Fractional shares allow investors to buy portions of expensive stocks, enabling diversified portfolios with minimal capital. Robo-advisors use automated algorithms to manage investments, offering low-cost, personalized financial planning. Explore the differences and benefits of fractional shares versus robo-advisors to optimize your investment strategy.

Why it is important

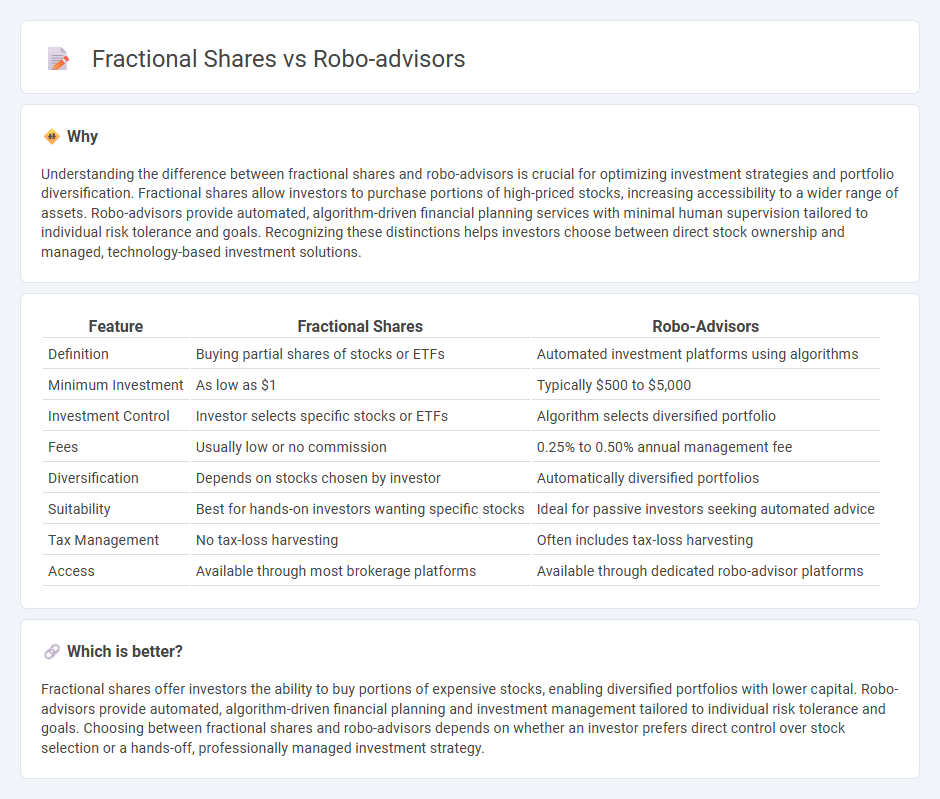

Understanding the difference between fractional shares and robo-advisors is crucial for optimizing investment strategies and portfolio diversification. Fractional shares allow investors to purchase portions of high-priced stocks, increasing accessibility to a wider range of assets. Robo-advisors provide automated, algorithm-driven financial planning services with minimal human supervision tailored to individual risk tolerance and goals. Recognizing these distinctions helps investors choose between direct stock ownership and managed, technology-based investment solutions.

Comparison Table

| Feature | Fractional Shares | Robo-Advisors |

|---|---|---|

| Definition | Buying partial shares of stocks or ETFs | Automated investment platforms using algorithms |

| Minimum Investment | As low as $1 | Typically $500 to $5,000 |

| Investment Control | Investor selects specific stocks or ETFs | Algorithm selects diversified portfolio |

| Fees | Usually low or no commission | 0.25% to 0.50% annual management fee |

| Diversification | Depends on stocks chosen by investor | Automatically diversified portfolios |

| Suitability | Best for hands-on investors wanting specific stocks | Ideal for passive investors seeking automated advice |

| Tax Management | No tax-loss harvesting | Often includes tax-loss harvesting |

| Access | Available through most brokerage platforms | Available through dedicated robo-advisor platforms |

Which is better?

Fractional shares offer investors the ability to buy portions of expensive stocks, enabling diversified portfolios with lower capital. Robo-advisors provide automated, algorithm-driven financial planning and investment management tailored to individual risk tolerance and goals. Choosing between fractional shares and robo-advisors depends on whether an investor prefers direct control over stock selection or a hands-off, professionally managed investment strategy.

Connection

Fractional shares enable investors to purchase partial units of expensive stocks, making diversified portfolios accessible with limited capital. Robo-advisors utilize fractional shares to automatically allocate funds across multiple assets, optimizing investment strategies based on user risk profiles and financial goals. This connection enhances portfolio diversification and cost-efficiency, empowering more individuals to participate in wealth building through technology-driven financial services.

Key Terms

Algorithmic Portfolio Management

Algorithmic portfolio management in robo-advisors uses advanced algorithms to automatically allocate and rebalance investments based on risk tolerance and financial goals, offering personalized portfolio optimization. Fractional shares enable investors to buy portions of high-priced stocks, making diversified portfolios more accessible but without the automated, data-driven adjustments of robo-advisors. Explore the nuances of how these technologies transform investment strategies and enhance portfolio management efficiency.

Micro-Investing

Robo-advisors use algorithms to automate portfolio management, offering tailored investments while fractional shares allow investors to buy portions of expensive stocks, enabling micro-investing with low capital. Combining robo-advisors with fractional share trading empowers users to diversify portfolios efficiently and access high-value equities with minimal funds. Explore the benefits and strategies of integrating robo-advisors and fractional shares to optimize your micro-investing journey.

Automated Rebalancing

Robo-advisors leverage automated rebalancing to maintain an optimal asset allocation by systematically buying and selling fractional shares based on market conditions and investor goals. Fractional shares enable robo-advisors to execute precise portfolio adjustments without the need for whole-share transactions, enhancing diversification and cost efficiency. Discover how combining robo-advisors with fractional shares revolutionizes automated rebalancing strategies in modern investment management.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are digital financial advisers that use algorithms to provide personalized investment management online with little human intervention, typically allocating assets based on client risk tolerance and often focusing on ETFs to offer cost-effective wealth management to a broad audience.

What is a robo advisor? | Robo advisory services - Fidelity Investments - A robo-advisor is an automated, affordable digital financial service that builds and manages investment portfolios based on user-provided information about financial goals and risk tolerance, often automatically rebalancing portfolios to stay aligned with these goals.

The Best Robo-Advisors of 2025 - Morningstar - Robo-advisors provide automated strategic asset allocation and portfolio management using algorithms, offering investors a cost-effective middle ground between self-directed investing platforms and human wealth managers, with evaluations based on fees, portfolio quality, and planning tools.

dowidth.com

dowidth.com