Tokenized treasury bills enable digital ownership of government debt, offering increased liquidity and transparency compared to traditional paper-based bills. Repo agreements involve short-term borrowing using securities as collateral, providing quick access to funds with minimal risk. Explore the key distinctions and benefits of tokenized treasury bills and repo agreements for smarter financial decisions.

Why it is important

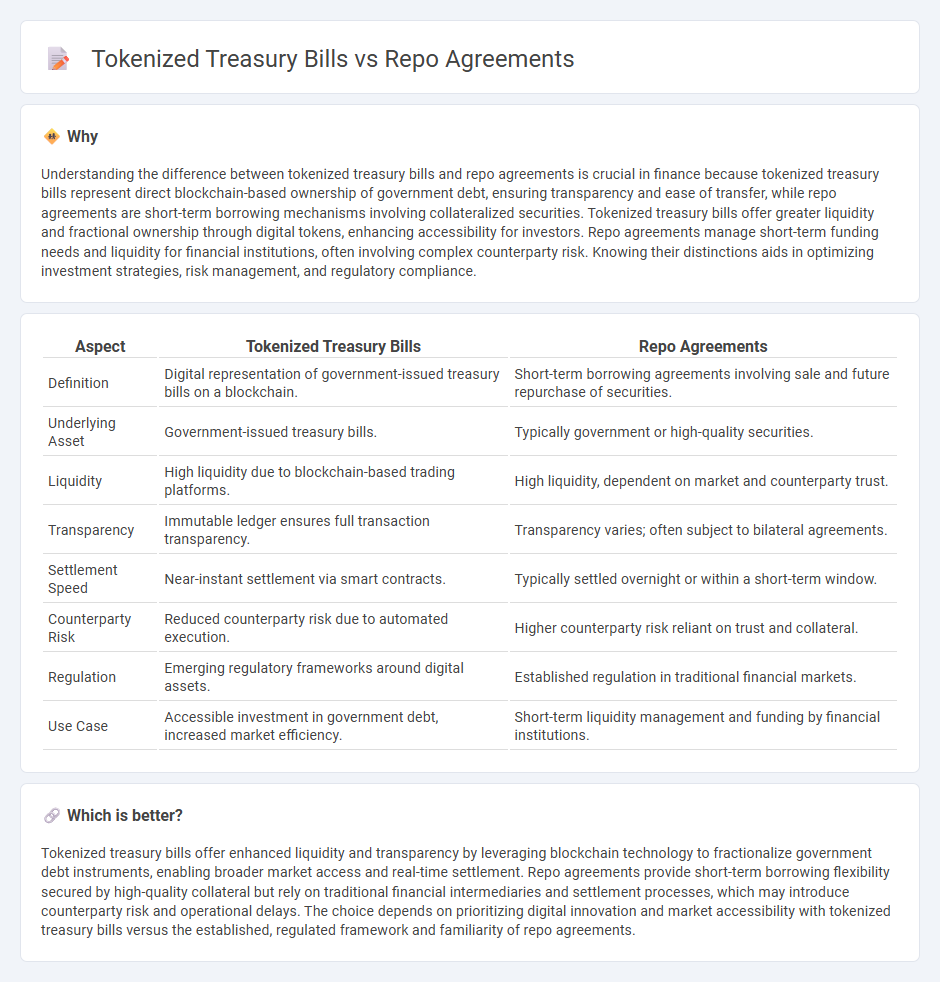

Understanding the difference between tokenized treasury bills and repo agreements is crucial in finance because tokenized treasury bills represent direct blockchain-based ownership of government debt, ensuring transparency and ease of transfer, while repo agreements are short-term borrowing mechanisms involving collateralized securities. Tokenized treasury bills offer greater liquidity and fractional ownership through digital tokens, enhancing accessibility for investors. Repo agreements manage short-term funding needs and liquidity for financial institutions, often involving complex counterparty risk. Knowing their distinctions aids in optimizing investment strategies, risk management, and regulatory compliance.

Comparison Table

| Aspect | Tokenized Treasury Bills | Repo Agreements |

|---|---|---|

| Definition | Digital representation of government-issued treasury bills on a blockchain. | Short-term borrowing agreements involving sale and future repurchase of securities. |

| Underlying Asset | Government-issued treasury bills. | Typically government or high-quality securities. |

| Liquidity | High liquidity due to blockchain-based trading platforms. | High liquidity, dependent on market and counterparty trust. |

| Transparency | Immutable ledger ensures full transaction transparency. | Transparency varies; often subject to bilateral agreements. |

| Settlement Speed | Near-instant settlement via smart contracts. | Typically settled overnight or within a short-term window. |

| Counterparty Risk | Reduced counterparty risk due to automated execution. | Higher counterparty risk reliant on trust and collateral. |

| Regulation | Emerging regulatory frameworks around digital assets. | Established regulation in traditional financial markets. |

| Use Case | Accessible investment in government debt, increased market efficiency. | Short-term liquidity management and funding by financial institutions. |

Which is better?

Tokenized treasury bills offer enhanced liquidity and transparency by leveraging blockchain technology to fractionalize government debt instruments, enabling broader market access and real-time settlement. Repo agreements provide short-term borrowing flexibility secured by high-quality collateral but rely on traditional financial intermediaries and settlement processes, which may introduce counterparty risk and operational delays. The choice depends on prioritizing digital innovation and market accessibility with tokenized treasury bills versus the established, regulated framework and familiarity of repo agreements.

Connection

Tokenized treasury bills leverage blockchain technology to represent government debt instruments digitally, enhancing liquidity and accessibility for investors. Repo agreements often use treasury bills as collateral, facilitating short-term borrowing and lending with reduced counterparty risk. Integrating tokenized treasury bills into repo markets streamlines settlement processes and increases transparency through secure, automated transactions on decentralized platforms.

Key Terms

Collateralization

Repo agreements involve short-term borrowing using securities as collateral, ensuring liquidity for borrowers while securing lending risk for investors through asset-backed transactions. Tokenized treasury bills represent digital securities issued on a blockchain, enhancing transparency and efficiency in collateral management with programmable features that automate compliance and settlement. Explore the evolving mechanisms of collateralization and risk mitigation in modern finance by learning more about these innovative financial instruments.

Liquidity

Repo agreements provide short-term liquidity by allowing entities to sell securities with a commitment to repurchase them, facilitating immediate cash flow without transferring asset ownership. Tokenized treasury bills offer liquidity through blockchain technology, enabling fractional ownership and 24/7 trading on digital platforms, thus increasing market accessibility and speed. Explore the benefits and mechanisms of both to understand which liquidity solution fits your financial strategy best.

Settlement

Repo agreements involve the sale and repurchase of securities, creating a short-term collateralized loan with settlement typically occurring within one to three business days through clearinghouses or bilateral transfers. Tokenized treasury bills represent digitized government debt instruments secured on a blockchain, enabling near-instant settlement and reducing counterparty risk due to automated smart contract execution. Explore the nuances of settlement efficiencies and risks in both methods to optimize your investment strategies.

Source and External Links

Repurchase agreement - A repo is a secured short-term borrowing transaction where one party sells securities to another with an agreement to repurchase them later, commonly in specified delivery, tri-party, or hold-in-custody forms.

Monitoring the Value of Securities in Repurchase Agreements - Repos are agreements where securities are sold with a promise to buy them back at a future date for the original price plus interest, commonly used with U.S. Treasury and GSE securities and available as overnight, term, or open contracts.

1. What is a repo? - A repo involves selling securities with a commitment to repurchase them later, effectively functioning as a collateralized loan where the difference in prices represents the lending return.

dowidth.com

dowidth.com