Decentralized over-the-counter (OTC) trading operates through a peer-to-peer network without a centralized exchange, allowing direct transactions between parties and enhancing privacy and flexibility. In contrast, dealer markets involve intermediaries, known as dealers, who facilitate trading by quoting bid and ask prices, providing liquidity, and managing risk. Explore the key differences and benefits of these market structures to understand their impact on modern financial trading.

Why it is important

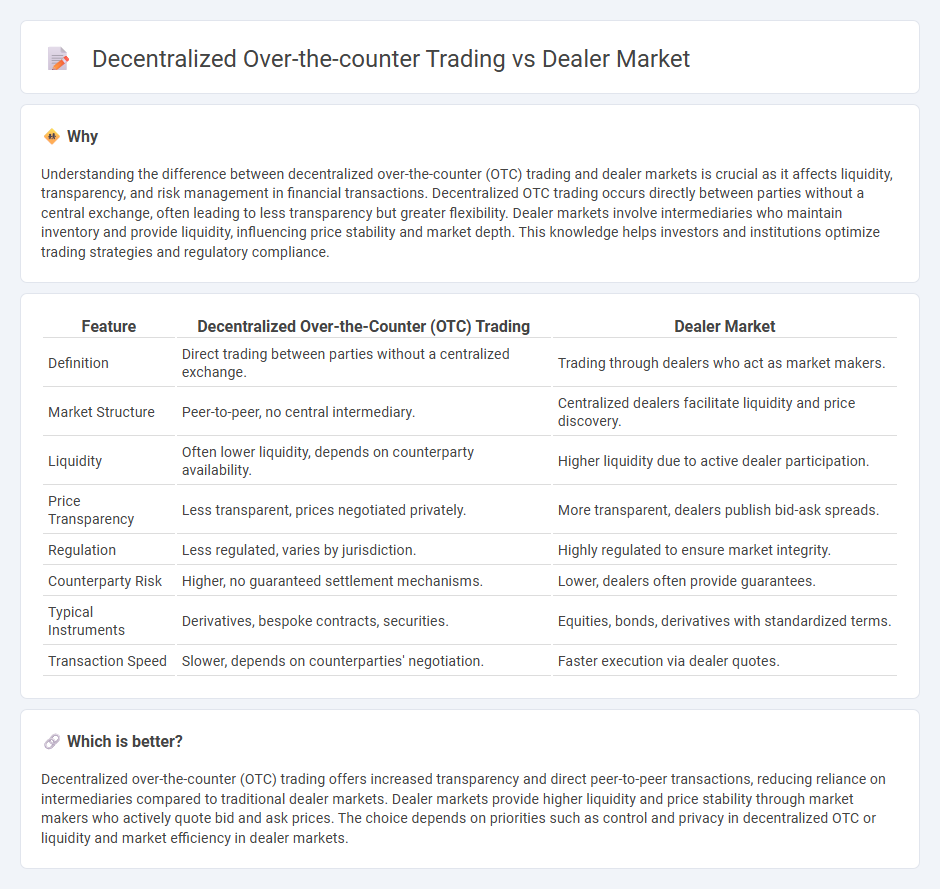

Understanding the difference between decentralized over-the-counter (OTC) trading and dealer markets is crucial as it affects liquidity, transparency, and risk management in financial transactions. Decentralized OTC trading occurs directly between parties without a central exchange, often leading to less transparency but greater flexibility. Dealer markets involve intermediaries who maintain inventory and provide liquidity, influencing price stability and market depth. This knowledge helps investors and institutions optimize trading strategies and regulatory compliance.

Comparison Table

| Feature | Decentralized Over-the-Counter (OTC) Trading | Dealer Market |

|---|---|---|

| Definition | Direct trading between parties without a centralized exchange. | Trading through dealers who act as market makers. |

| Market Structure | Peer-to-peer, no central intermediary. | Centralized dealers facilitate liquidity and price discovery. |

| Liquidity | Often lower liquidity, depends on counterparty availability. | Higher liquidity due to active dealer participation. |

| Price Transparency | Less transparent, prices negotiated privately. | More transparent, dealers publish bid-ask spreads. |

| Regulation | Less regulated, varies by jurisdiction. | Highly regulated to ensure market integrity. |

| Counterparty Risk | Higher, no guaranteed settlement mechanisms. | Lower, dealers often provide guarantees. |

| Typical Instruments | Derivatives, bespoke contracts, securities. | Equities, bonds, derivatives with standardized terms. |

| Transaction Speed | Slower, depends on counterparties' negotiation. | Faster execution via dealer quotes. |

Which is better?

Decentralized over-the-counter (OTC) trading offers increased transparency and direct peer-to-peer transactions, reducing reliance on intermediaries compared to traditional dealer markets. Dealer markets provide higher liquidity and price stability through market makers who actively quote bid and ask prices. The choice depends on priorities such as control and privacy in decentralized OTC or liquidity and market efficiency in dealer markets.

Connection

Decentralized over-the-counter (OTC) trading and dealer markets are interconnected through their reliance on direct negotiation between buyers and sellers outside traditional stock exchanges. Dealer markets involve participants acting as market makers, facilitating liquidity by quoting prices at which they are willing to buy or sell assets, which complements the decentralized OTC environment where transactions occur bilaterally without centralized oversight. This connection enhances market efficiency by enabling flexible pricing, personalized trade terms, and access to less liquid or more complex financial instruments.

Key Terms

Liquidity

Dealer markets enhance liquidity by connecting multiple market participants through centralized intermediaries who quote bid and ask prices, enabling rapid execution and price discovery. Decentralized over-the-counter (OTC) trading relies on direct peer-to-peer transactions without a central intermediary, often resulting in less transparent pricing and variable liquidity levels depending on counterparty availability. Explore further to understand how these market structures impact trading efficiency and risk management.

Price Discovery

Dealer markets centralize price discovery through intermediaries who provide liquidity and set bid-ask spreads, enhancing transaction efficiency and reducing volatility. Decentralized over-the-counter (OTC) trading relies on direct negotiation between parties, often resulting in less transparent and slower price discovery. Explore the dynamics of these trading models to understand their impact on market liquidity and price formation.

Counterparty Risk

Dealer markets centralize counterparty risk by involving dealers who act as intermediaries, providing liquidity and price stability in financial transactions. Decentralized over-the-counter (OTC) trading disperses counterparty risk among participants, increasing exposure due to direct transactions without intermediaries or centralized clearinghouses. Explore deeper insights on managing counterparty risk and choosing the optimal market structure for your trading strategy.

Source and External Links

Dealer Market: Definition, Example, Vs. Broker or Auction - A dealer market is a financial market where multiple dealers post buy and sell prices for securities, acting as market makers by staking their own capital to provide liquidity and earn profit from the bid-ask spread, differing from auction markets that require a defined buyer and seller for trades.

Dealer Market - Overview, Advantages, Disadvantages - Dealer markets, also known as OTC markets, are where dealers trade securities directly on their own account, posting bid and ask prices and managing risk via the bid-ask spread, thereby creating liquidity for investors.

Types of Markets - Dealers, Brokers, Exchanges - In dealer markets, dealers act as counterparties to buyers and sellers, setting bid and ask prices and assuming counterparty risk, commonly seen in bonds, currencies, and derivatives markets, making these markets typically very liquid.

dowidth.com

dowidth.com