Hard rug pulls involve sudden, complete withdrawal of liquidity by project creators, leaving investors with worthless tokens, while flash loan attacks exploit uncollateralized, instant loans to manipulate DeFi protocols and siphon funds. Both are significant threats in decentralized finance, causing substantial financial losses and undermining trust in blockchain projects. Explore the mechanisms behind these attacks to better protect your investments in the crypto space.

Why it is important

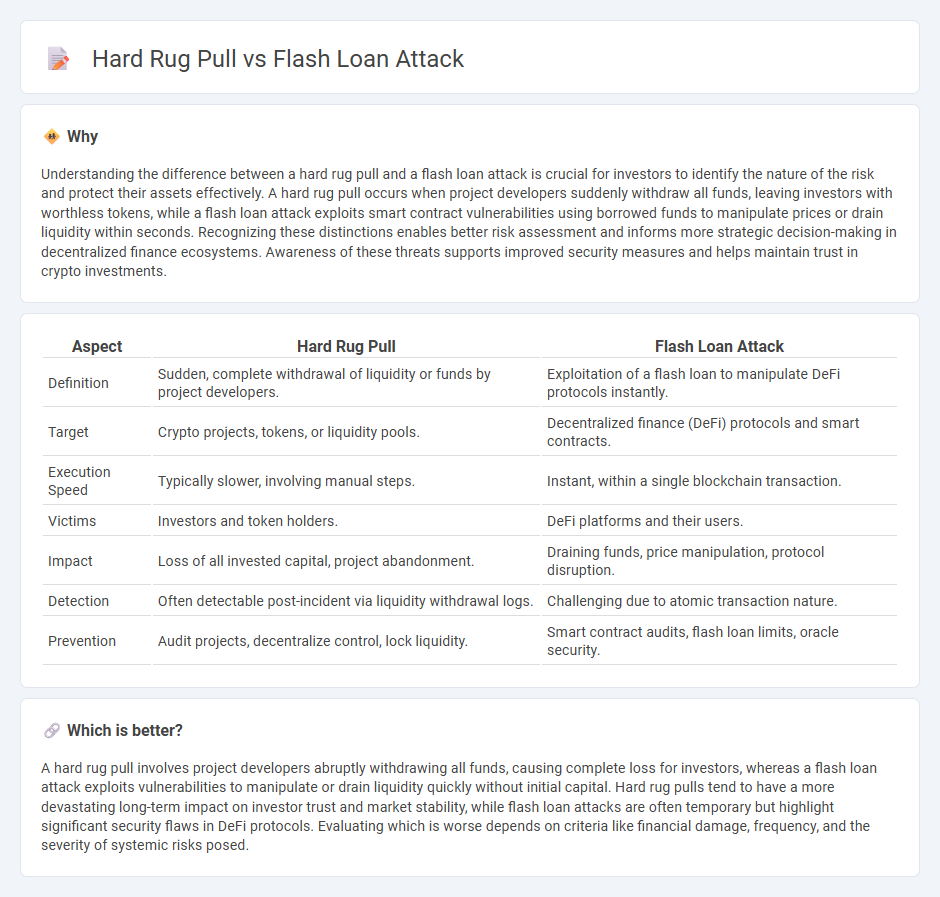

Understanding the difference between a hard rug pull and a flash loan attack is crucial for investors to identify the nature of the risk and protect their assets effectively. A hard rug pull occurs when project developers suddenly withdraw all funds, leaving investors with worthless tokens, while a flash loan attack exploits smart contract vulnerabilities using borrowed funds to manipulate prices or drain liquidity within seconds. Recognizing these distinctions enables better risk assessment and informs more strategic decision-making in decentralized finance ecosystems. Awareness of these threats supports improved security measures and helps maintain trust in crypto investments.

Comparison Table

| Aspect | Hard Rug Pull | Flash Loan Attack |

|---|---|---|

| Definition | Sudden, complete withdrawal of liquidity or funds by project developers. | Exploitation of a flash loan to manipulate DeFi protocols instantly. |

| Target | Crypto projects, tokens, or liquidity pools. | Decentralized finance (DeFi) protocols and smart contracts. |

| Execution Speed | Typically slower, involving manual steps. | Instant, within a single blockchain transaction. |

| Victims | Investors and token holders. | DeFi platforms and their users. |

| Impact | Loss of all invested capital, project abandonment. | Draining funds, price manipulation, protocol disruption. |

| Detection | Often detectable post-incident via liquidity withdrawal logs. | Challenging due to atomic transaction nature. |

| Prevention | Audit projects, decentralize control, lock liquidity. | Smart contract audits, flash loan limits, oracle security. |

Which is better?

A hard rug pull involves project developers abruptly withdrawing all funds, causing complete loss for investors, whereas a flash loan attack exploits vulnerabilities to manipulate or drain liquidity quickly without initial capital. Hard rug pulls tend to have a more devastating long-term impact on investor trust and market stability, while flash loan attacks are often temporary but highlight significant security flaws in DeFi protocols. Evaluating which is worse depends on criteria like financial damage, frequency, and the severity of systemic risks posed.

Connection

Rug pull and flash loan attacks are interconnected in decentralized finance (DeFi) through the exploitation of liquidity pools and smart contract vulnerabilities. Flash loans provide attackers with instant, uncollateralized capital to manipulate token prices or execute large-scale transactions, enabling rug pulls where developers or malicious actors drain liquidity. Understanding the role of flash loans in facilitating rapid price manipulations helps in assessing the risk and developing safeguards against rug pull schemes in DeFi ecosystems.

Key Terms

**Flash Loan Attack:**

Flash loan attacks exploit instant, uncollateralized loans to manipulate DeFi protocols and execute price oracle exploits or liquidations rapidly, causing significant financial loss within seconds. These attacks leverage smart contract vulnerabilities to drain liquidity pools without initial capital investment, posing a high risk to decentralized exchanges and lending platforms. Discover how to identify and protect against flash loan attacks to safeguard your crypto assets.

Smart Contract Vulnerability

Flash loan attacks exploit smart contract vulnerabilities by borrowing large amounts of assets instantly and manipulating on-chain protocols to drain funds without initial capital. Hard rug pulls occur when developers intentionally embed malicious code or backdoors in smart contracts, enabling them to seize investor funds abruptly and disappear. Explore deeper insights into smart contract vulnerabilities to better safeguard your decentralized investments.

Uncollateralized Loan

Flash loan attacks exploit uncollateralized loans by borrowing large sums instantly without upfront capital, manipulating protocols, and causing significant financial damage within seconds. Hard rug pulls involve project developers abruptly withdrawing all liquidity or funds, often deceiving investors, but don't typically rely on uncollateralized loans. Discover how uncollateralized loans uniquely impact DeFi security and risk management by exploring these attack vectors in-depth.

Source and External Links

What is a Flash Loan Attack? How It Works & Examples - A Flash Loan Attack is a sophisticated DeFi exploit where attackers use uncollateralized flash loans to manipulate smart contracts and market prices within a single atomic transaction, profiting without upfront capital by exploiting vulnerabilities in decentralized finance protocols.

Euler Finance Flash Loan Attack Explained - The March 2023 Euler Finance flash loan attack exploited a liquidity bug in the platform's token burn function, allowing the attacker to manipulate collateral and debt accounting to steal $197 million using strategically coordinated flash loan transactions.

Flash Loan Attacks Definition - FraudNet - Flash loan attacks exploit the unsecured nature of flash loans in DeFi to manipulate prices, arbitrage, collateral, or governance in rapid, single-block transactions, with recent incidents causing millions in losses and highlighting rising risks in crypto ecosystems.

dowidth.com

dowidth.com