Buy Now Pay Later (BNPL) services offer consumers short-term financing with low or zero interest, ideal for smaller purchases and quick approvals. Personal loans provide larger sums with fixed repayment schedules and interest rates, suitable for long-term financing and higher credit needs. Explore the key differences, benefits, and considerations to choose the right option for your financial goals.

Why it is important

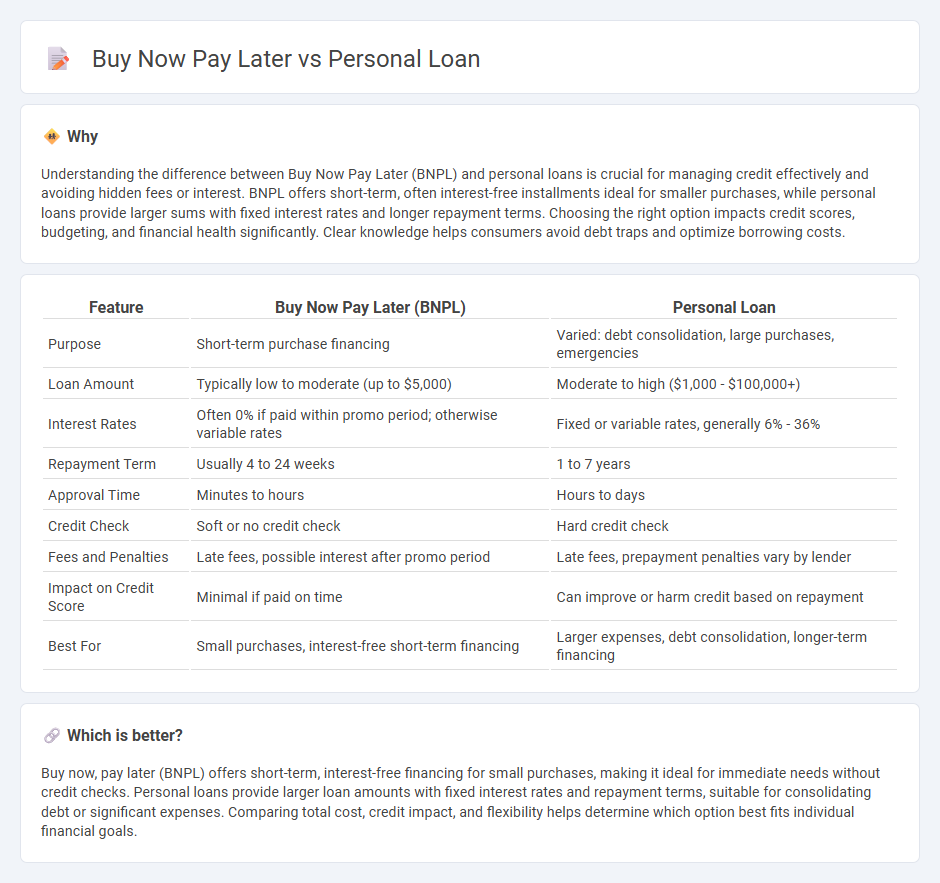

Understanding the difference between Buy Now Pay Later (BNPL) and personal loans is crucial for managing credit effectively and avoiding hidden fees or interest. BNPL offers short-term, often interest-free installments ideal for smaller purchases, while personal loans provide larger sums with fixed interest rates and longer repayment terms. Choosing the right option impacts credit scores, budgeting, and financial health significantly. Clear knowledge helps consumers avoid debt traps and optimize borrowing costs.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) | Personal Loan |

|---|---|---|

| Purpose | Short-term purchase financing | Varied: debt consolidation, large purchases, emergencies |

| Loan Amount | Typically low to moderate (up to $5,000) | Moderate to high ($1,000 - $100,000+) |

| Interest Rates | Often 0% if paid within promo period; otherwise variable rates | Fixed or variable rates, generally 6% - 36% |

| Repayment Term | Usually 4 to 24 weeks | 1 to 7 years |

| Approval Time | Minutes to hours | Hours to days |

| Credit Check | Soft or no credit check | Hard credit check |

| Fees and Penalties | Late fees, possible interest after promo period | Late fees, prepayment penalties vary by lender |

| Impact on Credit Score | Minimal if paid on time | Can improve or harm credit based on repayment |

| Best For | Small purchases, interest-free short-term financing | Larger expenses, debt consolidation, longer-term financing |

Which is better?

Buy now, pay later (BNPL) offers short-term, interest-free financing for small purchases, making it ideal for immediate needs without credit checks. Personal loans provide larger loan amounts with fixed interest rates and repayment terms, suitable for consolidating debt or significant expenses. Comparing total cost, credit impact, and flexibility helps determine which option best fits individual financial goals.

Connection

Buy Now Pay Later (BNPL) services and personal loans both provide consumers with credit options to manage purchases and expenses over time, facilitating cash flow flexibility. BNPL typically targets short-term financing for retail purchases with interest-free or low-interest installments, whereas personal loans offer larger sums with fixed interest rates and longer repayment periods for broader financial needs. Understanding the credit impact and cost structure of each can help consumers optimize borrowing strategies and maintain healthy credit profiles.

Key Terms

Interest Rate

Personal loans typically offer fixed interest rates ranging from 6% to 36%, providing predictable monthly payments over terms of one to seven years. Buy Now Pay Later (BNPL) services often feature zero or low up-front interest but may impose high late fees or deferred interest if payments are missed. Discover more about how interest rates impact your borrowing choices and financial health.

Credit Score

Personal loans typically require a higher credit score for approval and can positively impact credit history when payments are made on time, whereas Buy Now Pay Later (BNPL) options often have less stringent credit requirements but might not build credit if payments are timely or harm it if missed. The effect on credit score varies significantly between these financial products, with personal loans contributing more robustly to long-term credit health. Explore detailed comparisons to understand which option best aligns with your credit goals.

Repayment Terms

Personal loans typically offer fixed repayment terms ranging from one to seven years with consistent monthly payments and fixed or variable interest rates, providing borrowers clarity and predictability. Buy Now Pay Later (BNPL) options often feature shorter repayment periods, usually between 30 days to six months, with interest-free installments if paid on time but higher fees or interest charges if payments are missed. Explore detailed comparisons to understand which repayment structure best suits your financial needs.

Source and External Links

Personal loan - U.S. Bank - An unsecured personal loan up to $50,000 for various needs like debt consolidation, home improvements, or major purchases, with decisions based on credit profile and funds possibly available within hours for clients.

Apply for a Personal Loan up to $60000 | Get Funded Fast - LendingClub - A personal loan with fixed interest rates and terms, up to $60,000, for purposes such as debt consolidation or home improvement, with funding as fast as 24 hours after approval.

Online Personal Loans from $2500 to $40000 - Discover - Offers unsecured personal loans from $2,500 to $40,000 for uses like debt consolidation or unexpected expenses, featuring fixed rates, flexible terms, no fees, and next-business-day funding after acceptance.

dowidth.com

dowidth.com