Tokenized treasuries offer digital ownership of U.S. government debt through blockchain technology, providing enhanced liquidity and fractional investment opportunities compared to traditional Treasury ETFs, which pool investor funds to buy government securities. Treasury ETFs have long been favored for their ease of trading and diversification, but tokenized treasuries bring increased transparency and reduced intermediary costs. Explore how these innovations are reshaping fixed-income investing and what it means for your portfolio.

Why it is important

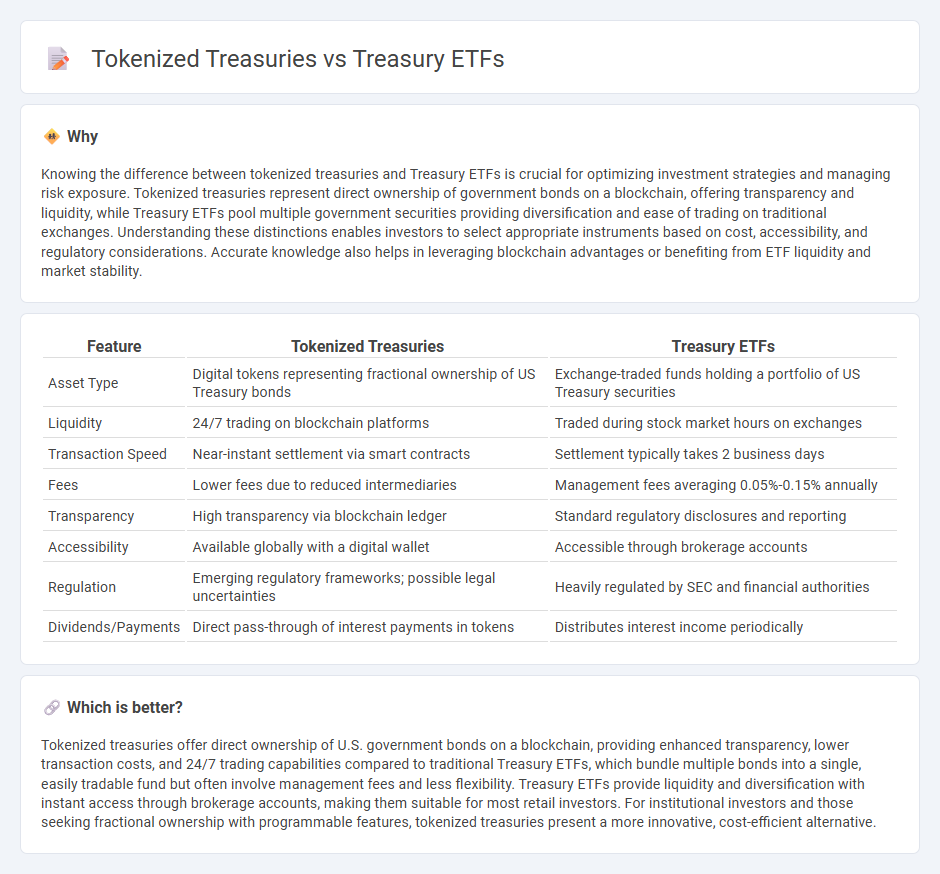

Knowing the difference between tokenized treasuries and Treasury ETFs is crucial for optimizing investment strategies and managing risk exposure. Tokenized treasuries represent direct ownership of government bonds on a blockchain, offering transparency and liquidity, while Treasury ETFs pool multiple government securities providing diversification and ease of trading on traditional exchanges. Understanding these distinctions enables investors to select appropriate instruments based on cost, accessibility, and regulatory considerations. Accurate knowledge also helps in leveraging blockchain advantages or benefiting from ETF liquidity and market stability.

Comparison Table

| Feature | Tokenized Treasuries | Treasury ETFs |

|---|---|---|

| Asset Type | Digital tokens representing fractional ownership of US Treasury bonds | Exchange-traded funds holding a portfolio of US Treasury securities |

| Liquidity | 24/7 trading on blockchain platforms | Traded during stock market hours on exchanges |

| Transaction Speed | Near-instant settlement via smart contracts | Settlement typically takes 2 business days |

| Fees | Lower fees due to reduced intermediaries | Management fees averaging 0.05%-0.15% annually |

| Transparency | High transparency via blockchain ledger | Standard regulatory disclosures and reporting |

| Accessibility | Available globally with a digital wallet | Accessible through brokerage accounts |

| Regulation | Emerging regulatory frameworks; possible legal uncertainties | Heavily regulated by SEC and financial authorities |

| Dividends/Payments | Direct pass-through of interest payments in tokens | Distributes interest income periodically |

Which is better?

Tokenized treasuries offer direct ownership of U.S. government bonds on a blockchain, providing enhanced transparency, lower transaction costs, and 24/7 trading capabilities compared to traditional Treasury ETFs, which bundle multiple bonds into a single, easily tradable fund but often involve management fees and less flexibility. Treasury ETFs provide liquidity and diversification with instant access through brokerage accounts, making them suitable for most retail investors. For institutional investors and those seeking fractional ownership with programmable features, tokenized treasuries present a more innovative, cost-efficient alternative.

Connection

Tokenized treasuries represent digital ownership of U.S. government debt securities, enabling fractional investment and improved liquidity on blockchain platforms. Treasury ETFs aggregate these underlying treasuries, providing investors with diversified exposure and easy tradability on traditional stock exchanges. The integration of tokenized treasuries with Treasury ETFs can enhance market accessibility and streamline asset management through digital innovation.

Key Terms

Liquidity

Treasury ETFs offer high liquidity through established exchanges, enabling fast buying and selling with narrow bid-ask spreads. Tokenized treasuries leverage blockchain technology for 24/7 trading and fractional ownership but may face liquidity constraints due to limited market adoption. Explore the differences in liquidity dynamics between these instruments to optimize your investment strategy.

Custody

Treasury ETFs offer traditional custody through established financial institutions, providing regulated and insured asset protection but often entail intermediary involvement and settlement delays. Tokenized treasuries utilize blockchain technology, enabling direct, real-time custody and transfer of ownership via digital wallets, reducing counterparty risk and enhancing liquidity. Explore the evolving landscape of custody solutions in treasury investments to understand their implications for security and accessibility.

Settlement

Settlement for Treasury ETFs typically involves T+2 days, ensuring efficient market clearing and investor liquidity, whereas tokenized treasuries leverage blockchain technology to achieve near-instantaneous settlement, drastically reducing counterparty risk and operational costs. The decentralized ledger system in tokenized treasuries enhances transparency and immutability compared to traditional ETF settlements. Explore deeper insights into how settlement dynamics influence investment strategies in Treasury ETFs and tokenized treasuries.

Source and External Links

SCHO | Schwab Short-Term U.S. Treasury ETF - This ETF aims to closely track the short-term U.S. Treasury bond market, offering low cost, tax-efficiency, and exposure to Treasury securities with 1 to 3 years maturity, suitable for diversified portfolios.

Treasuries ETF List | ETF Database - Provides a comprehensive list of U.S. Treasuries ETFs, which invest primarily in U.S. Treasury Notes, considered among the safest bonds due to low default risk, including historical performance and expense ratios.

Invest in US Treasuries with BondBloxx ETFs - BondBloxx offers U.S. Treasury ETFs with lower expense ratios (0.06%) than average and precise exposure to Treasury securities, designed for cost-effective fixed income investing.

dowidth.com

dowidth.com