Inflation swaps offer customization in hedging inflation risk by allowing counterparties to exchange fixed payments for inflation-linked payments over a specified period, while Treasury Inflation-Protected Securities (TIPS) provide direct inflation protection through principal adjustment tied to the Consumer Price Index (CPI). Inflation swaps typically appeal to institutional investors seeking tailored inflation exposure without the direct ownership of securities, whereas TIPS are government-issued bonds favored for guaranteed inflation adjustment and liquidity. Explore how these instruments fit different investment strategies and manage inflation risk effectively.

Why it is important

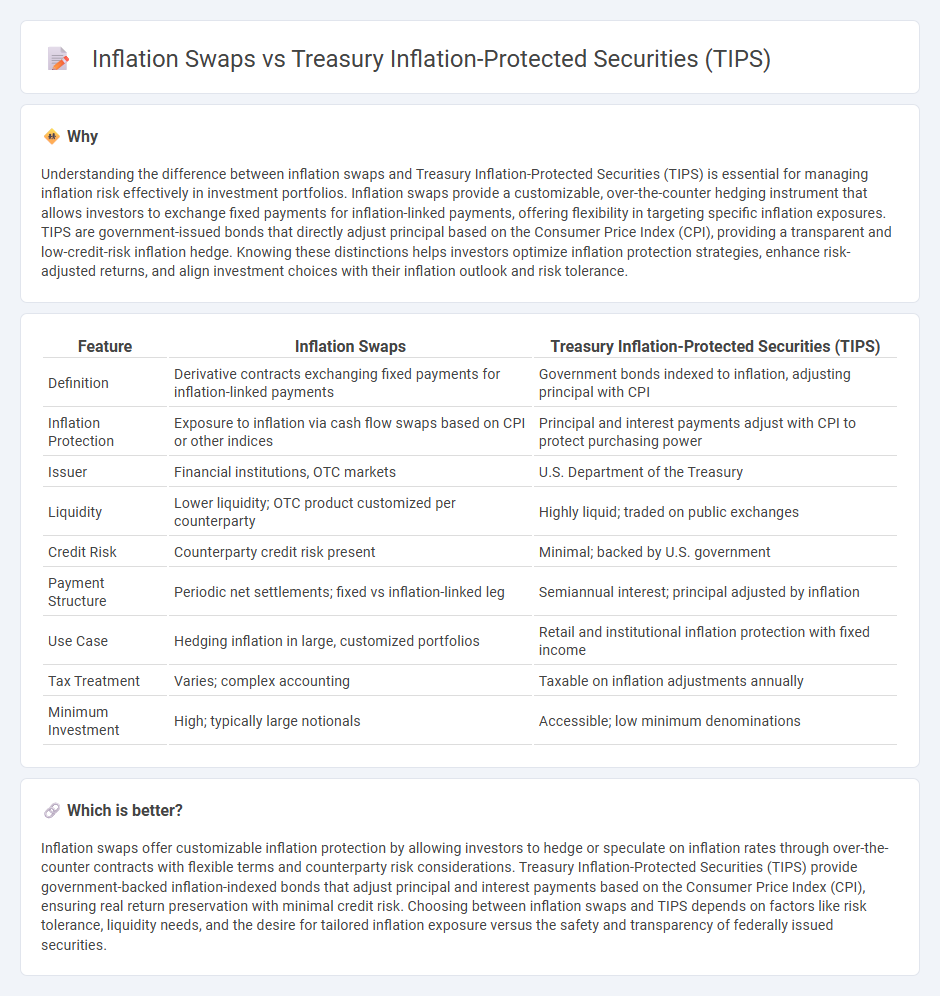

Understanding the difference between inflation swaps and Treasury Inflation-Protected Securities (TIPS) is essential for managing inflation risk effectively in investment portfolios. Inflation swaps provide a customizable, over-the-counter hedging instrument that allows investors to exchange fixed payments for inflation-linked payments, offering flexibility in targeting specific inflation exposures. TIPS are government-issued bonds that directly adjust principal based on the Consumer Price Index (CPI), providing a transparent and low-credit-risk inflation hedge. Knowing these distinctions helps investors optimize inflation protection strategies, enhance risk-adjusted returns, and align investment choices with their inflation outlook and risk tolerance.

Comparison Table

| Feature | Inflation Swaps | Treasury Inflation-Protected Securities (TIPS) |

|---|---|---|

| Definition | Derivative contracts exchanging fixed payments for inflation-linked payments | Government bonds indexed to inflation, adjusting principal with CPI |

| Inflation Protection | Exposure to inflation via cash flow swaps based on CPI or other indices | Principal and interest payments adjust with CPI to protect purchasing power |

| Issuer | Financial institutions, OTC markets | U.S. Department of the Treasury |

| Liquidity | Lower liquidity; OTC product customized per counterparty | Highly liquid; traded on public exchanges |

| Credit Risk | Counterparty credit risk present | Minimal; backed by U.S. government |

| Payment Structure | Periodic net settlements; fixed vs inflation-linked leg | Semiannual interest; principal adjusted by inflation |

| Use Case | Hedging inflation in large, customized portfolios | Retail and institutional inflation protection with fixed income |

| Tax Treatment | Varies; complex accounting | Taxable on inflation adjustments annually |

| Minimum Investment | High; typically large notionals | Accessible; low minimum denominations |

Which is better?

Inflation swaps offer customizable inflation protection by allowing investors to hedge or speculate on inflation rates through over-the-counter contracts with flexible terms and counterparty risk considerations. Treasury Inflation-Protected Securities (TIPS) provide government-backed inflation-indexed bonds that adjust principal and interest payments based on the Consumer Price Index (CPI), ensuring real return preservation with minimal credit risk. Choosing between inflation swaps and TIPS depends on factors like risk tolerance, liquidity needs, and the desire for tailored inflation exposure versus the safety and transparency of federally issued securities.

Connection

Inflation swaps and Treasury Inflation-Protected Securities (TIPS) both serve as financial instruments designed to hedge against inflation risk by exchanging fixed payments for inflation-indexed returns. Inflation swaps provide a customizable over-the-counter contract allowing investors to speculate or manage inflation expectations without direct exposure to the bond market. In contrast, TIPS are government-issued securities offering principal adjustments linked to the Consumer Price Index, providing direct inflation protection through guaranteed real yields.

Key Terms

Principal Adjustment

Treasury Inflation-Protected Securities (TIPS) offer principal adjustments directly linked to the Consumer Price Index (CPI), ensuring investors' capital maintains purchasing power amid inflation. Inflation swaps, on the other hand, involve exchanging fixed payments for inflation-linked payments without altering principal, focusing instead on cash flow adjustments tied to realized inflation rates. Explore more to understand how principal adjustment impacts the risk and return profiles of these inflation hedging instruments.

Real Yield

Treasury Inflation-Protected Securities (TIPS) provide investors with a real yield adjusted for inflation, preserving purchasing power through principal adjustments linked to the Consumer Price Index (CPI). Inflation swaps offer a derivative solution to hedge inflation risk by exchanging fixed payments for floating payments tied to inflation indices, enabling customized exposure to real yields without direct bond ownership. Explore the nuances of real yield dynamics between TIPS and inflation swaps to optimize inflation-linked investment strategies.

Breakeven Inflation Rate

Treasury Inflation-Protected Securities (TIPS) offer investors principal adjustments tied directly to the Consumer Price Index, reflecting actual inflation changes, while inflation swaps provide a contractual agreement to exchange fixed payments for inflation-linked payments based on agreed rates. The Breakeven Inflation Rate, derived from the yield difference between nominal Treasury bonds and TIPS, serves as a market-implied inflation expectation, whereas inflation swaps reflect market consensus but can incorporate risk premiums and liquidity factors. Explore deeper insights into how these instruments influence inflation forecasting and risk management strategies.

Source and External Links

What are TIPS? | Mackenzie Investments - Treasury Inflation-Protected Securities (TIPS) are US government bonds indexed to inflation via the Consumer Price Index, adjusting their principal to protect investors' purchasing power, with interest payments rising with inflation and guaranteed to never return less than the original principal at maturity.

Treasury Inflation-Protected Securities (TIPS) - TreasuryDirect - TIPS are issued with maturities of 5, 10, or 30 years, pay fixed interest on inflation-adjusted principal every six months, and return the greater of adjusted or original principal at maturity, providing federal tax obligations only on interest and principal adjustments.

Understanding Treasury Inflation-Protected Securities (TIPS) - PIMCO - TIPS offer a "real" rate of return by adjusting their face value with inflation changes reflected in the Consumer Price Index, paying interest on the inflation-adjusted principal, thus protecting investors from inflation erosion unlike traditional nominal bonds.

dowidth.com

dowidth.com