Decentralized exchanges (DEXs) enable peer-to-peer cryptocurrency trading without intermediaries, promoting enhanced security and user control over funds. In contrast, crypto brokers facilitate asset purchases through centralized platforms, often providing easier access and customer support but requiring trust in the broker. Explore the nuances between these platforms to determine the best fit for your crypto trading needs.

Why it is important

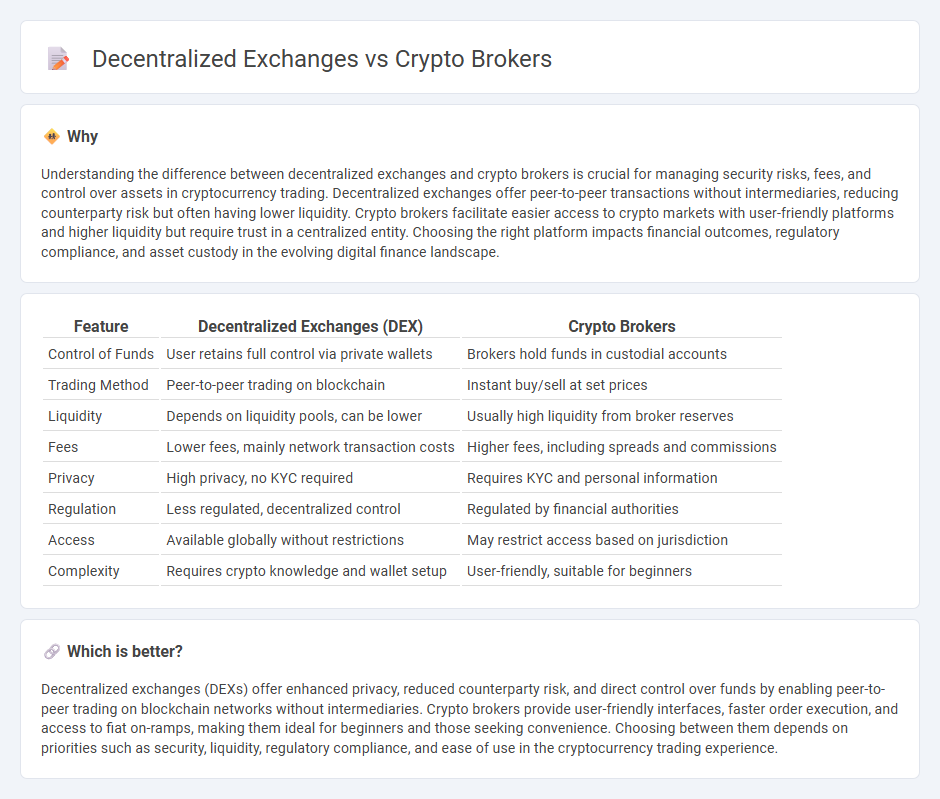

Understanding the difference between decentralized exchanges and crypto brokers is crucial for managing security risks, fees, and control over assets in cryptocurrency trading. Decentralized exchanges offer peer-to-peer transactions without intermediaries, reducing counterparty risk but often having lower liquidity. Crypto brokers facilitate easier access to crypto markets with user-friendly platforms and higher liquidity but require trust in a centralized entity. Choosing the right platform impacts financial outcomes, regulatory compliance, and asset custody in the evolving digital finance landscape.

Comparison Table

| Feature | Decentralized Exchanges (DEX) | Crypto Brokers |

|---|---|---|

| Control of Funds | User retains full control via private wallets | Brokers hold funds in custodial accounts |

| Trading Method | Peer-to-peer trading on blockchain | Instant buy/sell at set prices |

| Liquidity | Depends on liquidity pools, can be lower | Usually high liquidity from broker reserves |

| Fees | Lower fees, mainly network transaction costs | Higher fees, including spreads and commissions |

| Privacy | High privacy, no KYC required | Requires KYC and personal information |

| Regulation | Less regulated, decentralized control | Regulated by financial authorities |

| Access | Available globally without restrictions | May restrict access based on jurisdiction |

| Complexity | Requires crypto knowledge and wallet setup | User-friendly, suitable for beginners |

Which is better?

Decentralized exchanges (DEXs) offer enhanced privacy, reduced counterparty risk, and direct control over funds by enabling peer-to-peer trading on blockchain networks without intermediaries. Crypto brokers provide user-friendly interfaces, faster order execution, and access to fiat on-ramps, making them ideal for beginners and those seeking convenience. Choosing between them depends on priorities such as security, liquidity, regulatory compliance, and ease of use in the cryptocurrency trading experience.

Connection

Decentralized exchanges (DEXs) and crypto brokers both facilitate cryptocurrency trading by offering liquidity and market access, but DEXs operate on blockchain networks without intermediaries while crypto brokers act as centralized platforms providing user-friendly services. Crypto brokers often aggregate liquidity from multiple DEXs and centralized exchanges to offer competitive prices and seamless trading experiences. The connection between these two lies in the integration of on-chain liquidity pools from DEXs into broker platforms, enhancing market efficiency and accessibility for retail and institutional investors.

Key Terms

Custodial

Crypto brokers operate as custodial platforms, holding users' private keys and managing digital assets on their behalf, which provides convenience but introduces counterparty risk. Decentralized exchanges (DEXs) are non-custodial, enabling peer-to-peer transactions where users retain full control of their private keys, enhancing security and privacy. Discover the distinctions and find out which option best suits your trading strategy and security preferences.

Liquidity

Crypto brokers provide deep liquidity through aggregated order books from multiple sources, ensuring fast execution and price stability, particularly for large-volume trades. Decentralized exchanges (DEXs) rely on automated market makers (AMMs) and liquidity pools, which can vary widely in liquidity, often leading to slippage during high-demand periods. Explore the differences in liquidity mechanisms to choose the best trading platform for your needs.

Counterparty Risk

Crypto brokers assume counterparty risk by holding user assets and executing trades on centralized platforms, potentially exposing investors to hacking or insolvency. Decentralized exchanges eliminate this risk by enabling peer-to-peer transactions on blockchain networks, ensuring users maintain control over their funds throughout the trading process. Explore the advantages and risks of both options to make informed trading decisions.

Source and External Links

Best online brokers for buying and selling cryptocurrency - Highlights top crypto brokers like Robinhood, Interactive Brokers, Webull, and Coinbase, with details on their commission structures and account minimums, useful for direct cryptocurrency purchases and trading.

Best Crypto Brokers US - Reviews Capital.com as a leading crypto broker offering commission-free trading on over 285 crypto CFDs, strong regulation, educational resources, and advanced trading analytics.

Crypto Trading Platforms for Beginners in 2025 - Lists beginner-friendly crypto brokers like Fusion Markets and FP Markets offering crypto CFDs, user-friendly platforms, educational tools, no minimum account sizes, and options for copy trading.

dowidth.com

dowidth.com