Impact investing directs capital towards ventures generating measurable social and environmental benefits alongside financial returns, emphasizing accountability and transparency in achieving positive outcomes. Corporate social responsibility (CSR) involves businesses integrating ethical practices and sustainability into their operations, often focusing on philanthropy and compliance without direct financial gain. Explore the distinctions between impact investing and CSR to understand their unique roles in advancing sustainable finance.

Why it is important

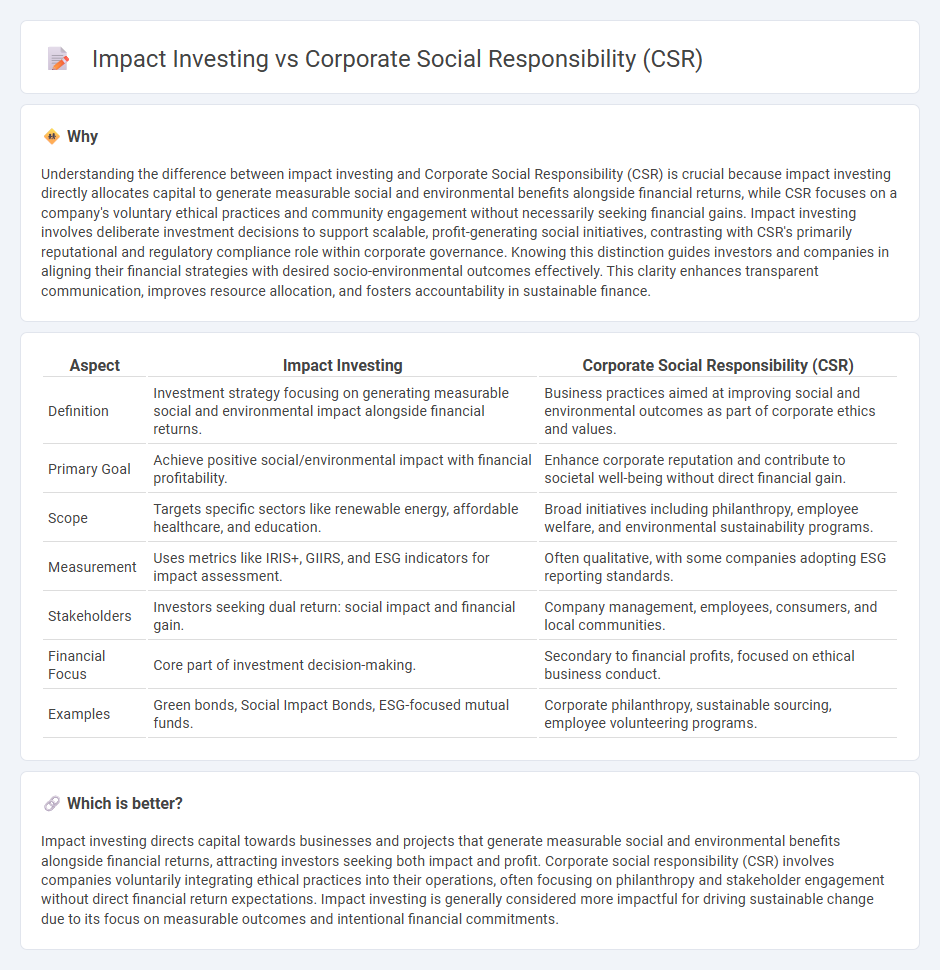

Understanding the difference between impact investing and Corporate Social Responsibility (CSR) is crucial because impact investing directly allocates capital to generate measurable social and environmental benefits alongside financial returns, while CSR focuses on a company's voluntary ethical practices and community engagement without necessarily seeking financial gains. Impact investing involves deliberate investment decisions to support scalable, profit-generating social initiatives, contrasting with CSR's primarily reputational and regulatory compliance role within corporate governance. Knowing this distinction guides investors and companies in aligning their financial strategies with desired socio-environmental outcomes effectively. This clarity enhances transparent communication, improves resource allocation, and fosters accountability in sustainable finance.

Comparison Table

| Aspect | Impact Investing | Corporate Social Responsibility (CSR) |

|---|---|---|

| Definition | Investment strategy focusing on generating measurable social and environmental impact alongside financial returns. | Business practices aimed at improving social and environmental outcomes as part of corporate ethics and values. |

| Primary Goal | Achieve positive social/environmental impact with financial profitability. | Enhance corporate reputation and contribute to societal well-being without direct financial gain. |

| Scope | Targets specific sectors like renewable energy, affordable healthcare, and education. | Broad initiatives including philanthropy, employee welfare, and environmental sustainability programs. |

| Measurement | Uses metrics like IRIS+, GIIRS, and ESG indicators for impact assessment. | Often qualitative, with some companies adopting ESG reporting standards. |

| Stakeholders | Investors seeking dual return: social impact and financial gain. | Company management, employees, consumers, and local communities. |

| Financial Focus | Core part of investment decision-making. | Secondary to financial profits, focused on ethical business conduct. |

| Examples | Green bonds, Social Impact Bonds, ESG-focused mutual funds. | Corporate philanthropy, sustainable sourcing, employee volunteering programs. |

Which is better?

Impact investing directs capital towards businesses and projects that generate measurable social and environmental benefits alongside financial returns, attracting investors seeking both impact and profit. Corporate social responsibility (CSR) involves companies voluntarily integrating ethical practices into their operations, often focusing on philanthropy and stakeholder engagement without direct financial return expectations. Impact investing is generally considered more impactful for driving sustainable change due to its focus on measurable outcomes and intentional financial commitments.

Connection

Impact investing and Corporate Social Responsibility (CSR) are interconnected through their shared goal of generating positive social and environmental outcomes alongside financial returns. Impact investing channels capital into companies and projects with measurable social impact, while CSR integrates responsible practices into a corporation's core operations to address societal challenges. Both approaches enhance corporate accountability, attract socially-conscious investors, and drive sustainable business growth.

Key Terms

Stakeholder engagement

Corporate social responsibility (CSR) emphasizes stakeholder engagement by integrating ethical practices and community welfare into business operations, fostering trust and long-term relationships. Impact investing targets measurable social and environmental outcomes alongside financial returns, prioritizing investments that directly benefit stakeholders and generate positive change. Explore how aligning CSR strategies with impact investing can enhance stakeholder value and sustainable development.

Social return on investment (SROI)

Corporate social responsibility (CSR) initiatives primarily aim to enhance brand reputation and stakeholder trust through ethical business practices and community engagement, whereas impact investing targets measurable social and environmental outcomes alongside financial returns. Social return on investment (SROI) quantifies the value created relative to resources invested, offering a data-driven approach to evaluate both CSR programs and impact investment performance. Explore how integrating SROI can optimize strategies for maximizing positive social impact across sectors.

ESG (Environmental, Social, and Governance) criteria

Corporate social responsibility (CSR) emphasizes integrating ESG (Environmental, Social, and Governance) criteria into a company's operations to promote ethical practices, sustainability, and social impact. Impact investing targets capital deployment into ventures and funds that generate measurable environmental and social benefits alongside financial returns, with an explicit focus on ESG outcomes. Explore further to understand how CSR and impact investing uniquely contribute to sustainable business strategies.

Source and External Links

Corporate social responsibility - Wikipedia - CSR is an international private business self-regulation approach aiming to contribute to societal goals via philanthropy, ethical business practices, and community engagement, evolving from voluntary activities to mandatory schemes at various levels worldwide.

What Is Corporate Social Responsibility (CSR)? - CSR ensures companies' day-to-day practices are ethical and socially beneficial, integrating with ESG frameworks and emphasizing transparency, accountability, and long-term positive social impact to build trust and business success.

What is Corporate Social Responsibility (CSR)? Guide & Examples - CSR involves a company's efforts to improve society through philanthropy, ethical practices, environmental initiatives, and social justice, aiming to use business as a force for good beyond profit-making.

dowidth.com

dowidth.com