Altcoins staking involves locking up specific cryptocurrencies to support blockchain operations and earn rewards, typically requiring users to immobilize their funds for a set period. Liquid staking allows participants to stake assets while retaining liquidity through tokenized derivatives that can be traded or used in DeFi applications. Explore the benefits and risks of each approach to optimize your crypto investment strategy.

Why it is important

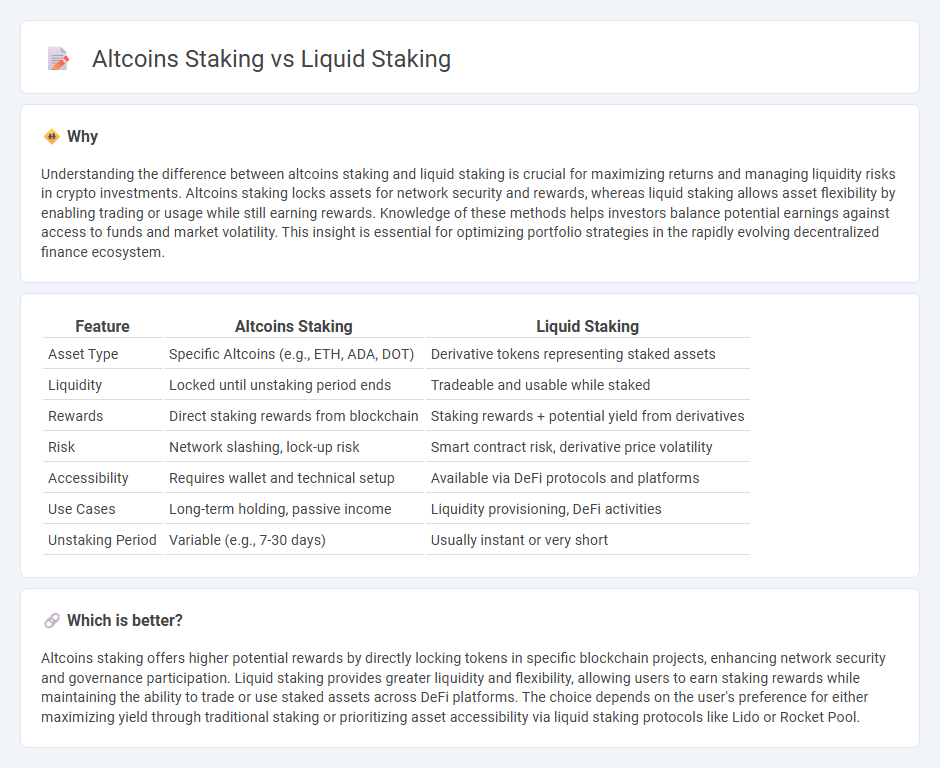

Understanding the difference between altcoins staking and liquid staking is crucial for maximizing returns and managing liquidity risks in crypto investments. Altcoins staking locks assets for network security and rewards, whereas liquid staking allows asset flexibility by enabling trading or usage while still earning rewards. Knowledge of these methods helps investors balance potential earnings against access to funds and market volatility. This insight is essential for optimizing portfolio strategies in the rapidly evolving decentralized finance ecosystem.

Comparison Table

| Feature | Altcoins Staking | Liquid Staking |

|---|---|---|

| Asset Type | Specific Altcoins (e.g., ETH, ADA, DOT) | Derivative tokens representing staked assets |

| Liquidity | Locked until unstaking period ends | Tradeable and usable while staked |

| Rewards | Direct staking rewards from blockchain | Staking rewards + potential yield from derivatives |

| Risk | Network slashing, lock-up risk | Smart contract risk, derivative price volatility |

| Accessibility | Requires wallet and technical setup | Available via DeFi protocols and platforms |

| Use Cases | Long-term holding, passive income | Liquidity provisioning, DeFi activities |

| Unstaking Period | Variable (e.g., 7-30 days) | Usually instant or very short |

Which is better?

Altcoins staking offers higher potential rewards by directly locking tokens in specific blockchain projects, enhancing network security and governance participation. Liquid staking provides greater liquidity and flexibility, allowing users to earn staking rewards while maintaining the ability to trade or use staked assets across DeFi platforms. The choice depends on the user's preference for either maximizing yield through traditional staking or prioritizing asset accessibility via liquid staking protocols like Lido or Rocket Pool.

Connection

Altcoins staking involves locking up cryptocurrency assets to support blockchain network operations and earn rewards, while liquid staking allows users to maintain liquidity by receiving tradeable tokens representing staked assets. Liquid staking bridges the gap between earning staking rewards and enabling asset flexibility, enhancing capital efficiency in decentralized finance. This connection boosts participation in altcoin ecosystems by offering both security incentives and the ability to trade or invest staked tokens.

Key Terms

Liquidity

Liquid staking offers enhanced liquidity by allowing stakers to trade or utilize their staked assets through derivative tokens without waiting for lock-up periods, contrasting with altcoins staking where assets are often immobilized during the staking duration. This mechanism not only preserves capital flexibility but also enables participation in DeFi activities, increasing potential returns while maintaining network security. Explore the advantages of liquid staking to optimize your asset management and maximize yield opportunities.

Staking Rewards

Liquid staking offers increased liquidity by allowing users to trade or reinvest staked assets while earning rewards, unlike traditional altcoins staking where assets are locked for a fixed period. Staking rewards in liquid staking protocols often come with reduced risk of opportunity cost and enhanced flexibility due to tokenized derivatives representing staked assets. Explore comprehensive analyses to understand which staking method maximizes your passive income potential.

Lock-up Period

Liquid staking significantly reduces or eliminates the lock-up period by allowing users to stake assets while maintaining liquidity through tradable tokens, contrasting with altcoins staking that typically requires funds to be locked for fixed durations, limiting immediate access. This flexibility in liquid staking enhances capital efficiency and user engagement in decentralized finance (DeFi) platforms. Explore more about how lock-up periods impact staking strategies and portfolio optimization.

Source and External Links

What is liquid staking and why does it matter? - Liquid staking allows users to stake cryptocurrency on proof-of-stake blockchains and receive tradable liquid staking tokens (LSTs) representing their staked assets, enabling them to earn rewards while still using these tokens across DeFi platforms, unlike traditional staking that locks tokens until unstaking.

What is liquid staking? - Liquid staking lets traders stake assets on proof-of-stake blockchains and receive receipt tokens at a 1:1 ratio, which can be used to generate additional yield in other DeFi protocols or swapped to withdraw their funds, with notable protocols including Lido and Rocket Pool on Ethereum.

What Is Liquid Staking? How It Works and Advantages ... - Liquid staking works by issuing liquid staking tokens that represent staked holdings, allowing users to trade or lend these while earning staking rewards, and can involve restaking of derivatives to amplify returns, although this adds layers of complexity and risks.

dowidth.com

dowidth.com