Structured credit involves pooling various debt instruments and slicing them into tranches with different risk levels, often used in collateralized loan obligations (CLOs) and asset-backed securities (ABS). Leverage finance focuses on high-yield debt used by companies or private equity firms to fund acquisitions, recapitalizations, or buyouts, commonly involving leveraged loans and high-yield bonds. Explore the nuances and risk profiles of structured credit versus leverage finance to enhance investment strategies.

Why it is important

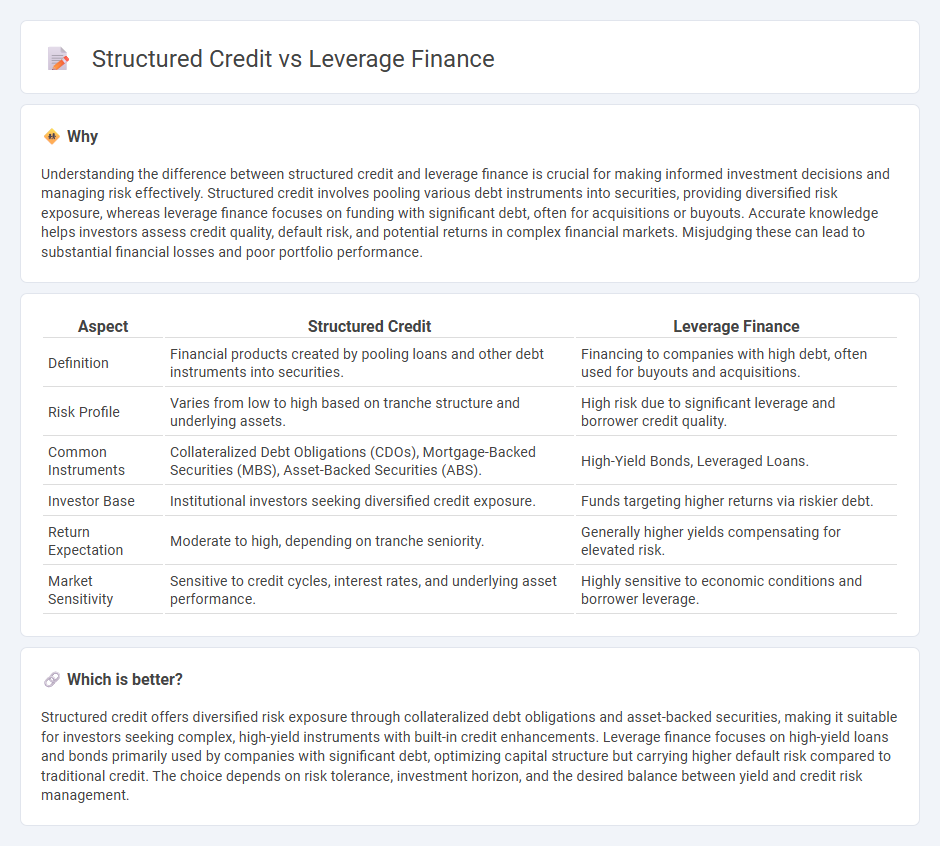

Understanding the difference between structured credit and leverage finance is crucial for making informed investment decisions and managing risk effectively. Structured credit involves pooling various debt instruments into securities, providing diversified risk exposure, whereas leverage finance focuses on funding with significant debt, often for acquisitions or buyouts. Accurate knowledge helps investors assess credit quality, default risk, and potential returns in complex financial markets. Misjudging these can lead to substantial financial losses and poor portfolio performance.

Comparison Table

| Aspect | Structured Credit | Leverage Finance |

|---|---|---|

| Definition | Financial products created by pooling loans and other debt instruments into securities. | Financing to companies with high debt, often used for buyouts and acquisitions. |

| Risk Profile | Varies from low to high based on tranche structure and underlying assets. | High risk due to significant leverage and borrower credit quality. |

| Common Instruments | Collateralized Debt Obligations (CDOs), Mortgage-Backed Securities (MBS), Asset-Backed Securities (ABS). | High-Yield Bonds, Leveraged Loans. |

| Investor Base | Institutional investors seeking diversified credit exposure. | Funds targeting higher returns via riskier debt. |

| Return Expectation | Moderate to high, depending on tranche seniority. | Generally higher yields compensating for elevated risk. |

| Market Sensitivity | Sensitive to credit cycles, interest rates, and underlying asset performance. | Highly sensitive to economic conditions and borrower leverage. |

Which is better?

Structured credit offers diversified risk exposure through collateralized debt obligations and asset-backed securities, making it suitable for investors seeking complex, high-yield instruments with built-in credit enhancements. Leverage finance focuses on high-yield loans and bonds primarily used by companies with significant debt, optimizing capital structure but carrying higher default risk compared to traditional credit. The choice depends on risk tolerance, investment horizon, and the desired balance between yield and credit risk management.

Connection

Structured credit and leverage finance are connected through their roles in complex capital markets transactions where high-yield debt instruments are designed to optimize risk and return profiles. Structured credit involves pooling and repackaging debt, often including leveraged loans or high-yield bonds, to create tranches with varying risk levels for investors. Leverage finance provides the underlying debt capital, typically for acquisitions or recapitalizations, which is then structured and securitized within structured credit products to enhance market liquidity and investor access.

Key Terms

Debt-to-Equity Ratio

Leverage finance involves using borrowed capital to increase the potential return of an investment, often resulting in a higher debt-to-equity ratio compared to structured credit, which typically features tailored risk mitigation through asset-backed securities. Structured credit instruments like collateralized loan obligations (CLOs) and asset-backed securities (ABS) help distribute and manage credit risk, thereby allowing for more controlled leverage levels and enhancing credit quality. Explore how the debt-to-equity ratio impacts investment strategies and risk assessment in these financing methods for a deeper understanding.

Collateralized Debt Obligation (CDO)

Leverage finance involves borrowing to increase investment capacity, commonly used in acquisitions and corporate financing, whereas structured credit refers to complex securities like Collateralized Debt Obligations (CDOs) that pool various debt instruments to redistribute risk. CDOs are tranches of debt categorized by credit quality and payment priority, optimizing risk-adjusted returns for investors by leveraging underlying collateral cash flows. Explore deeper insights into leveraging financial instruments and CDO structures to enhance portfolio strategies.

Covenant

Leverage finance typically involves higher-risk loans with looser covenant structures, allowing borrowers more operational flexibility. Structured credit products, such as collateralized loan obligations (CLOs), often embed tighter covenant packages to protect investor interests and manage default risk. Explore how covenant variations impact risk and return profiles in both leverage finance and structured credit markets.

Source and External Links

Leverage (finance) - Leverage in finance refers to borrowing funds to buy investments, amplifying potential returns but also increasing risk, often using assets as collateral.

Leveraged Finance - Definition, Examples, How it Works - Leveraged finance involves using an above-normal amount of debt to finance assets, aiming to increase investment returns but raising risks and earnings volatility.

Leveraged Finance (LevFin) | Ultimate Guide - Leveraged Finance relates to raising debt capital to fund highly leveraged transactions like buyouts, mergers, and recapitalizations, mostly through syndicated loans and bonds.

dowidth.com

dowidth.com