Direct indexing allows investors to replicate an index by owning individual securities, offering tax efficiency and customization compared to traditional index funds. Custom indexing provides a tailored portfolio that aligns with specific investment goals, values, or risk tolerances, enhancing control over holdings and potential tax outcomes. Explore the differences between direct and custom indexing to optimize your investment strategy.

Why it is important

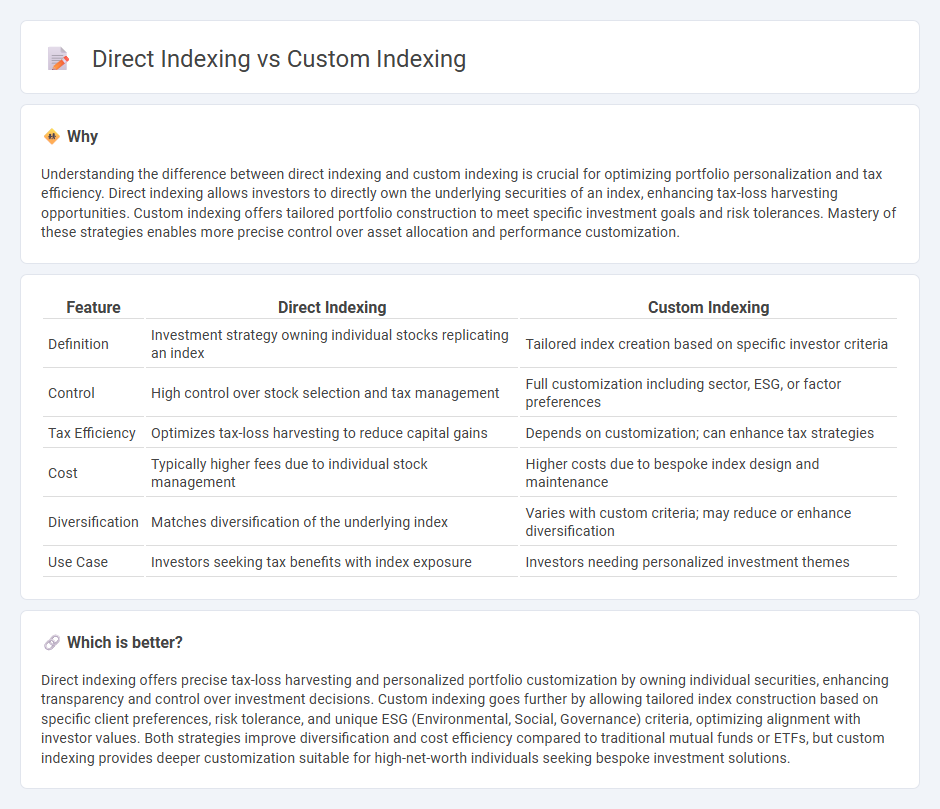

Understanding the difference between direct indexing and custom indexing is crucial for optimizing portfolio personalization and tax efficiency. Direct indexing allows investors to directly own the underlying securities of an index, enhancing tax-loss harvesting opportunities. Custom indexing offers tailored portfolio construction to meet specific investment goals and risk tolerances. Mastery of these strategies enables more precise control over asset allocation and performance customization.

Comparison Table

| Feature | Direct Indexing | Custom Indexing |

|---|---|---|

| Definition | Investment strategy owning individual stocks replicating an index | Tailored index creation based on specific investor criteria |

| Control | High control over stock selection and tax management | Full customization including sector, ESG, or factor preferences |

| Tax Efficiency | Optimizes tax-loss harvesting to reduce capital gains | Depends on customization; can enhance tax strategies |

| Cost | Typically higher fees due to individual stock management | Higher costs due to bespoke index design and maintenance |

| Diversification | Matches diversification of the underlying index | Varies with custom criteria; may reduce or enhance diversification |

| Use Case | Investors seeking tax benefits with index exposure | Investors needing personalized investment themes |

Which is better?

Direct indexing offers precise tax-loss harvesting and personalized portfolio customization by owning individual securities, enhancing transparency and control over investment decisions. Custom indexing goes further by allowing tailored index construction based on specific client preferences, risk tolerance, and unique ESG (Environmental, Social, Governance) criteria, optimizing alignment with investor values. Both strategies improve diversification and cost efficiency compared to traditional mutual funds or ETFs, but custom indexing provides deeper customization suitable for high-net-worth individuals seeking bespoke investment solutions.

Connection

Direct indexing enables investors to own individual securities that replicate a custom index, providing personalized exposure and tax optimization benefits. Custom indexing tailors the index composition to specific investment goals, risk tolerances, or ESG criteria, which direct indexing then executes by buying the underlying stocks. This connection allows for enhanced portfolio customization, improved diversification, and cost-efficient index tracking within the realm of personalized finance strategies.

Key Terms

Personalization

Custom indexing offers unparalleled personalization by allowing investors to tailor portfolios based on specific values, tax considerations, and individual preferences, unlike direct indexing which follows a predefined benchmark with limited modifications. This approach enables precise control over asset selection and weighting, enhancing alignment with personal financial goals and ethical standards. Explore how custom indexing can revolutionize your investment personalization strategy.

Tax Efficiency

Custom indexing offers enhanced tax efficiency by enabling precise control over tax-loss harvesting and individual security selection within a portfolio compared to direct indexing. Direct indexing provides broad market exposure but may lack the tailored tax optimization capabilities found in custom indexing strategies. Explore how custom indexing can optimize your tax outcomes and improve after-tax returns.

Portfolio Construction

Custom indexing allows precise portfolio construction by tailoring holdings to specific investor preferences, tax considerations, and risk tolerance, enhancing personalization beyond standard benchmarks. Direct indexing replicates an index's performance by purchasing its individual securities, offering cost-efficiency and tax-loss harvesting opportunities within a diversified framework. Discover how these strategies can optimize your portfolio construction to align with your unique investment goals.

Source and External Links

The Ultimate Guide to Custom Index Construction - Custom indexing, also known as personalized or direct indexing, is a method of building tailored investment portfolios that mirror market indices while allowing investors to include or exclude specific stocks according to their unique goals, values, or constraints, enabling more personalized and tax-efficient investing compared to traditional ETFs or mutual funds.

Custom indexing: a powerful way to express unique investment ideas - Custom indexing uses rules-based, transparent methods to select and weight index constituents, offering clients flexibility to create nuanced and personalized indices, with tools enabling ideation, historical research, and detailed customization beyond the capabilities of traditional passive investing.

Custom Indexing: The Next Evolution of Index Investing - The future of custom indexing involves dynamic software-driven creation and management of personalized indices via separate accounts, allowing direct ownership of individual stocks and bonds that reflect each investor's circumstances and preferences and can be adjusted over time to maintain alignment with changing goals.

dowidth.com

dowidth.com