Carbon credits represent tradable certificates allowing companies to offset their greenhouse gas emissions by funding projects that reduce or capture carbon dioxide. Voluntary carbon markets enable businesses and individuals to purchase these credits outside regulatory mandates, promoting sustainability and corporate social responsibility. Explore how these mechanisms drive environmental impact and business strategy integration.

Why it is important

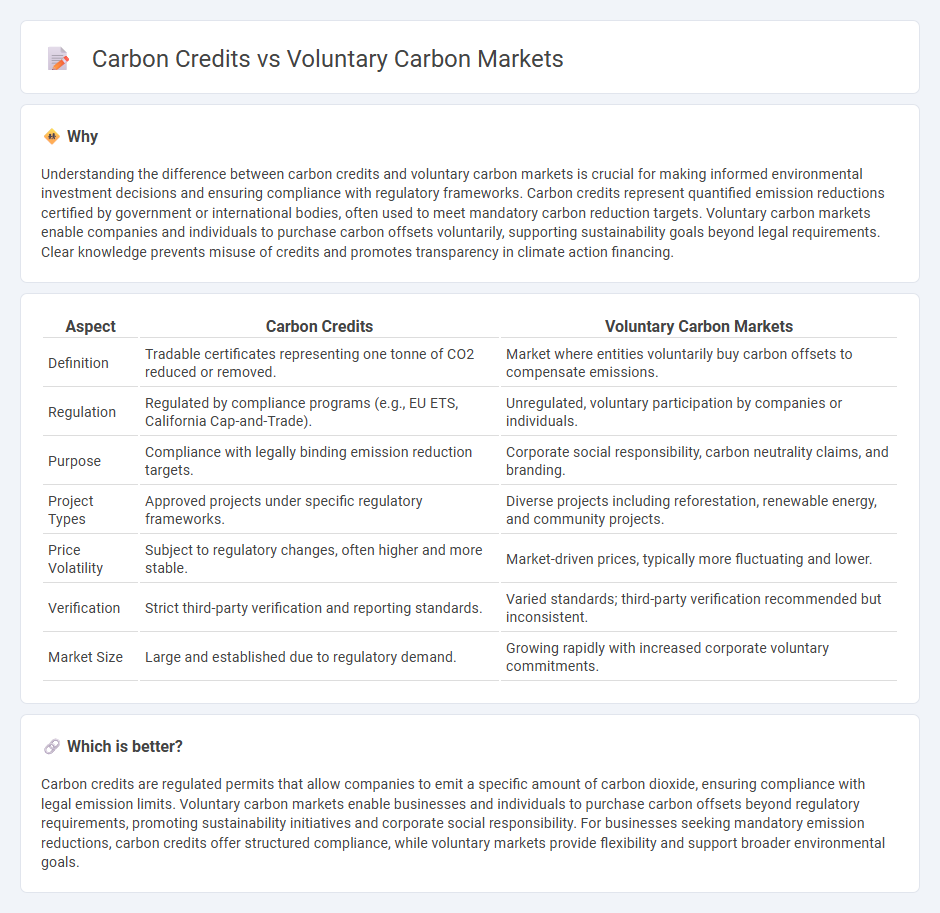

Understanding the difference between carbon credits and voluntary carbon markets is crucial for making informed environmental investment decisions and ensuring compliance with regulatory frameworks. Carbon credits represent quantified emission reductions certified by government or international bodies, often used to meet mandatory carbon reduction targets. Voluntary carbon markets enable companies and individuals to purchase carbon offsets voluntarily, supporting sustainability goals beyond legal requirements. Clear knowledge prevents misuse of credits and promotes transparency in climate action financing.

Comparison Table

| Aspect | Carbon Credits | Voluntary Carbon Markets |

|---|---|---|

| Definition | Tradable certificates representing one tonne of CO2 reduced or removed. | Market where entities voluntarily buy carbon offsets to compensate emissions. |

| Regulation | Regulated by compliance programs (e.g., EU ETS, California Cap-and-Trade). | Unregulated, voluntary participation by companies or individuals. |

| Purpose | Compliance with legally binding emission reduction targets. | Corporate social responsibility, carbon neutrality claims, and branding. |

| Project Types | Approved projects under specific regulatory frameworks. | Diverse projects including reforestation, renewable energy, and community projects. |

| Price Volatility | Subject to regulatory changes, often higher and more stable. | Market-driven prices, typically more fluctuating and lower. |

| Verification | Strict third-party verification and reporting standards. | Varied standards; third-party verification recommended but inconsistent. |

| Market Size | Large and established due to regulatory demand. | Growing rapidly with increased corporate voluntary commitments. |

Which is better?

Carbon credits are regulated permits that allow companies to emit a specific amount of carbon dioxide, ensuring compliance with legal emission limits. Voluntary carbon markets enable businesses and individuals to purchase carbon offsets beyond regulatory requirements, promoting sustainability initiatives and corporate social responsibility. For businesses seeking mandatory emission reductions, carbon credits offer structured compliance, while voluntary markets provide flexibility and support broader environmental goals.

Connection

Carbon credits serve as tradable certificates representing the reduction or removal of one metric ton of CO2 emissions, forming the foundation of voluntary carbon markets where businesses and individuals purchase these credits to offset their carbon footprint. Voluntary carbon markets enable organizations to invest in environmentally sustainable projects while meeting corporate social responsibility goals outside of regulatory requirements. The growth of these markets directly drives demand for carbon credits, fostering investment in renewable energy, reforestation, and carbon capture technologies.

Key Terms

Additionality

Voluntary carbon markets facilitate trades of carbon credits generated from projects demonstrating additionality, which ensures emissions reductions are beyond business-as-usual scenarios. Carbon credits represent quantified emission reductions, but only those verified with strong additionality criteria truly contribute to genuine climate mitigation. Explore in-depth how additionality drives credibility and impact in voluntary carbon markets.

Offset

Voluntary carbon markets allow businesses and individuals to purchase carbon offsets to compensate for their greenhouse gas emissions outside regulated requirements, emphasizing flexibility and diverse project types like reforestation or renewable energy. Carbon credits, often standardized and verified units representing one ton of CO2 reduced or removed, are tradable assets within these markets, providing measurable environmental benefits and transparency. Explore how offset projects drive sustainability and the evolving role of voluntary carbon markets in achieving net-zero goals.

Verification

Voluntary carbon markets rely heavily on rigorous verification processes by third-party organizations to ensure the authenticity and impact of carbon credits, which represent measurable emission reductions or removals. Verification standards such as the Verified Carbon Standard (VCS) and the Gold Standard play a crucial role in maintaining transparency, credibility, and investor confidence within these markets. Explore in-depth comparisons of verification methodologies and their implications for carbon credit integrity to better understand the evolving landscape of voluntary carbon markets.

Source and External Links

What is the Voluntary Carbon Market? - The voluntary carbon market allows companies, governments, nonprofits, and individuals to buy and sell carbon offset credits to compensate for their greenhouse gas emissions, supporting projects that reduce or remove carbon from the atmosphere.

What's Plaguing Voluntary Carbon Markets? - Voluntary carbon markets are debated for their role in enabling net-zero goals and climate finance but face criticism for risks of greenwashing, though new initiatives aim to improve their credibility and market scale could reach $250 billion by 2050.

Voluntary Carbon Market: VCM - The voluntary carbon market is a pricing platform where businesses and individuals voluntarily trade carbon credits representing verified reductions or removals of CO2, helping finance climate mitigation efforts beyond direct emission cuts.

dowidth.com

dowidth.com