Carbon trading enables businesses to buy and sell carbon emission allowances to meet regulatory limits and reduce overall greenhouse gas output, fostering a market-driven approach to climate change mitigation. Environmental derivatives, including options and futures based on environmental assets such as carbon credits or renewable energy certificates, provide financial instruments to hedge risks and speculate within the sustainability sector. Discover how these innovative financial tools shape the future of sustainable investment and environmental impact management.

Why it is important

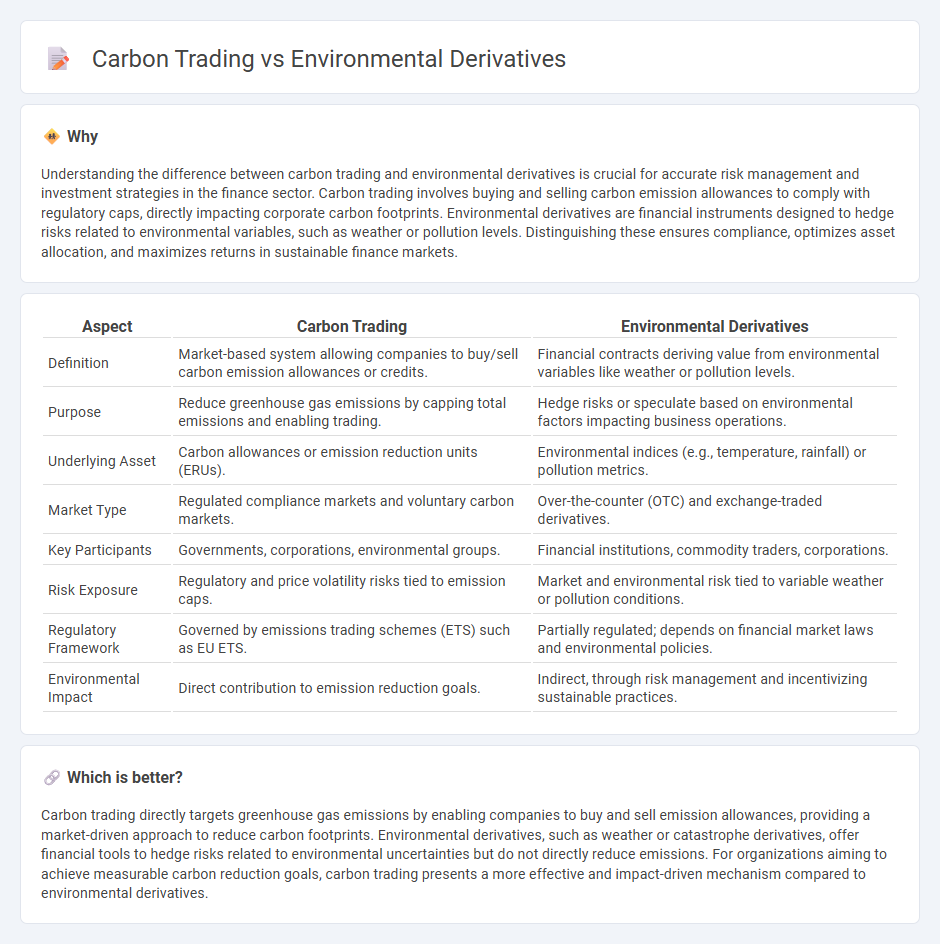

Understanding the difference between carbon trading and environmental derivatives is crucial for accurate risk management and investment strategies in the finance sector. Carbon trading involves buying and selling carbon emission allowances to comply with regulatory caps, directly impacting corporate carbon footprints. Environmental derivatives are financial instruments designed to hedge risks related to environmental variables, such as weather or pollution levels. Distinguishing these ensures compliance, optimizes asset allocation, and maximizes returns in sustainable finance markets.

Comparison Table

| Aspect | Carbon Trading | Environmental Derivatives |

|---|---|---|

| Definition | Market-based system allowing companies to buy/sell carbon emission allowances or credits. | Financial contracts deriving value from environmental variables like weather or pollution levels. |

| Purpose | Reduce greenhouse gas emissions by capping total emissions and enabling trading. | Hedge risks or speculate based on environmental factors impacting business operations. |

| Underlying Asset | Carbon allowances or emission reduction units (ERUs). | Environmental indices (e.g., temperature, rainfall) or pollution metrics. |

| Market Type | Regulated compliance markets and voluntary carbon markets. | Over-the-counter (OTC) and exchange-traded derivatives. |

| Key Participants | Governments, corporations, environmental groups. | Financial institutions, commodity traders, corporations. |

| Risk Exposure | Regulatory and price volatility risks tied to emission caps. | Market and environmental risk tied to variable weather or pollution conditions. |

| Regulatory Framework | Governed by emissions trading schemes (ETS) such as EU ETS. | Partially regulated; depends on financial market laws and environmental policies. |

| Environmental Impact | Direct contribution to emission reduction goals. | Indirect, through risk management and incentivizing sustainable practices. |

Which is better?

Carbon trading directly targets greenhouse gas emissions by enabling companies to buy and sell emission allowances, providing a market-driven approach to reduce carbon footprints. Environmental derivatives, such as weather or catastrophe derivatives, offer financial tools to hedge risks related to environmental uncertainties but do not directly reduce emissions. For organizations aiming to achieve measurable carbon reduction goals, carbon trading presents a more effective and impact-driven mechanism compared to environmental derivatives.

Connection

Carbon trading and environmental derivatives are connected through their shared goal of managing environmental risks and promoting sustainability by assigning economic value to emissions and ecological impacts. Carbon trading involves the buying and selling of carbon emission allowances to meet regulatory limits, while environmental derivatives are financial instruments like futures and options based on underlying environmental assets, such as carbon credits or renewable energy indices. Both mechanisms incentivize emission reductions and enable investors and companies to hedge against price fluctuations in environmental assets, aligning financial markets with climate objectives.

Key Terms

**Environmental Derivatives:**

Environmental derivatives are financial instruments designed to manage risks related to environmental variables such as temperature, rainfall, or pollution levels, allowing companies to hedge against climate-related uncertainties. These derivatives offer customizable contracts based on environmental indices, providing flexibility beyond traditional carbon trading mechanisms that focus primarily on emissions allowances. Explore how environmental derivatives can complement sustainability strategies by reducing exposure to environmental risks.

Futures Contracts

Environmental derivatives and carbon trading both serve as mechanisms for managing environmental risk, with futures contracts playing a crucial role in each market. Environmental derivatives often include futures contracts based on emissions reductions, renewable energy credits, or weather-related indices, providing hedging opportunities against environmental variables. Explore the benefits and structures of futures contracts within environmental markets to better understand their impact on sustainability finance.

Option Pricing

Environmental derivatives and carbon trading both play crucial roles in managing climate risk, with option pricing serving as a key tool to value flexibility in emissions reduction strategies. In environmental derivatives, option pricing models help quantify the risk and potential payoff linked to regulatory changes or environmental contingencies, while carbon trading options provide a market-driven mechanism to hedge against price volatility of carbon allowances. Explore how advanced option pricing methodologies enhance strategic decision-making in both environmental derivatives and carbon markets for sustainable investment planning.

Source and External Links

Overview of ESG-related Derivatives Products and Transactions - Environmental derivatives enable capital flow to sustainable investments, help hedge ESG risks, and include sustainability-linked derivatives, emissions trading derivatives, and weather derivatives among others, playing a key role in financing the transition to a sustainable economy.

Leveraging ESG Derivatives to Catalyze Green Transition - ESG derivatives manage risks linked to sustainable investments, improve market efficiency, and encourage capital flow by offering financial risk mitigation instruments such as interest rate swaps tailored for green projects.

ESG Derivatives - ESG derivatives are financial instruments reflecting environmental, social, and governance criteria that help transfer risk linked to sustainable investments and are evolving towards standardizing ESG performance measurement in derivative trades.

dowidth.com

dowidth.com