Robo advisory platforms leverage algorithm-driven financial planning with minimal human intervention, offering personalized investment strategies based on individual risk profiles and goals. ETF portfolios consist of exchange-traded funds that provide diversified exposure to various asset classes, often favored for their low costs and liquidity. Explore the advantages and differences between robo advisory services and ETF portfolios to make informed investing decisions.

Why it is important

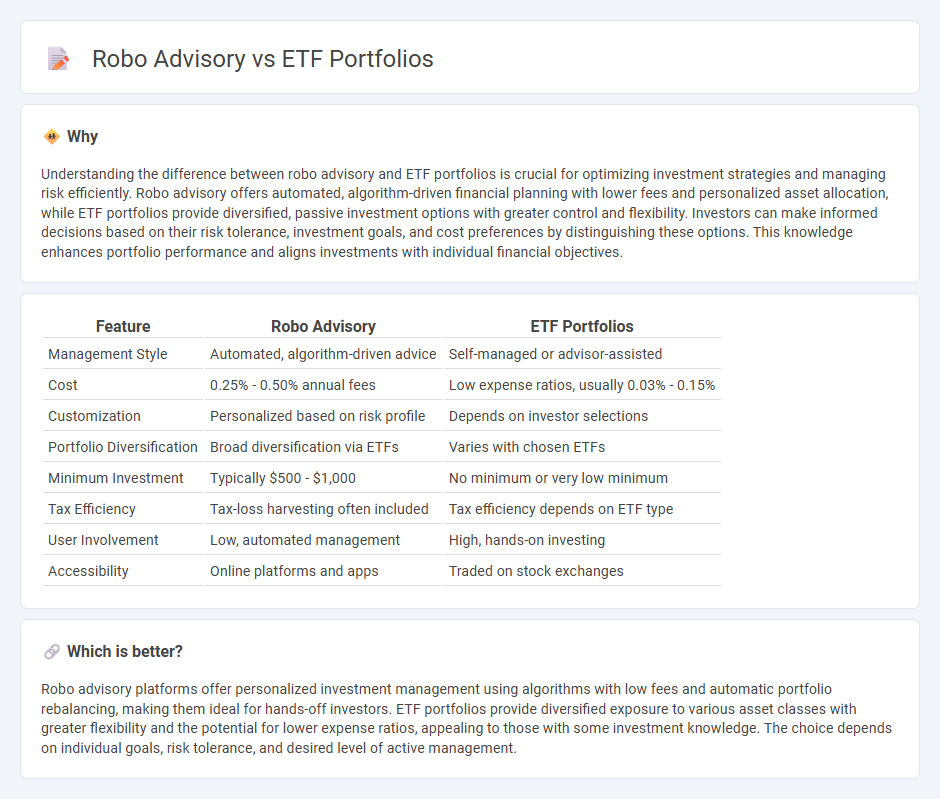

Understanding the difference between robo advisory and ETF portfolios is crucial for optimizing investment strategies and managing risk efficiently. Robo advisory offers automated, algorithm-driven financial planning with lower fees and personalized asset allocation, while ETF portfolios provide diversified, passive investment options with greater control and flexibility. Investors can make informed decisions based on their risk tolerance, investment goals, and cost preferences by distinguishing these options. This knowledge enhances portfolio performance and aligns investments with individual financial objectives.

Comparison Table

| Feature | Robo Advisory | ETF Portfolios |

|---|---|---|

| Management Style | Automated, algorithm-driven advice | Self-managed or advisor-assisted |

| Cost | 0.25% - 0.50% annual fees | Low expense ratios, usually 0.03% - 0.15% |

| Customization | Personalized based on risk profile | Depends on investor selections |

| Portfolio Diversification | Broad diversification via ETFs | Varies with chosen ETFs |

| Minimum Investment | Typically $500 - $1,000 | No minimum or very low minimum |

| Tax Efficiency | Tax-loss harvesting often included | Tax efficiency depends on ETF type |

| User Involvement | Low, automated management | High, hands-on investing |

| Accessibility | Online platforms and apps | Traded on stock exchanges |

Which is better?

Robo advisory platforms offer personalized investment management using algorithms with low fees and automatic portfolio rebalancing, making them ideal for hands-off investors. ETF portfolios provide diversified exposure to various asset classes with greater flexibility and the potential for lower expense ratios, appealing to those with some investment knowledge. The choice depends on individual goals, risk tolerance, and desired level of active management.

Connection

Robo advisory platforms utilize algorithm-driven models to create and manage ETF portfolios, offering cost-effective, diversified investment solutions tailored to individual risk profiles. These automated services continuously rebalance ETF allocations based on market data, optimizing returns while minimizing fees. Integration of robo advisors with ETF portfolios democratizes access to sophisticated financial management typically reserved for high-net-worth investors.

Key Terms

Diversification

ETF portfolios offer broad market exposure by investing in a variety of asset classes, sectors, and geographies, enhancing diversification. Robo advisory platforms use algorithms to create customized, diversified portfolios incorporating ETFs and other securities tailored to individual risk profiles. Explore how each approach maximizes diversification and meets your investment goals.

Automation

ETF portfolios offer diverse, low-cost investment options that automatically rebalance to maintain target asset allocation, enhancing automation efficiency. Robo advisory platforms integrate algorithms to manage ETF portfolios while providing personalized advice based on individual risk profiles and financial goals. Explore how automation optimizes your investment strategy with the latest innovations in ETFs and robo advisory services.

Management fees

Management fees for ETF portfolios typically range from 0.05% to 0.25%, offering cost-effective investment diversification and passive growth strategies. Robo advisory services charge higher management fees, usually between 0.25% and 0.50%, reflecting the automated, algorithm-driven portfolio management and personalized advice provided. Explore more to understand how fee structures impact your long-term investment returns and portfolio performance.

Source and External Links

ETFs and Model Portfolios Combine Forces - ETFs have evolved into versatile, transparent, and cost-effective components that are increasingly favored in model portfolios, with a growing trend toward ETF-only models mixing active and passive ETFs for improved investment management.

3 Ways to Build an All-ETF Portfolio | Charles Schwab - Building an ETF portfolio can range from simple broad-market exposure to fine-tuned portfolios with over 20 ETFs, allowing investors to target specific sectors, regions, bond types, and commodities for precise market allocation.

Create your own ETF portfolio - Vanguard - Investors can build a diversified ETF portfolio with just four total market ETFs covering U.S. and international stocks and bonds, balancing risk and simplifying portfolio management with commission-free trading.

dowidth.com

dowidth.com