Liability driven investing (LDI) focuses on managing assets to cover future liabilities, emphasizing risk management and long-term financial stability. Cash flow matching involves aligning specific asset cash flows with upcoming liabilities to ensure precise coverage without relying on market fluctuations. Explore detailed strategies and benefits of LDI versus cash flow matching to optimize investment outcomes.

Why it is important

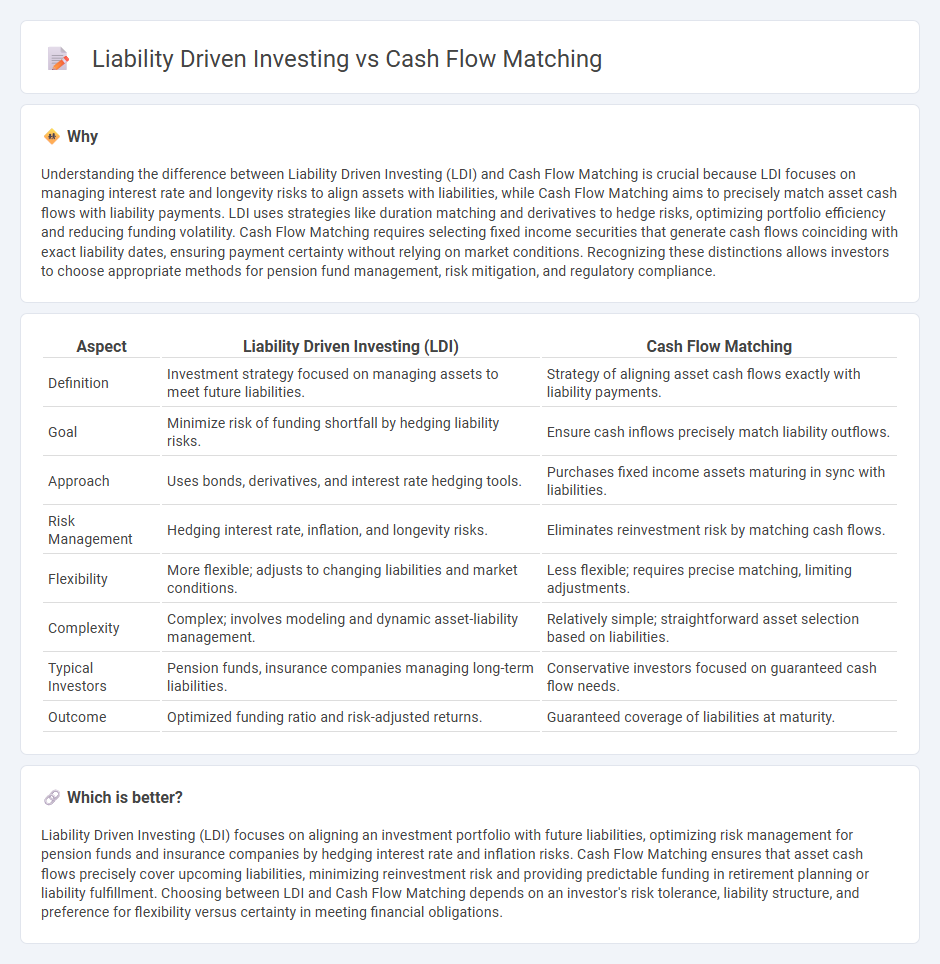

Understanding the difference between Liability Driven Investing (LDI) and Cash Flow Matching is crucial because LDI focuses on managing interest rate and longevity risks to align assets with liabilities, while Cash Flow Matching aims to precisely match asset cash flows with liability payments. LDI uses strategies like duration matching and derivatives to hedge risks, optimizing portfolio efficiency and reducing funding volatility. Cash Flow Matching requires selecting fixed income securities that generate cash flows coinciding with exact liability dates, ensuring payment certainty without relying on market conditions. Recognizing these distinctions allows investors to choose appropriate methods for pension fund management, risk mitigation, and regulatory compliance.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Cash Flow Matching |

|---|---|---|

| Definition | Investment strategy focused on managing assets to meet future liabilities. | Strategy of aligning asset cash flows exactly with liability payments. |

| Goal | Minimize risk of funding shortfall by hedging liability risks. | Ensure cash inflows precisely match liability outflows. |

| Approach | Uses bonds, derivatives, and interest rate hedging tools. | Purchases fixed income assets maturing in sync with liabilities. |

| Risk Management | Hedging interest rate, inflation, and longevity risks. | Eliminates reinvestment risk by matching cash flows. |

| Flexibility | More flexible; adjusts to changing liabilities and market conditions. | Less flexible; requires precise matching, limiting adjustments. |

| Complexity | Complex; involves modeling and dynamic asset-liability management. | Relatively simple; straightforward asset selection based on liabilities. |

| Typical Investors | Pension funds, insurance companies managing long-term liabilities. | Conservative investors focused on guaranteed cash flow needs. |

| Outcome | Optimized funding ratio and risk-adjusted returns. | Guaranteed coverage of liabilities at maturity. |

Which is better?

Liability Driven Investing (LDI) focuses on aligning an investment portfolio with future liabilities, optimizing risk management for pension funds and insurance companies by hedging interest rate and inflation risks. Cash Flow Matching ensures that asset cash flows precisely cover upcoming liabilities, minimizing reinvestment risk and providing predictable funding in retirement planning or liability fulfillment. Choosing between LDI and Cash Flow Matching depends on an investor's risk tolerance, liability structure, and preference for flexibility versus certainty in meeting financial obligations.

Connection

Liability Driven Investing (LDI) focuses on structuring a portfolio to meet future liabilities by aligning assets with obligations, enhancing financial stability for pension funds and insurers. Cash flow matching is a core strategy within LDI, where assets are selected to produce cash flows that coincide precisely with liability payments, reducing reinvestment risk. This connection ensures that liabilities are funded on time, minimizing funding gaps and reducing exposure to market volatility.

Key Terms

Duration

Cash flow matching involves structuring a portfolio to generate cash flows that precisely align with upcoming liabilities, minimizing reinvestment and interest rate risk. Liability Driven Investing (LDI) emphasizes managing duration gaps by aligning the portfolio's interest rate sensitivity with that of liabilities to protect against market fluctuations. Explore more to understand how duration-focused strategies optimize pension fund performance.

Present Value

Cash flow matching focuses on aligning asset cash inflows precisely with liability payments, minimizing reinvestment risk and ensuring liquidity at each liability date based on present value calculations. Liability Driven Investing (LDI) utilizes duration-matching and interest rate hedging to manage funding ratio volatility, emphasizing the present value of liabilities and assets to stabilize the pension fund's balance sheet. Explore detailed strategies and benefits of both approaches to optimize your portfolio's alignment with future obligations.

Immunization

Cash flow matching involves structuring asset cash flows to precisely meet future liabilities, ensuring that funds are available exactly when needed, while liability-driven investing (LDI) focuses on managing overall interest rate risk and funding status by aligning asset durations with liability durations. Immunization, a key strategy within LDI, aims to protect the portfolio from interest rate volatility by balancing asset duration to offset changes in liability values, thereby securing the ability to meet future obligations. Explore more about how these strategies optimize portfolio stability and risk management in fixed income investing.

Source and External Links

Cashflow matching - Wikipedia - Cash flow matching is a hedging strategy where a company aligns its cash outflows (liabilities) with its cash inflows over time to cover obligations, often solved using linear or mixed-integer programming to minimize initial costs while meeting liabilities in each period.

The Final Phase of LDI--Cash Flow Matching | Western Asset - Cash flow matching is an investment method that fully aligns bond portfolio cash flows with forecasted benefit payments in pension plans, reducing operational risks and funded status volatility, and is considered a final phase of Liability-Driven Investment (LDI) strategies.

Pension Risk Transfer versus Cash Flow Matching - Mercer - Cash flow matching, introduced during WWII, constructs fixed-income portfolios dedicated to matching pension liabilities and offers higher expected returns by using less liquid securities, making it a cost-effective alternative to pension risk transfer.

dowidth.com

dowidth.com