Thematic ETFs focus on specific investment themes such as technology, clean energy, or healthcare, offering targeted exposure to sectors poised for growth. Currency ETFs track the performance of foreign currencies relative to the U.S. dollar, providing investors with opportunities to hedge currency risk or speculate on exchange rate movements. Explore the nuances between these ETF types to enhance your portfolio strategy.

Why it is important

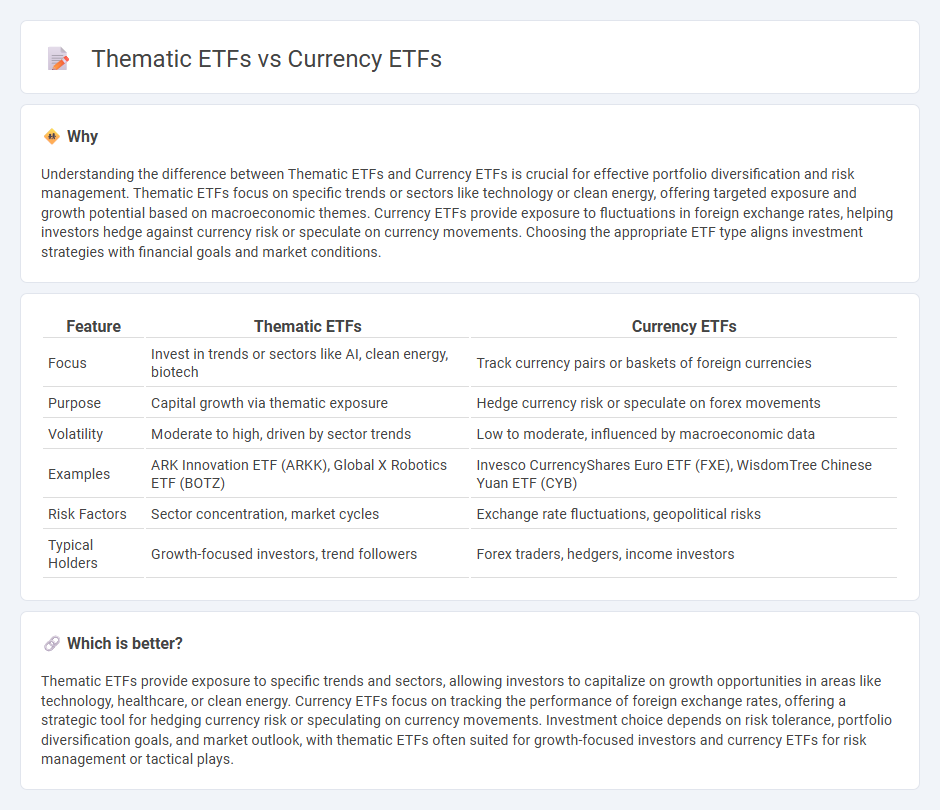

Understanding the difference between Thematic ETFs and Currency ETFs is crucial for effective portfolio diversification and risk management. Thematic ETFs focus on specific trends or sectors like technology or clean energy, offering targeted exposure and growth potential based on macroeconomic themes. Currency ETFs provide exposure to fluctuations in foreign exchange rates, helping investors hedge against currency risk or speculate on currency movements. Choosing the appropriate ETF type aligns investment strategies with financial goals and market conditions.

Comparison Table

| Feature | Thematic ETFs | Currency ETFs |

|---|---|---|

| Focus | Invest in trends or sectors like AI, clean energy, biotech | Track currency pairs or baskets of foreign currencies |

| Purpose | Capital growth via thematic exposure | Hedge currency risk or speculate on forex movements |

| Volatility | Moderate to high, driven by sector trends | Low to moderate, influenced by macroeconomic data |

| Examples | ARK Innovation ETF (ARKK), Global X Robotics ETF (BOTZ) | Invesco CurrencyShares Euro ETF (FXE), WisdomTree Chinese Yuan ETF (CYB) |

| Risk Factors | Sector concentration, market cycles | Exchange rate fluctuations, geopolitical risks |

| Typical Holders | Growth-focused investors, trend followers | Forex traders, hedgers, income investors |

Which is better?

Thematic ETFs provide exposure to specific trends and sectors, allowing investors to capitalize on growth opportunities in areas like technology, healthcare, or clean energy. Currency ETFs focus on tracking the performance of foreign exchange rates, offering a strategic tool for hedging currency risk or speculating on currency movements. Investment choice depends on risk tolerance, portfolio diversification goals, and market outlook, with thematic ETFs often suited for growth-focused investors and currency ETFs for risk management or tactical plays.

Connection

Thematic ETFs often invest in specific sectors or trends that have significant exposure to foreign markets, making Currency ETFs crucial for hedging against exchange rate volatility. Currency ETFs provide investors with targeted access to currency movements, which can directly impact the returns of global thematic investments. Understanding the interplay between thematic equity exposure and currency fluctuations enhances portfolio diversification and risk management strategies.

Key Terms

Exchange Rate Risk

Currency ETFs provide direct exposure to foreign exchange rate fluctuations by tracking individual currencies or a basket of currencies, making them ideal for investors seeking to hedge or speculate on exchange rate risk. Thematic ETFs, while primarily focused on specific sectors or trends, can carry indirect currency risk when underlying assets are denominated in foreign currencies, impacting overall performance. Explore further to understand the nuances of exchange rate risk management in both currency and thematic ETFs.

Diversification

Currency ETFs offer targeted exposure to foreign exchange markets, allowing investors to hedge currency risk or speculate on currency movements with diversified baskets of multiple currencies. Thematic ETFs focus on specific trends or sectors such as clean energy or technology, providing diversified access to companies aligned with those themes across various industries and regions. Explore how combining currency and thematic ETFs can enhance portfolio diversification and mitigate risks by learning more about their strategic roles.

Investment Theme

Currency ETFs primarily track the performance of foreign exchange rates, offering investors exposure to currency fluctuations and hedging opportunities. Thematic ETFs concentrate on specific investment themes such as clean energy, technology innovation, or demographic trends, enabling targeted exposure to growth sectors. Discover how aligning your portfolio with currency dynamics or thematic growth can enhance your investment strategy.

Source and External Links

Currency ETFs: Your Complete Guide to Global Investing - Currency ETFs provide exposure to foreign currencies relative to the U.S. dollar and include single-currency ETFs, inverse and leveraged ETFs for short-term trading, and currency basket ETFs that track a group of currencies for diversification or thematic investments.

Currency ETFs - Fidelity Investments - Currency ETFs track the performance of a single or basket of currencies against the US dollar, offering benefits like portfolio diversification, hedging currency risk, speculative trading, low management fees, and easy trading via brokerage accounts.

Currency ETFs - ETF Database - Currency ETFs typically hold currency futures contracts to provide exposure to single currencies or currency baskets, and some ETFs implement strategies such as targeting commodity-linked currencies or carry trades.

dowidth.com

dowidth.com