Copy trading platforms enable investors to replicate the trades of experienced traders in real time, offering a hands-off approach to portfolio management compared to traditional brokerage accounts. Traditional brokerage accounts provide direct market access and a wide range of investment options but require more active decision-making and market knowledge. Explore the advantages and drawbacks of each to determine which investment method aligns best with your financial goals.

Why it is important

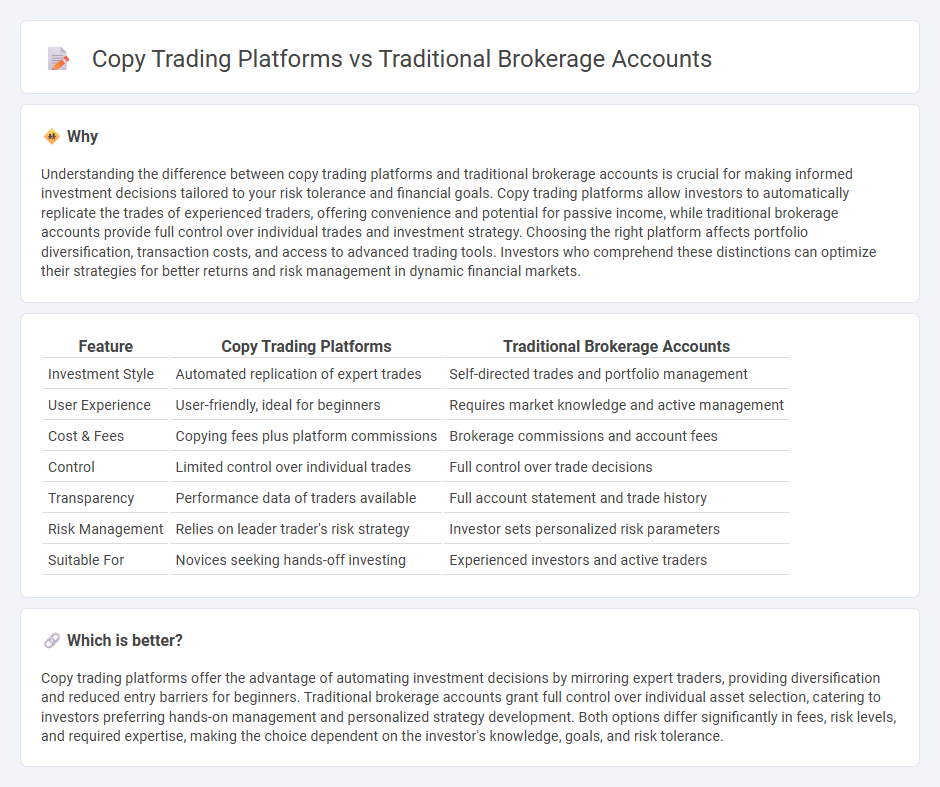

Understanding the difference between copy trading platforms and traditional brokerage accounts is crucial for making informed investment decisions tailored to your risk tolerance and financial goals. Copy trading platforms allow investors to automatically replicate the trades of experienced traders, offering convenience and potential for passive income, while traditional brokerage accounts provide full control over individual trades and investment strategy. Choosing the right platform affects portfolio diversification, transaction costs, and access to advanced trading tools. Investors who comprehend these distinctions can optimize their strategies for better returns and risk management in dynamic financial markets.

Comparison Table

| Feature | Copy Trading Platforms | Traditional Brokerage Accounts |

|---|---|---|

| Investment Style | Automated replication of expert trades | Self-directed trades and portfolio management |

| User Experience | User-friendly, ideal for beginners | Requires market knowledge and active management |

| Cost & Fees | Copying fees plus platform commissions | Brokerage commissions and account fees |

| Control | Limited control over individual trades | Full control over trade decisions |

| Transparency | Performance data of traders available | Full account statement and trade history |

| Risk Management | Relies on leader trader's risk strategy | Investor sets personalized risk parameters |

| Suitable For | Novices seeking hands-off investing | Experienced investors and active traders |

Which is better?

Copy trading platforms offer the advantage of automating investment decisions by mirroring expert traders, providing diversification and reduced entry barriers for beginners. Traditional brokerage accounts grant full control over individual asset selection, catering to investors preferring hands-on management and personalized strategy development. Both options differ significantly in fees, risk levels, and required expertise, making the choice dependent on the investor's knowledge, goals, and risk tolerance.

Connection

Copy trading platforms and traditional brokerage accounts both facilitate investment in financial markets by allowing users to execute trades, but copy trading platforms automate this process by replicating the trades of experienced investors. Traditional brokerage accounts provide the infrastructure for placing trades, holding assets, and accessing market data, which copy trading platforms leverage through API integrations or direct partnerships. This connection enhances investor accessibility and streamlines portfolio management by combining expert strategies with established brokerage services.

Key Terms

Trade Execution

Traditional brokerage accounts offer direct control over trade execution, enabling investors to place orders with precision and customize strategies based on market conditions. Copy trading platforms automate trade execution by replicating the transactions of experienced traders, providing a hands-off approach with potentially faster response times to market changes. Explore the benefits and limitations of each to determine which trade execution method aligns best with your investment goals.

Investor Autonomy

Traditional brokerage accounts provide investors with full control over their trades, asset selection, and portfolio management, emphasizing personalized investment strategies and decision-making autonomy. Copy trading platforms enable users to replicate the trades of experienced investors, reducing the need for active management while potentially diminishing individual control over investment choices. Explore the advantages and limitations of both approaches to find the best fit for your investment style.

Social Trading

Traditional brokerage accounts offer direct control over investment decisions and access to diverse financial instruments, catering to experienced traders seeking personalized strategies. Copy trading platforms enable investors to automatically replicate the trades of expert traders, leveraging collective insights through social trading networks to potentially enhance returns with reduced individual analysis. Explore the benefits and risks of both to determine the best fit for your investment goals and learning preference.

Source and External Links

What is a Brokerage account and how does it work? - Vanguard - A traditional brokerage account is a standard nonretirement investing account allowing you to buy and hold stocks, bonds, ETFs, and mutual funds with no contribution limits or early withdrawal penalties, suitable for saving flexible goals like a new car or emergency fund.

What is a Brokerage Account - Schwab - A brokerage account lets you invest in a variety of securities including stocks, bonds, and funds with no fees for opening or maintenance, allowing you to withdraw funds anytime and use it for both long-term retirement savings or shorter-term financial goals.

What Is a Brokerage Account? Where and How to Open One - NerdWallet - A brokerage account allows investors to buy and sell securities and may be self-managed or managed by advisors or robo-advisors, offering flexibility in investment choices for various financial goals without restrictions on contributions.

dowidth.com

dowidth.com