Tax loss harvesting is a strategic investment practice that involves selling securities at a loss to offset capital gains and reduce taxable income, thus maximizing after-tax returns. The wash sale rule, enforced by the IRS, prohibits claiming a tax deduction for a security sold at a loss if a substantially identical security is purchased within 30 days before or after the sale, preventing investors from claiming artificial losses. Explore how understanding the interplay between tax loss harvesting and the wash sale rule can enhance your investment tax strategy.

Why it is important

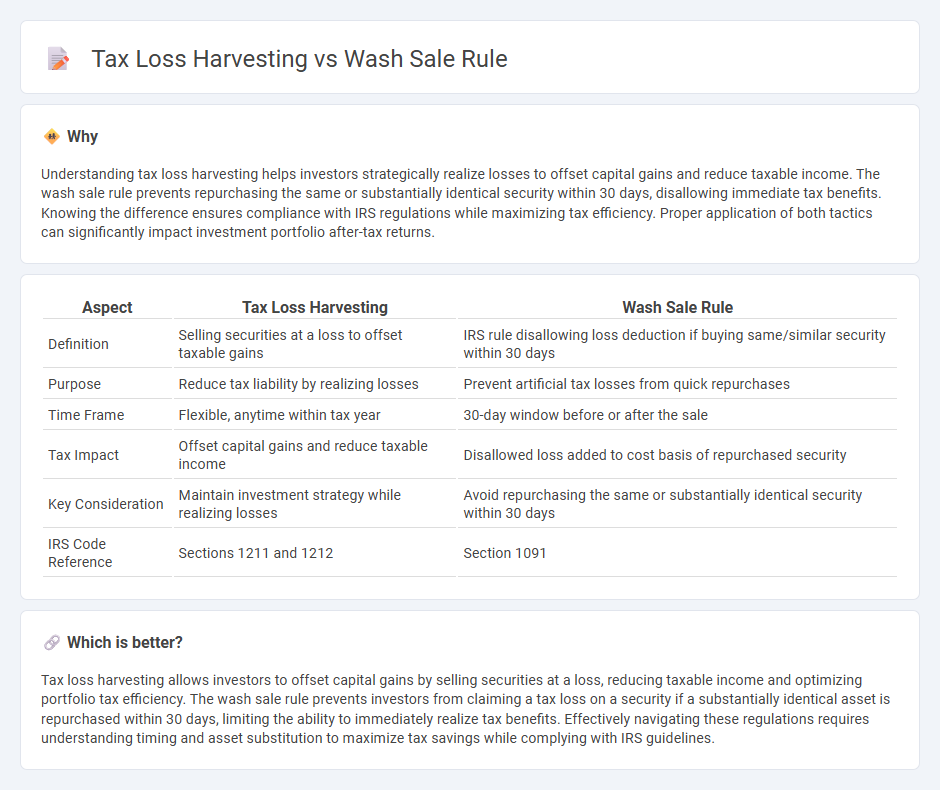

Understanding tax loss harvesting helps investors strategically realize losses to offset capital gains and reduce taxable income. The wash sale rule prevents repurchasing the same or substantially identical security within 30 days, disallowing immediate tax benefits. Knowing the difference ensures compliance with IRS regulations while maximizing tax efficiency. Proper application of both tactics can significantly impact investment portfolio after-tax returns.

Comparison Table

| Aspect | Tax Loss Harvesting | Wash Sale Rule |

|---|---|---|

| Definition | Selling securities at a loss to offset taxable gains | IRS rule disallowing loss deduction if buying same/similar security within 30 days |

| Purpose | Reduce tax liability by realizing losses | Prevent artificial tax losses from quick repurchases |

| Time Frame | Flexible, anytime within tax year | 30-day window before or after the sale |

| Tax Impact | Offset capital gains and reduce taxable income | Disallowed loss added to cost basis of repurchased security |

| Key Consideration | Maintain investment strategy while realizing losses | Avoid repurchasing the same or substantially identical security within 30 days |

| IRS Code Reference | Sections 1211 and 1212 | Section 1091 |

Which is better?

Tax loss harvesting allows investors to offset capital gains by selling securities at a loss, reducing taxable income and optimizing portfolio tax efficiency. The wash sale rule prevents investors from claiming a tax loss on a security if a substantially identical asset is repurchased within 30 days, limiting the ability to immediately realize tax benefits. Effectively navigating these regulations requires understanding timing and asset substitution to maximize tax savings while complying with IRS guidelines.

Connection

Tax loss harvesting involves selling securities at a loss to offset capital gains and reduce taxable income, while the wash sale rule prevents taxpayers from claiming a loss if they repurchase the same or substantially identical security within 30 days before or after the sale. This rule is designed to discourage investors from creating artificial losses without genuinely changing their investment position. Understanding the interplay between tax loss harvesting and the wash sale rule is crucial for effective tax planning and compliance with IRS regulations.

Key Terms

Capital Gains/Losses

The wash sale rule prohibits claiming a tax loss on a security if the same or substantially identical stock is repurchased within 30 days before or after the sale, thereby preventing immediate tax benefits from losses. Tax loss harvesting strategically sells securities at a loss to offset capital gains, reducing taxable income while remaining compliant with the wash sale rule. Explore how to optimize your capital gains and losses management by understanding key IRS rules and effective portfolio strategies.

IRS Regulations

The wash sale rule, enforced by the IRS, disallows claiming a tax deduction for a security sold at a loss if the same or substantially identical security is purchased within 30 days before or after the sale. Tax loss harvesting leverages this regulation by strategically selling securities at a loss to offset capital gains, while avoiding repurchasing the same assets within the wash sale window to maintain tax benefits. Explore IRS guidelines in detail to master compliant tax loss harvesting strategies.

Tax Lot Accounting

The wash sale rule disallows claiming a tax loss on a security if substantially identical stock is purchased within 30 days before or after the sale, complicating tax lot accounting by deferring the loss recognition. Tax loss harvesting strategically sells securities at a loss to offset gains, requiring meticulous tracking of individual tax lots to maximize tax benefits while avoiding wash sale violations. Explore detailed tax lot accounting strategies to optimize tax loss harvesting within IRS regulations.

Source and External Links

Understanding the Wash Sale Rule for Investors - SD Mayer - The IRS wash sale rule disallows claiming a tax loss if you sell a stock at a loss and repurchase the same or substantially identical security within 30 days before or after the sale, preventing immediate tax benefits while preserving the loss in the cost basis of the repurchased shares.

Wash Sale Rule: What Is It, How Does It Work, and More - TurboTax - The wash sale rule prohibits claiming a loss on a stock or security if you buy substantially identical shares within 30 days before or after selling at a loss, covering all securities including stocks, bonds, ETFs, and mutual funds within a 61-day window centered on the sale date.

Wash-Sale Rules | Avoid this tax pitfall - Fidelity Investments - The wash sale rule disallows tax benefits on losses when you buy the same or substantially identical investment 30 days before or after a loss sale, including trades between spouses and across taxable and tax-advantaged accounts, applying broadly to stocks, bonds, mutual funds, ETFs, and options.

dowidth.com

dowidth.com