Regenerative finance focuses on sustainable investment strategies that restore and enhance natural and social systems, promoting long-term ecological and economic health. Microfinance provides small-scale financial services to underserved populations, aiming to reduce poverty by enabling entrepreneurship and improving access to credit. Explore detailed comparisons and impacts of these financial models to understand their roles in economic development.

Why it is important

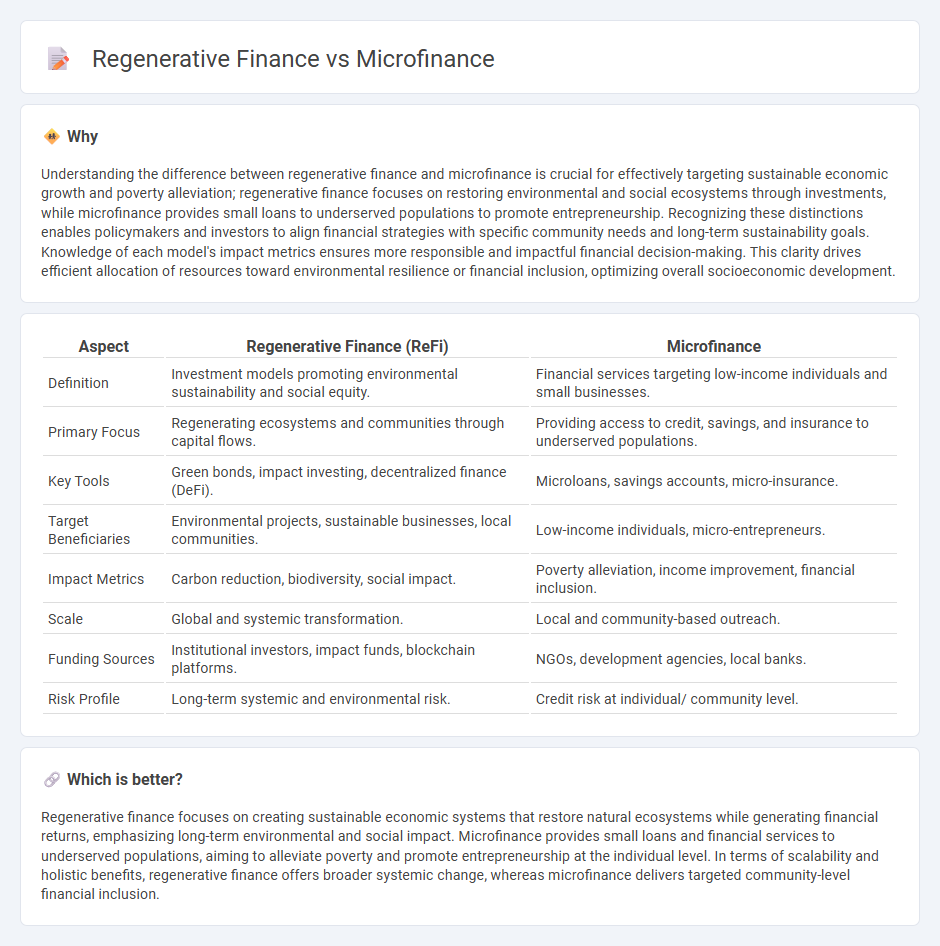

Understanding the difference between regenerative finance and microfinance is crucial for effectively targeting sustainable economic growth and poverty alleviation; regenerative finance focuses on restoring environmental and social ecosystems through investments, while microfinance provides small loans to underserved populations to promote entrepreneurship. Recognizing these distinctions enables policymakers and investors to align financial strategies with specific community needs and long-term sustainability goals. Knowledge of each model's impact metrics ensures more responsible and impactful financial decision-making. This clarity drives efficient allocation of resources toward environmental resilience or financial inclusion, optimizing overall socioeconomic development.

Comparison Table

| Aspect | Regenerative Finance (ReFi) | Microfinance |

|---|---|---|

| Definition | Investment models promoting environmental sustainability and social equity. | Financial services targeting low-income individuals and small businesses. |

| Primary Focus | Regenerating ecosystems and communities through capital flows. | Providing access to credit, savings, and insurance to underserved populations. |

| Key Tools | Green bonds, impact investing, decentralized finance (DeFi). | Microloans, savings accounts, micro-insurance. |

| Target Beneficiaries | Environmental projects, sustainable businesses, local communities. | Low-income individuals, micro-entrepreneurs. |

| Impact Metrics | Carbon reduction, biodiversity, social impact. | Poverty alleviation, income improvement, financial inclusion. |

| Scale | Global and systemic transformation. | Local and community-based outreach. |

| Funding Sources | Institutional investors, impact funds, blockchain platforms. | NGOs, development agencies, local banks. |

| Risk Profile | Long-term systemic and environmental risk. | Credit risk at individual/ community level. |

Which is better?

Regenerative finance focuses on creating sustainable economic systems that restore natural ecosystems while generating financial returns, emphasizing long-term environmental and social impact. Microfinance provides small loans and financial services to underserved populations, aiming to alleviate poverty and promote entrepreneurship at the individual level. In terms of scalability and holistic benefits, regenerative finance offers broader systemic change, whereas microfinance delivers targeted community-level financial inclusion.

Connection

Regenerative finance focuses on sustainable investment strategies that restore natural and social capital, while microfinance provides financial services to underserved communities, enabling economic empowerment at a grassroots level. Both approaches emphasize ethical funding models that prioritize long-term community resilience and environmental health over short-term profits. Integrating regenerative finance principles into microfinance enhances social impact by fostering inclusive growth and supporting regenerative practices within local economies.

Key Terms

Financial Inclusion

Microfinance provides small loans and financial services to underserved populations, aiming to enhance financial inclusion by empowering low-income individuals and fostering entrepreneurship. Regenerative finance goes beyond traditional models by integrating environmental and social impact criteria, ensuring that financial growth supports sustainable development and ecosystem health. Explore how these innovative financial approaches reshape access and equity in the global economy.

Sustainability

Microfinance provides small loans to underserved communities, supporting economic inclusion and poverty alleviation, while regenerative finance emphasizes sustainable investments that restore ecosystems and promote long-term environmental health. Regenerative finance integrates principles like circular economy and stakeholder equity to drive systemic change beyond traditional financial returns. Explore how these financial models uniquely contribute to sustainable development goals and community resilience.

Social Impact

Microfinance provides small loans and financial services to underserved populations, aiming to alleviate poverty by enabling entrepreneurship and self-sufficiency. Regenerative finance extends beyond traditional microfinance by integrating sustainable practices that restore social and environmental systems, promoting long-term community resilience and equitable growth. Explore the transformative potential of these financial models for social impact in greater detail.

Source and External Links

Microfinance 101: All you need to know - Microfinance provides financial services such as loans, savings, insurance, and fund transfers to individuals and small businesses lacking access to traditional banking, helping over 1.7 billion unbanked people worldwide overcome poverty and systemic inequality.

Microfinancing Basics - My Own Business Institute - Microfinance delivers small loans and increasingly savings and insurance products to entrepreneurs without access to traditional financial services, helping them start and grow businesses.

Top 10 things to know about microfinance - Originating in the 1970s, microfinance offers financial access beyond traditional loans, including savings, insurance, and payment services, to empower financially excluded populations worldwide.

dowidth.com

dowidth.com