Tokenized treasuries leverage blockchain technology to offer fractional ownership, enhanced liquidity, and faster settlement compared to traditional treasury bonds issued and managed by government entities through centralized processes. Traditional treasury bonds provide fixed interest payments and are considered low-risk investments backed by the government's creditworthiness, but they often involve longer settlement times and limited accessibility for smaller investors. Explore the advantages and challenges of tokenized treasuries versus traditional bonds to better understand their impact on modern finance.

Why it is important

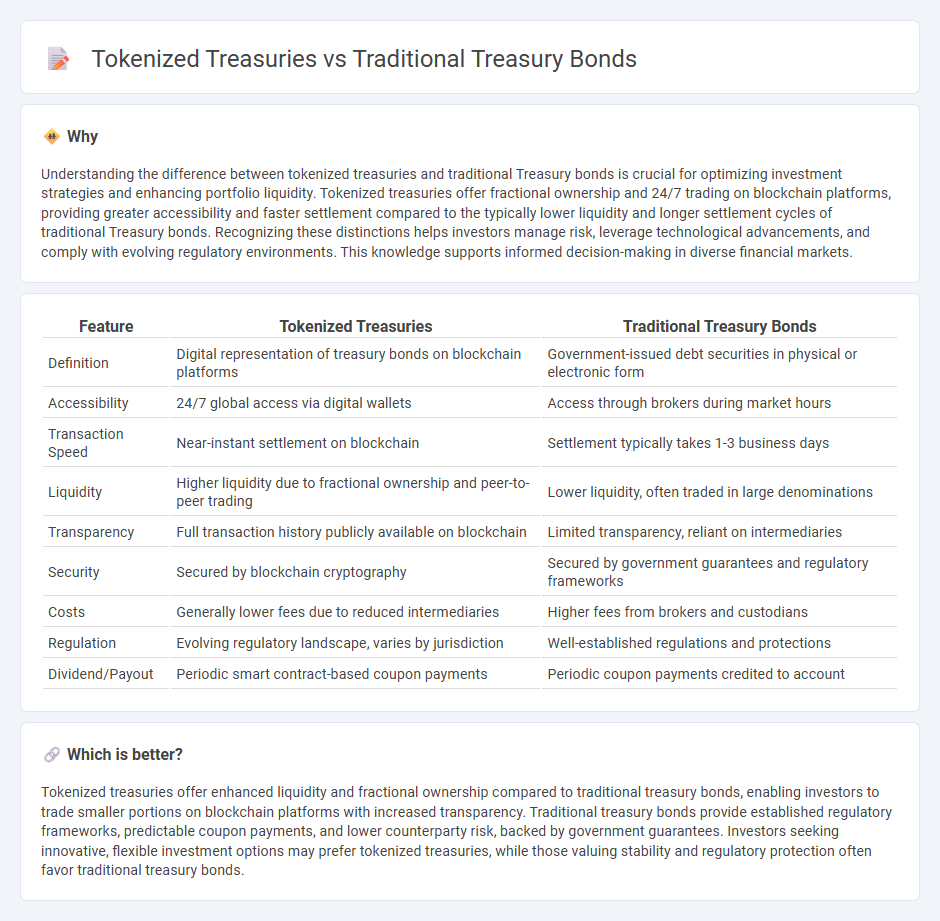

Understanding the difference between tokenized treasuries and traditional Treasury bonds is crucial for optimizing investment strategies and enhancing portfolio liquidity. Tokenized treasuries offer fractional ownership and 24/7 trading on blockchain platforms, providing greater accessibility and faster settlement compared to the typically lower liquidity and longer settlement cycles of traditional Treasury bonds. Recognizing these distinctions helps investors manage risk, leverage technological advancements, and comply with evolving regulatory environments. This knowledge supports informed decision-making in diverse financial markets.

Comparison Table

| Feature | Tokenized Treasuries | Traditional Treasury Bonds |

|---|---|---|

| Definition | Digital representation of treasury bonds on blockchain platforms | Government-issued debt securities in physical or electronic form |

| Accessibility | 24/7 global access via digital wallets | Access through brokers during market hours |

| Transaction Speed | Near-instant settlement on blockchain | Settlement typically takes 1-3 business days |

| Liquidity | Higher liquidity due to fractional ownership and peer-to-peer trading | Lower liquidity, often traded in large denominations |

| Transparency | Full transaction history publicly available on blockchain | Limited transparency, reliant on intermediaries |

| Security | Secured by blockchain cryptography | Secured by government guarantees and regulatory frameworks |

| Costs | Generally lower fees due to reduced intermediaries | Higher fees from brokers and custodians |

| Regulation | Evolving regulatory landscape, varies by jurisdiction | Well-established regulations and protections |

| Dividend/Payout | Periodic smart contract-based coupon payments | Periodic coupon payments credited to account |

Which is better?

Tokenized treasuries offer enhanced liquidity and fractional ownership compared to traditional treasury bonds, enabling investors to trade smaller portions on blockchain platforms with increased transparency. Traditional treasury bonds provide established regulatory frameworks, predictable coupon payments, and lower counterparty risk, backed by government guarantees. Investors seeking innovative, flexible investment options may prefer tokenized treasuries, while those valuing stability and regulatory protection often favor traditional treasury bonds.

Connection

Tokenized treasuries represent traditional U.S. Treasury bonds on a blockchain, enabling fractional ownership and increased liquidity while maintaining the creditworthiness and low-risk profile of conventional government securities. These digital assets bridge traditional fixed-income markets with decentralized finance, offering real-time settlement and greater accessibility to global investors. The integration leverages blockchain technology to enhance transparency, reduce transaction costs, and streamline the trading of Treasury bonds.

Key Terms

Liquidity

Traditional Treasury Bonds offer high liquidity through established secondary markets, enabling investors to easily buy and sell these government-backed securities. Tokenized treasuries leverage blockchain technology, enhancing liquidity by allowing fractional ownership, 24/7 trading, and reduced settlement times. Explore the evolving landscape of treasury investments to understand how tokenization transforms liquidity dynamics.

Custody

Traditional Treasury Bonds require secure physical or digital custody managed by financial institutions or custodians, ensuring regulatory compliance and protection against theft or loss. Tokenized treasuries leverage blockchain technology, allowing for decentralized custody solutions and potentially enhanced transparency and efficiency in asset management. Explore the evolving custody mechanisms to understand the future of treasury asset security.

Settlement

Traditional Treasury Bonds settle through centralized clearinghouses, often requiring days to finalize transactions, increasing counterparty risk and limiting liquidity. Tokenized treasuries leverage blockchain technology to enable near-instant settlement, reduced intermediary costs, and enhanced transparency in ownership transfers. Explore the advantages of tokenized treasuries to understand the future of efficient bond settlement.

Source and External Links

Treasury bills vs. bonds vs. notes: What you need to know - Traditional Treasury bonds (T-bonds) are long-term U.S. government debt securities with maturities of 20 or 30 years, paying fixed interest every six months and exempt from state and local taxes.

U.S. Treasury Securities: Bonds, Bills & More | Vanguard - Treasury bonds typically mature after 30 years, provide semiannual interest payments, are exempt from state and local taxes, and serve as a steady, reliable long-term income source suitable for retirement planning.

Treasury Bonds - Treasury bonds are issued electronically in $100 increments with fixed interest rates set at auction, pay interest semiannually for 20 or 30 years, and investors can hold until maturity or sell beforehand, with federal tax applied on interest but no state or local tax.

dowidth.com

dowidth.com