket investing offers a structured approach by dividing assets into separate time-specific buckets, providing clear risk management tailored to short-, medium-, and long-term goals. Thematic investing focuses on targeting specific trends or sectors, potentially delivering higher returns through concentrated exposure to innovation or growth areas. Investors seeking stability and predictable outcomes may prefer bucket investing, while those aiming for growth and diversification might benefit more from thematic investing.

Connection

Bucket investing segments assets into time-based portfolios to manage risk and meet financial goals, while thematic investing focuses on sectors or trends like technology or sustainability. Both strategies optimize portfolio diversification by targeting specific risk profiles and growth opportunities aligned with investors' time horizons and interests. Integrating thematic investing within bucket investing allows for strategic exposure to high-conviction themes while maintaining organized liquidity and risk management.

Key Terms

Sector Allocation

Thematic investing targets specific sectors or trends such as technology, healthcare, or renewable energy, allowing investors to capitalize on long-term growth opportunities within specialized areas. Bucket investing divides the portfolio into segments based on time horizons or goals, often blending multiple asset classes and sectors to balance risk and liquidity. Discover how sector allocation strategies differ between these approaches to optimize your investment outcomes.

Risk Diversification

Thematic investing targets specific trends or sectors, leading to concentrated exposure that may increase risk volatility compared to bucket investing, which allocates assets into distinct categories like growth, income, and safety to balance overall portfolio risk. Risk diversification in bucket investing reduces the impact of poor performance in any single segment, enhancing stability during market fluctuations. Explore further to understand how these strategies affect portfolio resilience and risk management.

Investment Thesis

Thematic investing centers on identifying long-term macro trends such as technology innovation, climate change, or demographic shifts, forming an investment thesis that aligns with these evolving narratives. Bucket investing divides assets into different "buckets" based on time horizons and risk tolerance, each bucket targeting specific financial goals with tailored strategies rather than overarching themes. Explore detailed comparisons and strategic insights to deepen your understanding of these investing approaches.

Source and External Links

What is Thematic Investing? - Thematic investing targets broad ideas, values, or trends across industries that traditional sector classifications may not capture, grouping relevant companies into portfolios for investors interested in themes such as AI or social forces, with a disciplined approach advised despite the trendiness of many products.

Thematic investing - Wikipedia - Thematic investing involves identifying macro-level trends and building portfolios focused on areas expected to outperform long-term, spanning sectors and including themes like sustainable development, AI, ageing populations, and cybersecurity, but caution is advised due to some funds leveraging themes mainly for marketing.

Thematic Investing: Tomorrow's themes, today - BlackRock - Thematic investing aligns portfolios with evolving economic trends and leverages dynamic, cross-sector themes identified through techniques like natural language processing to capture investment opportunities that traditional sector classifications might miss, emphasizing themes' potential to drive meaningful returns over time.

dowidth.com

dowidth.com