Green bond laddering involves strategically staggering maturities of environmentally-focused bonds to optimize returns and manage risk, while social bonds target financing projects that address social issues such as affordable housing and healthcare. Both instruments play pivotal roles in sustainable finance portfolios by aligning investment goals with environmental and social impact objectives. Explore further to understand how these bonds can enhance your sustainable investment strategy.

Why it is important

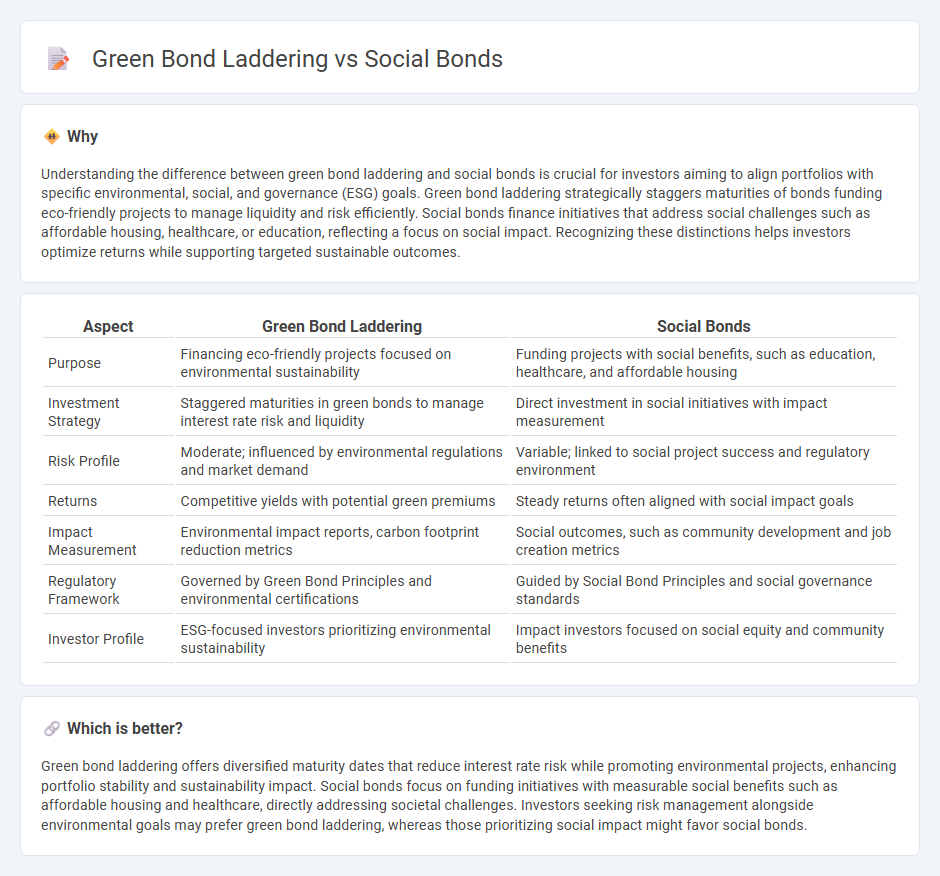

Understanding the difference between green bond laddering and social bonds is crucial for investors aiming to align portfolios with specific environmental, social, and governance (ESG) goals. Green bond laddering strategically staggers maturities of bonds funding eco-friendly projects to manage liquidity and risk efficiently. Social bonds finance initiatives that address social challenges such as affordable housing, healthcare, or education, reflecting a focus on social impact. Recognizing these distinctions helps investors optimize returns while supporting targeted sustainable outcomes.

Comparison Table

| Aspect | Green Bond Laddering | Social Bonds |

|---|---|---|

| Purpose | Financing eco-friendly projects focused on environmental sustainability | Funding projects with social benefits, such as education, healthcare, and affordable housing |

| Investment Strategy | Staggered maturities in green bonds to manage interest rate risk and liquidity | Direct investment in social initiatives with impact measurement |

| Risk Profile | Moderate; influenced by environmental regulations and market demand | Variable; linked to social project success and regulatory environment |

| Returns | Competitive yields with potential green premiums | Steady returns often aligned with social impact goals |

| Impact Measurement | Environmental impact reports, carbon footprint reduction metrics | Social outcomes, such as community development and job creation metrics |

| Regulatory Framework | Governed by Green Bond Principles and environmental certifications | Guided by Social Bond Principles and social governance standards |

| Investor Profile | ESG-focused investors prioritizing environmental sustainability | Impact investors focused on social equity and community benefits |

Which is better?

Green bond laddering offers diversified maturity dates that reduce interest rate risk while promoting environmental projects, enhancing portfolio stability and sustainability impact. Social bonds focus on funding initiatives with measurable social benefits such as affordable housing and healthcare, directly addressing societal challenges. Investors seeking risk management alongside environmental goals may prefer green bond laddering, whereas those prioritizing social impact might favor social bonds.

Connection

Green bond laddering enhances portfolio diversification by staggering maturity dates of environmentally focused investments, which aligns with the social impact goals of social bonds targeting community development and social welfare projects. Both financial instruments attract socially responsible investors aiming to achieve measurable environmental and social outcomes, thereby integrating sustainability into fixed-income strategies. This connection facilitates long-term capital allocation towards projects that generate positive social and environmental benefits while managing investment risk.

Key Terms

Use of Proceeds

Social bonds channel funds towards projects with positive societal impacts, such as affordable housing and healthcare, ensuring measurable social outcomes. Green bond laddering involves structuring green bonds with staggered maturities to optimize funding for environmental projects focused on climate change mitigation and renewable energy. Discover how strategic use of proceeds in these bonds drives sustainable investments.

Impact Measurement

Social bonds emphasize funding projects with measurable social benefits, utilizing frameworks like IRIS+ for impact measurement to ensure transparency and accountability. Green bond laddering involves staggered issuance of green bonds aligned with environmental milestones, monitored through specific KPIs such as carbon emission reductions and biodiversity preservation metrics. Explore how these innovative approaches enhance impact measurement and deliver sustainable value by diving deeper into their methodologies.

Maturity Structure

Social bonds primarily target projects with social impact objectives and often feature shorter maturity structures to align with community development timelines. Green bond laddering involves staggering maturities across various tenors to optimize funding for environmental projects while managing interest rate risk and cash flows. Explore how different maturity strategies influence the risk and return profiles of these sustainable investment instruments.

Source and External Links

Building Social Bonds | NIH News in Health - Social bonds are strong, healthy relationships that affect mental, emotional, and physical well-being, linking to stress reduction, heart health, and longer life, with early emotional bonds shaping lifelong social skills and relationship health.

Social Bonds: Definition & Benefits - Nasdaq - Social bonds are fixed-income financial instruments issued to raise capital for projects with measurable social benefits, like affordable housing and healthcare, supporting sustainable and socially responsible investment goals.

Social impact bond - Wikipedia - Social impact bonds are outcome-based contracts where investors fund social programs and are repaid by governments only if the projects meet agreed social outcomes, aiming to finance prevention efforts in social and health sectors.

dowidth.com

dowidth.com