Decentralized Autonomous Organization (DAO) treasuries leverage blockchain technology for transparent, community-driven fund management, contrasting sharply with centralized corporate treasuries that rely on hierarchical control and traditional financial systems. DAOs use smart contracts to automate transactions and governance, enhancing security and reducing human error, while corporate treasuries focus on risk management, liquidity, and regulatory compliance within centralized frameworks. Explore the evolving dynamics between DAO and corporate treasuries to understand their impact on the future of financial governance.

Why it is important

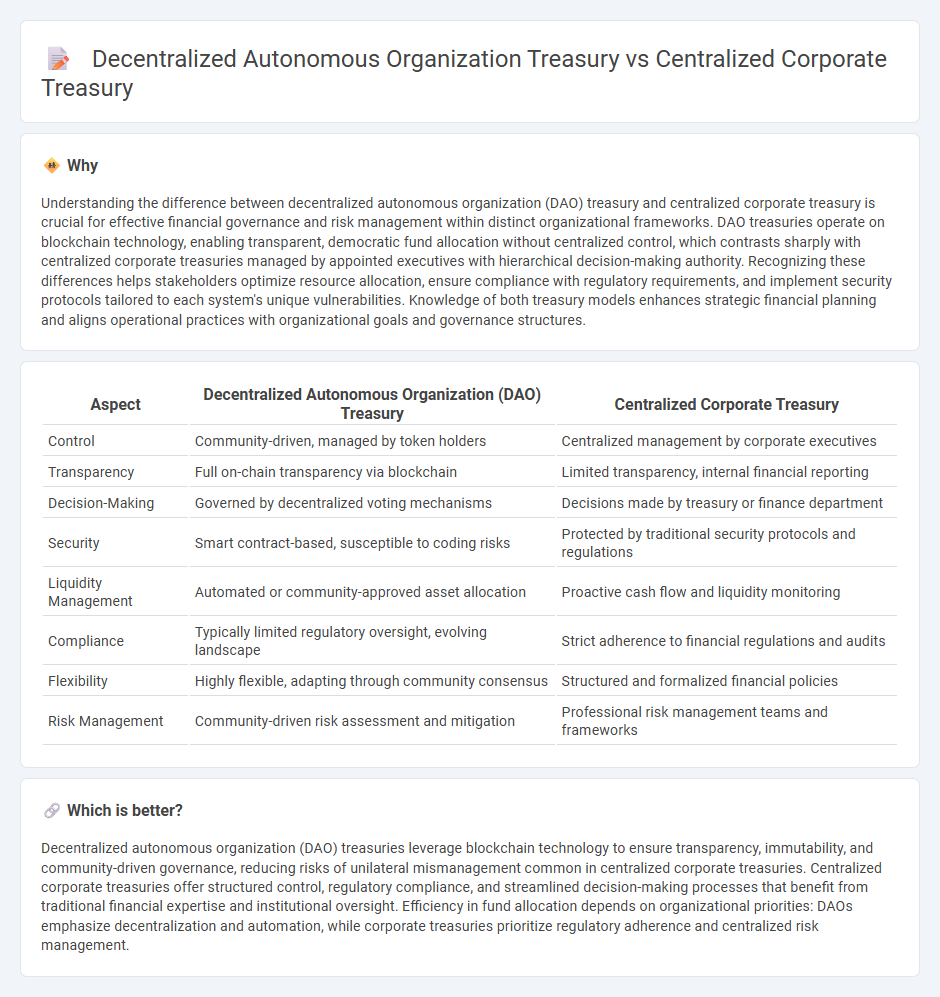

Understanding the difference between decentralized autonomous organization (DAO) treasury and centralized corporate treasury is crucial for effective financial governance and risk management within distinct organizational frameworks. DAO treasuries operate on blockchain technology, enabling transparent, democratic fund allocation without centralized control, which contrasts sharply with centralized corporate treasuries managed by appointed executives with hierarchical decision-making authority. Recognizing these differences helps stakeholders optimize resource allocation, ensure compliance with regulatory requirements, and implement security protocols tailored to each system's unique vulnerabilities. Knowledge of both treasury models enhances strategic financial planning and aligns operational practices with organizational goals and governance structures.

Comparison Table

| Aspect | Decentralized Autonomous Organization (DAO) Treasury | Centralized Corporate Treasury |

|---|---|---|

| Control | Community-driven, managed by token holders | Centralized management by corporate executives |

| Transparency | Full on-chain transparency via blockchain | Limited transparency, internal financial reporting |

| Decision-Making | Governed by decentralized voting mechanisms | Decisions made by treasury or finance department |

| Security | Smart contract-based, susceptible to coding risks | Protected by traditional security protocols and regulations |

| Liquidity Management | Automated or community-approved asset allocation | Proactive cash flow and liquidity monitoring |

| Compliance | Typically limited regulatory oversight, evolving landscape | Strict adherence to financial regulations and audits |

| Flexibility | Highly flexible, adapting through community consensus | Structured and formalized financial policies |

| Risk Management | Community-driven risk assessment and mitigation | Professional risk management teams and frameworks |

Which is better?

Decentralized autonomous organization (DAO) treasuries leverage blockchain technology to ensure transparency, immutability, and community-driven governance, reducing risks of unilateral mismanagement common in centralized corporate treasuries. Centralized corporate treasuries offer structured control, regulatory compliance, and streamlined decision-making processes that benefit from traditional financial expertise and institutional oversight. Efficiency in fund allocation depends on organizational priorities: DAOs emphasize decentralization and automation, while corporate treasuries prioritize regulatory adherence and centralized risk management.

Connection

Decentralized autonomous organization (DAO) treasuries are managed through blockchain-based smart contracts enabling transparent, automated financial transactions, while centralized corporate treasuries rely on traditional finance systems and centralized control for liquidity management and risk mitigation. Both treasuries focus on optimizing capital allocation, cash flow forecasting, and investment strategies, but DAO treasuries leverage decentralized governance for decision-making, contrasting with the hierarchical structure of corporate treasuries. Integration occurs when corporations adopt blockchain technology to enhance transparency and efficiency in treasury operations, facilitating hybrid models that blend centralized oversight with decentralized asset management.

Key Terms

**Cash Management**

Centralized corporate treasury centralizes cash management to optimize liquidity, reduce banking fees, and streamline forecasting through consolidated cash positions across subsidiaries. Decentralized autonomous organization (DAO) treasury operates with distributed control, utilizing blockchain technology and smart contracts for transparent, programmable cash flow and real-time tracking without intermediaries. Explore the advantages and challenges of both systems to enhance your organization's cash management strategy.

**Governance Structure**

Centralized corporate treasury structures consolidate decision-making authority within a defined leadership, ensuring streamlined oversight and consistent policy enforcement, critical for risk management and regulatory compliance. In contrast, decentralized autonomous organization (DAO) treasuries distribute governance across token holders using blockchain-based voting, promoting transparency and collective ownership but introducing challenges in coordination and strategic alignment. Explore the distinct governance frameworks shaping treasury management in centralized corporates and DAOs to understand their operational efficiencies and risks.

**Decision-Making Authority**

Centralized corporate treasury consolidates decision-making authority under a unified management team, allowing for standardized financial strategies and tighter risk control. Decentralized autonomous organization (DAO) treasury distributes decision-making power among token holders or governance participants, fostering transparency and collective oversight. Discover how these differing structures impact financial agility and governance by exploring their unique decision-making dynamics.

Source and External Links

A Guide to Centralized Treasury Management for MNC - Trovata - Centralized corporate treasury consolidates financial operations of multinational corporations under a single umbrella to streamline treasury functions, improve liquidity and risk management, and enhance regulatory compliance through better operational efficiency and holistic financial visibility.

A Guide to Centralizing Treasury Functions for Better Control - Centralized treasury consolidates cash management, risk mitigation, and funding decisions into one cohesive framework, enabling optimized liquidity, standardized processes, improved oversight, and streamlined communication for enhanced control and efficiency.

Centralized Treasury | HighRadius(tm) | Autonomous Finance - The purpose of centralized treasury is to optimize cash management, enhance cash visibility, enforce greater control, improve efficiency by reducing redundancies, and better manage financial risks like foreign exchange and interest rate exposure through a unified treasury function.

dowidth.com

dowidth.com