Bucket investing divides assets into distinct categories based on time horizons and risk tolerance, aiming to balance short-term liquidity with long-term growth. Dollar-Cost Averaging (DCA) systematically invests a fixed amount over regular intervals to reduce market timing risk and mitigate volatility impact. Explore these strategies to understand how each can optimize your investment portfolio for different financial goals.

Why it is important

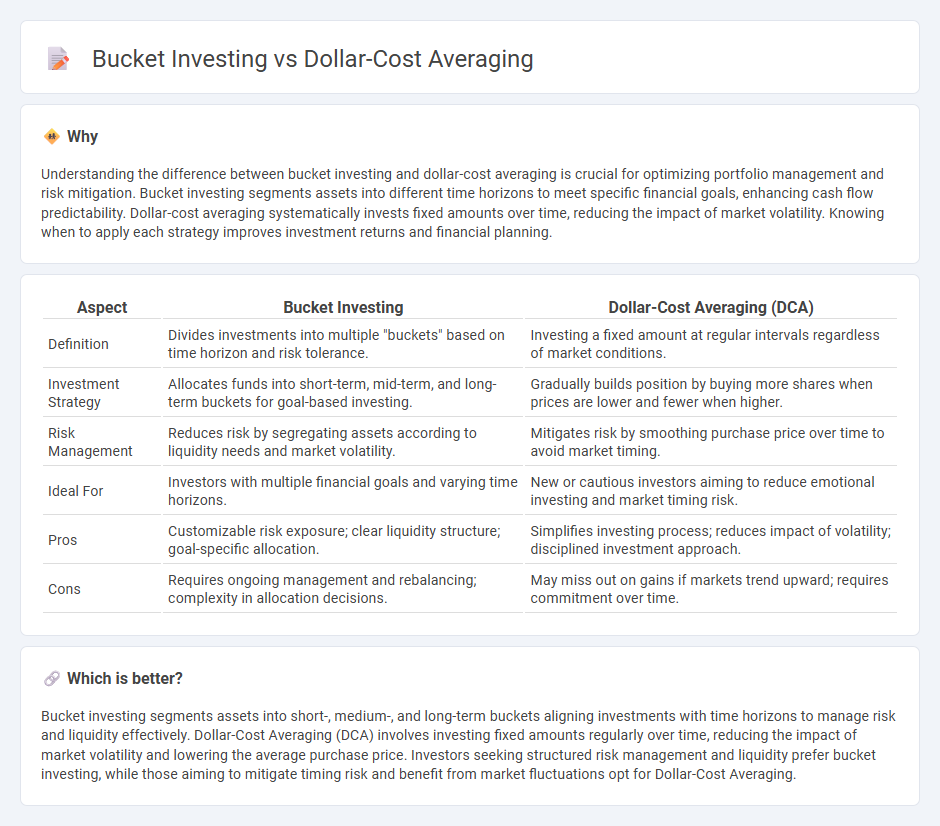

Understanding the difference between bucket investing and dollar-cost averaging is crucial for optimizing portfolio management and risk mitigation. Bucket investing segments assets into different time horizons to meet specific financial goals, enhancing cash flow predictability. Dollar-cost averaging systematically invests fixed amounts over time, reducing the impact of market volatility. Knowing when to apply each strategy improves investment returns and financial planning.

Comparison Table

| Aspect | Bucket Investing | Dollar-Cost Averaging (DCA) |

|---|---|---|

| Definition | Divides investments into multiple "buckets" based on time horizon and risk tolerance. | Investing a fixed amount at regular intervals regardless of market conditions. |

| Investment Strategy | Allocates funds into short-term, mid-term, and long-term buckets for goal-based investing. | Gradually builds position by buying more shares when prices are lower and fewer when higher. |

| Risk Management | Reduces risk by segregating assets according to liquidity needs and market volatility. | Mitigates risk by smoothing purchase price over time to avoid market timing. |

| Ideal For | Investors with multiple financial goals and varying time horizons. | New or cautious investors aiming to reduce emotional investing and market timing risk. |

| Pros | Customizable risk exposure; clear liquidity structure; goal-specific allocation. | Simplifies investing process; reduces impact of volatility; disciplined investment approach. |

| Cons | Requires ongoing management and rebalancing; complexity in allocation decisions. | May miss out on gains if markets trend upward; requires commitment over time. |

Which is better?

Bucket investing segments assets into short-, medium-, and long-term buckets aligning investments with time horizons to manage risk and liquidity effectively. Dollar-Cost Averaging (DCA) involves investing fixed amounts regularly over time, reducing the impact of market volatility and lowering the average purchase price. Investors seeking structured risk management and liquidity prefer bucket investing, while those aiming to mitigate timing risk and benefit from market fluctuations opt for Dollar-Cost Averaging.

Connection

Bucket investing and Dollar-Cost Averaging both aim to manage investment risk by diversifying timing and asset allocation. Bucket investing segments portfolios into short-, medium-, and long-term buckets to align with different liquidity needs, while Dollar-Cost Averaging systematically invests fixed amounts over time to reduce market timing risk. Integrating these strategies enhances portfolio stability by balancing immediate cash flow requirements with gradual, disciplined market exposure.

Key Terms

Investment Strategy

Dollar-Cost Averaging (DCA) involves investing a fixed amount at regular intervals to reduce the impact of market volatility and lower the average cost per share over time. Bucket investing, on the other hand, divides assets into distinct categories based on time horizons and risk tolerance, aiming to match investment goals with varying liquidity needs. Explore detailed comparisons to understand which strategy aligns best with your financial objectives.

Risk Management

Dollar-cost averaging mitigates market volatility by investing fixed amounts consistently, reducing the risk of poor market timing. Bucket investing enhances risk management by segmenting assets into time-based buckets, aligning with liquidity needs and growth goals. Explore detailed strategies on how these methods optimize investment risk profiles.

Asset Allocation

Dollar-cost averaging involves regularly investing a fixed amount across assets to reduce market timing risk, while bucket investing allocates funds into different segments based on time horizons and risk tolerance. Asset allocation in dollar-cost averaging emphasizes steady accumulation across diversified assets, whereas bucket investing strategically divides portfolios into short-term, medium-term, and long-term buckets for liquidity and growth optimization. Discover how these strategies can enhance your investment plan by exploring their detailed asset allocation benefits.

Source and External Links

What Is Dollar-Cost Averaging? - Dollar-cost averaging is an investment strategy where you invest a fixed dollar amount regularly regardless of share price, enabling you to buy more shares when prices are low and fewer when prices are high, thus lowering your average cost per share over time.

Dollar cost averaging - Dollar-cost averaging (DCA), coined by Benjamin Graham, involves investing the same dollar amount periodically to purchase more shares when prices are low and fewer when high, aiming to reduce the average cost per share and avoiding the need to time the market.

What is Dollar-Cost Averaging? - Dollar-cost averaging is a straightforward strategy of investing fixed amounts at regular intervals, helping to reduce risk from market volatility, encouraging disciplined investing, and benefiting long-term savings by averaging purchase prices over time.

dowidth.com

dowidth.com