Nonfungible tokens (NFTs) fractionalization allows investors to own partial shares of unique digital assets, enhancing liquidity and accessibility in the NFT market. Real Estate Investment Trusts (REITs) offer pooled ownership in income-generating real estate properties, providing diversification and regular dividends. Explore the differences between NFT fractionalization and REITs to understand which investment suits your financial goals.

Why it is important

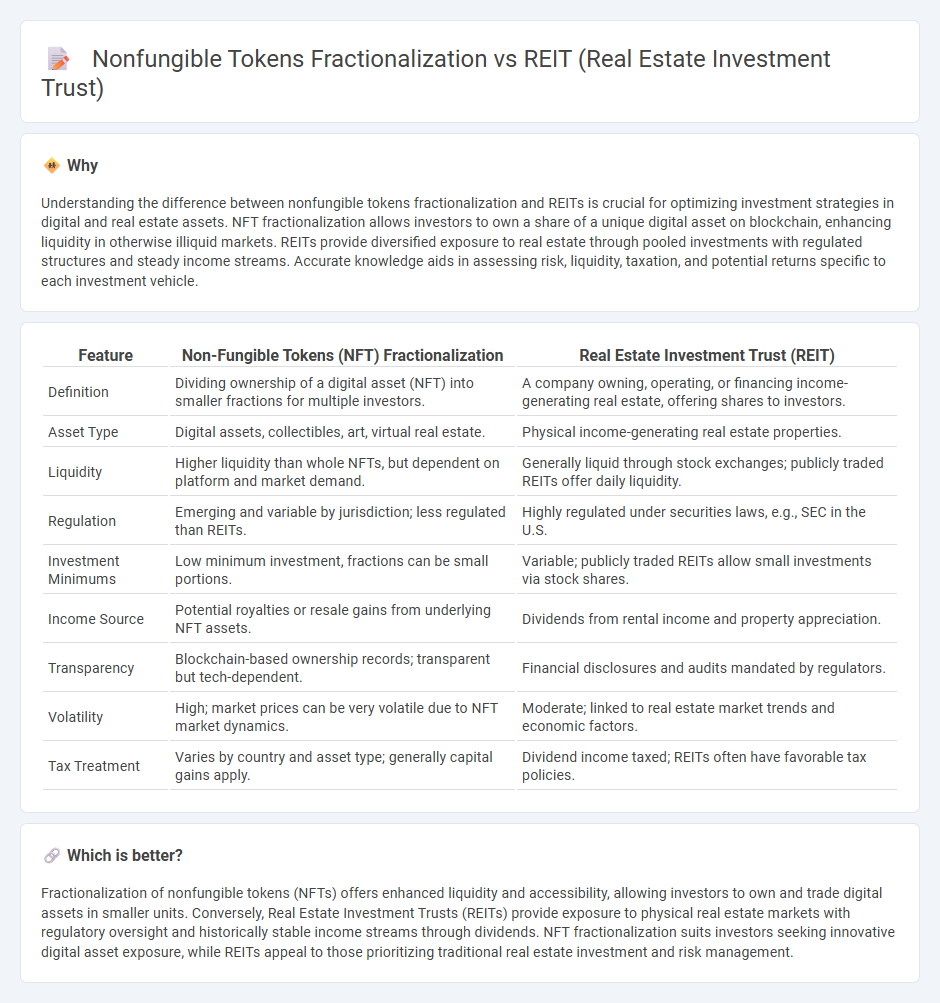

Understanding the difference between nonfungible tokens fractionalization and REITs is crucial for optimizing investment strategies in digital and real estate assets. NFT fractionalization allows investors to own a share of a unique digital asset on blockchain, enhancing liquidity in otherwise illiquid markets. REITs provide diversified exposure to real estate through pooled investments with regulated structures and steady income streams. Accurate knowledge aids in assessing risk, liquidity, taxation, and potential returns specific to each investment vehicle.

Comparison Table

| Feature | Non-Fungible Tokens (NFT) Fractionalization | Real Estate Investment Trust (REIT) |

|---|---|---|

| Definition | Dividing ownership of a digital asset (NFT) into smaller fractions for multiple investors. | A company owning, operating, or financing income-generating real estate, offering shares to investors. |

| Asset Type | Digital assets, collectibles, art, virtual real estate. | Physical income-generating real estate properties. |

| Liquidity | Higher liquidity than whole NFTs, but dependent on platform and market demand. | Generally liquid through stock exchanges; publicly traded REITs offer daily liquidity. |

| Regulation | Emerging and variable by jurisdiction; less regulated than REITs. | Highly regulated under securities laws, e.g., SEC in the U.S. |

| Investment Minimums | Low minimum investment, fractions can be small portions. | Variable; publicly traded REITs allow small investments via stock shares. |

| Income Source | Potential royalties or resale gains from underlying NFT assets. | Dividends from rental income and property appreciation. |

| Transparency | Blockchain-based ownership records; transparent but tech-dependent. | Financial disclosures and audits mandated by regulators. |

| Volatility | High; market prices can be very volatile due to NFT market dynamics. | Moderate; linked to real estate market trends and economic factors. |

| Tax Treatment | Varies by country and asset type; generally capital gains apply. | Dividend income taxed; REITs often have favorable tax policies. |

Which is better?

Fractionalization of nonfungible tokens (NFTs) offers enhanced liquidity and accessibility, allowing investors to own and trade digital assets in smaller units. Conversely, Real Estate Investment Trusts (REITs) provide exposure to physical real estate markets with regulatory oversight and historically stable income streams through dividends. NFT fractionalization suits investors seeking innovative digital asset exposure, while REITs appeal to those prioritizing traditional real estate investment and risk management.

Connection

Nonfungible token (NFT) fractionalization enables the division of a single NFT into multiple tradable shares, increasing liquidity and accessibility for investors. This concept parallels Real Estate Investment Trusts (REITs), which pool capital to allow fractional ownership of real estate assets while providing dividends from property income. Both mechanisms democratize investment by lowering entry barriers and enabling partial asset ownership in traditionally illiquid markets.

Key Terms

Asset Ownership

REITs (Real Estate Investment Trusts) provide investors with fractional ownership in diversified real estate portfolios, offering stable income streams and regulatory protections under the SEC. In contrast, nonfungible token (NFT) fractionalization enables digital representation of unique real assets with blockchain-based transparent ownership and liquidity but faces regulatory uncertainties. Explore how these distinct asset ownership models impact investment strategy and risk exposure.

Liquidity

REITs offer high liquidity through publicly traded shares on major stock exchanges, enabling investors to buy and sell real estate assets with ease and transparency. Nonfungible tokens (NFTs) fractionalization provides liquidity by dividing unique digital or physical assets into smaller, tradable units on blockchain platforms, though this market remains less regulated and often exhibits higher volatility. Explore further to understand the nuances of liquidity differences between REITs and NFT fractionalization in real estate investment.

Regulation

REITs operate under well-established regulatory frameworks such as the SEC's guidelines in the United States, ensuring investor protection, transparency, and compliance with fiduciary duties. In contrast, fractionalization of nonfungible tokens (NFTs) remains a developing area with inconsistent regulatory oversight, raising concerns about securities classification, investor risk, and market manipulation. Explore the latest regulatory developments to understand the evolving landscape of NFT fractionalization.

Source and External Links

Real estate investment trust - Wikipedia - A REIT is a company that owns or operates income-producing real estate, including offices, apartments, shopping centers, or finances real estate; they are often publicly traded and offer tax advantages by paying little to no corporate income tax in exchange for distributing most income as dividends.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own, operate or finance income-producing real estate, providing investors with regular income streams, diversification, and long-term capital appreciation, and most trade on major stock exchanges.

What is a REIT? - Fidelity Investments - REITs pool money from investors to buy and manage real estate portfolios, typically paying out at least 90% of taxable income as dividends to shareholders, making them popular for steady income-focused investing while offering special tax treatment.

dowidth.com

dowidth.com