Fractional shares enable investors to purchase partial stocks of companies, offering flexibility and access to high-priced equities without the need for large capital. Mutual funds pool money from multiple investors to invest in diversified portfolios managed by professional fund managers, providing risk mitigation and ease of management. Explore the key differences and benefits of fractional shares and mutual funds to optimize your investment strategy.

Why it is important

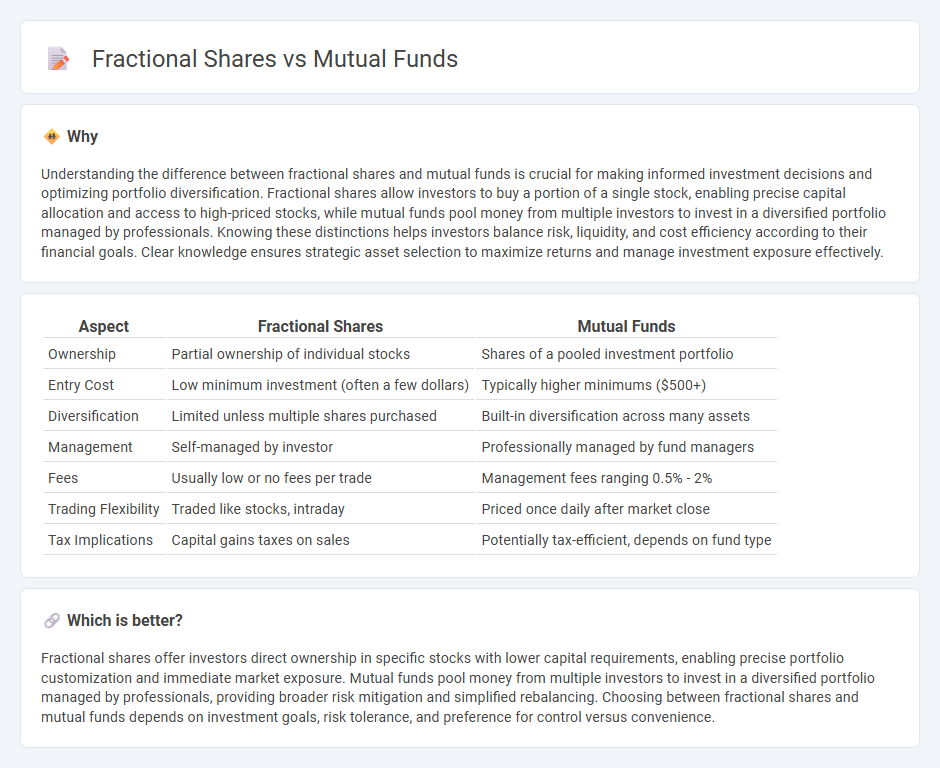

Understanding the difference between fractional shares and mutual funds is crucial for making informed investment decisions and optimizing portfolio diversification. Fractional shares allow investors to buy a portion of a single stock, enabling precise capital allocation and access to high-priced stocks, while mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professionals. Knowing these distinctions helps investors balance risk, liquidity, and cost efficiency according to their financial goals. Clear knowledge ensures strategic asset selection to maximize returns and manage investment exposure effectively.

Comparison Table

| Aspect | Fractional Shares | Mutual Funds |

|---|---|---|

| Ownership | Partial ownership of individual stocks | Shares of a pooled investment portfolio |

| Entry Cost | Low minimum investment (often a few dollars) | Typically higher minimums ($500+) |

| Diversification | Limited unless multiple shares purchased | Built-in diversification across many assets |

| Management | Self-managed by investor | Professionally managed by fund managers |

| Fees | Usually low or no fees per trade | Management fees ranging 0.5% - 2% |

| Trading Flexibility | Traded like stocks, intraday | Priced once daily after market close |

| Tax Implications | Capital gains taxes on sales | Potentially tax-efficient, depends on fund type |

Which is better?

Fractional shares offer investors direct ownership in specific stocks with lower capital requirements, enabling precise portfolio customization and immediate market exposure. Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professionals, providing broader risk mitigation and simplified rebalancing. Choosing between fractional shares and mutual funds depends on investment goals, risk tolerance, and preference for control versus convenience.

Connection

Fractional shares enable investors to purchase portions of individual stocks, lowering entry barriers and increasing portfolio diversity. Mutual funds aggregate fractional shares of multiple assets, offering diversification and professional management within a single investment vehicle. Both tools enhance access to varied financial markets, promoting inclusive and balanced investment strategies.

Key Terms

Diversification

Mutual funds offer built-in diversification by pooling investors' capital to invest in a broad range of assets, reducing individual risk across sectors and asset classes. Fractional shares allow investors to diversify their portfolios by purchasing portions of high-priced stocks that might otherwise be unaffordable, enabling exposure to multiple companies with smaller investment amounts. Explore the advantages and best strategies for maximizing diversification through mutual funds and fractional shares to enhance your investment portfolio.

Liquidity

Mutual funds offer high liquidity as investors can redeem shares at the end of each trading day based on the fund's net asset value (NAV). Fractional shares provide immediate liquidity since investors buy and sell parts of a full share on the market during trading hours. Explore detailed comparisons to understand which investment suits your liquidity needs best.

Minimum Investment

Mutual funds often require a minimum investment, commonly ranging from $500 to $3,000, setting a higher entry barrier for new investors; fractional shares enable purchasing portions of a single share with amounts as low as $1, making investing more accessible. This difference in minimum investment requirements impacts diversification opportunities and portfolio customization for investors with limited capital. Explore detailed comparisons to choose the best option for your investment goals.

Source and External Links

Mutual Funds - Mutual funds are SEC-registered open-end investment companies pooling money from many investors to invest in diversified portfolios of stocks, bonds, and other securities managed by professional advisers.

Mutual fund - Wikipedia - Mutual funds pool investor money to purchase securities and are commonly classified by investment type and management style, offering advantages like diversification, liquidity, and professional management but involve various fees.

Understanding Mutual Funds | Schwab - Mutual funds provide diversification, professional management, and convenience by pooling money to invest in a mix of asset classes with generally lower transaction costs through active or index fund strategies.

dowidth.com

dowidth.com