Green bond laddering involves structuring a portfolio with staggered maturities of environmentally focused bonds to manage interest rate risk and ensure steady cash flow. The Barbell strategy combines short-term and long-term bond investments, balancing liquidity and yield potential while maintaining exposure to green investments. Explore the nuances of these strategies to optimize sustainable finance portfolios.

Why it is important

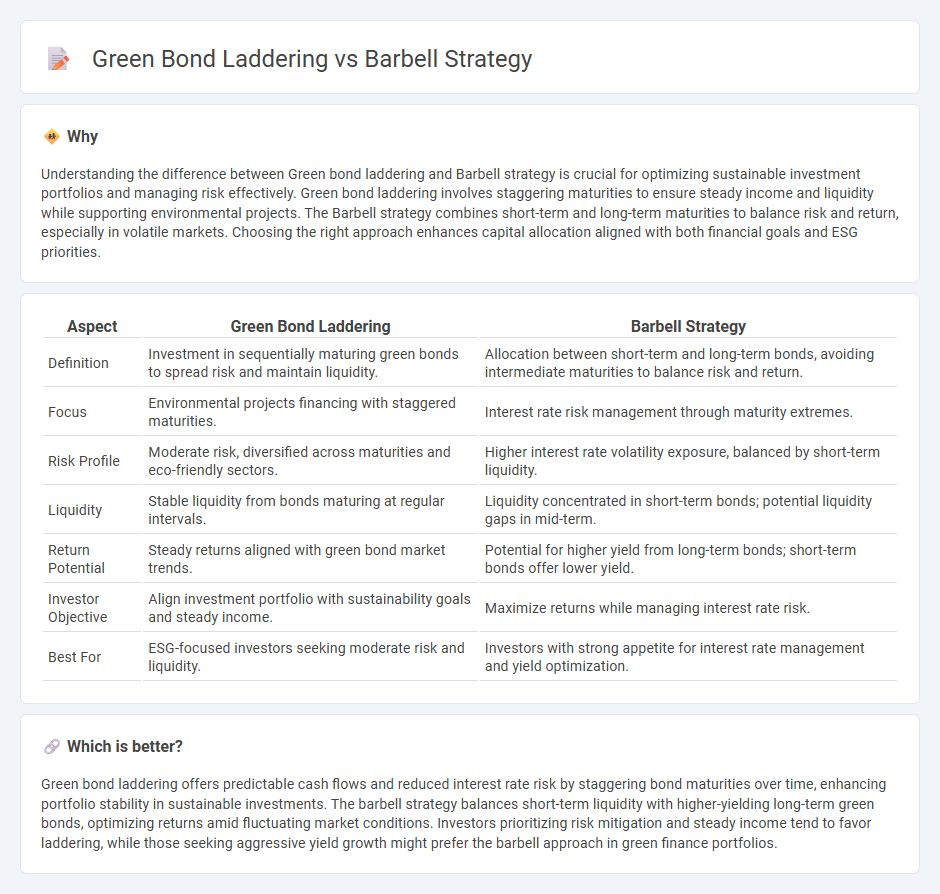

Understanding the difference between Green bond laddering and Barbell strategy is crucial for optimizing sustainable investment portfolios and managing risk effectively. Green bond laddering involves staggering maturities to ensure steady income and liquidity while supporting environmental projects. The Barbell strategy combines short-term and long-term maturities to balance risk and return, especially in volatile markets. Choosing the right approach enhances capital allocation aligned with both financial goals and ESG priorities.

Comparison Table

| Aspect | Green Bond Laddering | Barbell Strategy |

|---|---|---|

| Definition | Investment in sequentially maturing green bonds to spread risk and maintain liquidity. | Allocation between short-term and long-term bonds, avoiding intermediate maturities to balance risk and return. |

| Focus | Environmental projects financing with staggered maturities. | Interest rate risk management through maturity extremes. |

| Risk Profile | Moderate risk, diversified across maturities and eco-friendly sectors. | Higher interest rate volatility exposure, balanced by short-term liquidity. |

| Liquidity | Stable liquidity from bonds maturing at regular intervals. | Liquidity concentrated in short-term bonds; potential liquidity gaps in mid-term. |

| Return Potential | Steady returns aligned with green bond market trends. | Potential for higher yield from long-term bonds; short-term bonds offer lower yield. |

| Investor Objective | Align investment portfolio with sustainability goals and steady income. | Maximize returns while managing interest rate risk. |

| Best For | ESG-focused investors seeking moderate risk and liquidity. | Investors with strong appetite for interest rate management and yield optimization. |

Which is better?

Green bond laddering offers predictable cash flows and reduced interest rate risk by staggering bond maturities over time, enhancing portfolio stability in sustainable investments. The barbell strategy balances short-term liquidity with higher-yielding long-term green bonds, optimizing returns amid fluctuating market conditions. Investors prioritizing risk mitigation and steady income tend to favor laddering, while those seeking aggressive yield growth might prefer the barbell approach in green finance portfolios.

Connection

Green bond laddering and the barbell strategy both optimize fixed-income portfolios by balancing risk and return through diversified maturities. Laddering spreads investments across various green bond maturities to ensure steady cash flow and reduced reinvestment risk, while the barbell strategy concentrates holdings in short-term and long-term green bonds, minimizing intermediate maturity exposures to adapt to interest rate changes. Combining these approaches enhances portfolio resilience and aligns sustainable finance goals with strategic duration management.

Key Terms

Maturity structure

The barbell strategy concentrates investments in short- and long-term maturities, creating a portfolio with two distinct maturity buckets that balance risk and return. Green bond laddering involves staggering maturities evenly over time, providing steady income while supporting environmentally sustainable projects and reducing reinvestment risk. Explore in-depth comparisons of these strategies to optimize your portfolio's maturity structure with sustainable investing goals.

Interest rate risk

The barbell strategy involves investing in short- and long-term bonds to mitigate interest rate risk and capitalize on varying rate environments, while green bond laddering spreads investments across maturities within environmentally focused bonds to balance returns and sustainability objectives. Both strategies aim to manage duration and interest rate sensitivity, with the barbell approach offering flexibility against rate fluctuations and laddering providing steady cash flows and reduced reinvestment risk. Explore detailed comparisons to decide which method aligns best with your portfolio's interest rate risk tolerance and sustainability goals.

Sustainability

Barbell strategy in sustainable investing balances short-term and long-term green bonds to optimize yield while managing risk and promoting environmental projects. Green bond laddering diversifies maturity dates across a sequence of green bonds, ensuring steady cash flow and continuous support for sustainability initiatives. Explore in-depth comparisons and benefits of these approaches for impactful, eco-friendly investment portfolios.

Source and External Links

Use the Barbell Strategy for Success in Creativity (& Life) - The Barbell Strategy, introduced by Nassim Taleb, involves balancing one end with very low risk and the other with high-risk opportunities, protecting against catastrophic losses while enabling big gains, applicable not only in investing but also in creative work and exercise.

What's The Barbell Strategy? - Definition, Examples, and ... - The barbell strategy uses a split like 90% in safe assets (e.g., cash) and 10% in high-risk investments (e.g., Bitcoin) to limit downside loss while preserving exposure to extreme upside, avoiding the uncertain middle ground of moderate risks.

Barbell strategy - Wikipedia - In finance, the barbell strategy involves investing in short- and long-duration bonds but avoiding intermediate maturities, allowing quick turnover of short-term investments and benefiting from rising interest rates on rolled-over bonds.

dowidth.com

dowidth.com