Synthetic assets replicate the performance of real assets such as stocks, commodities, or bonds through financial derivatives and contracts without direct ownership. Real assets consist of tangible items like real estate, precious metals, or physical commodities that have intrinsic value and can generate cash flow or appreciate over time. Explore the distinctions and benefits of synthetic versus real assets to optimize your investment strategy.

Why it is important

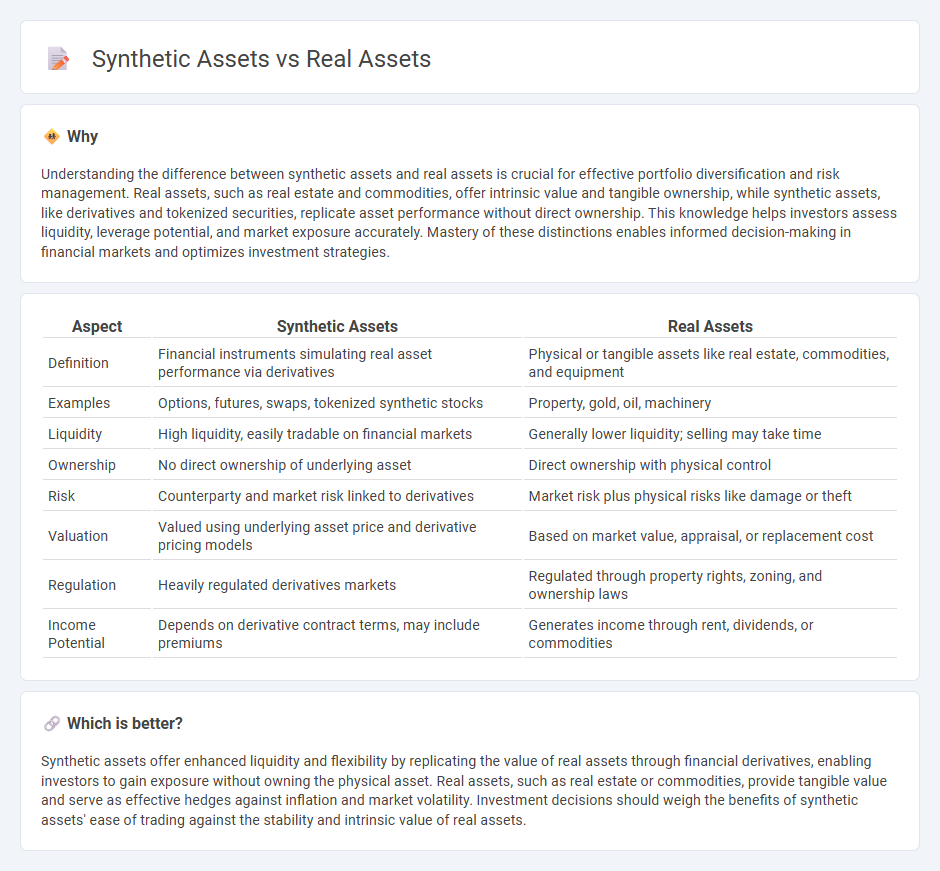

Understanding the difference between synthetic assets and real assets is crucial for effective portfolio diversification and risk management. Real assets, such as real estate and commodities, offer intrinsic value and tangible ownership, while synthetic assets, like derivatives and tokenized securities, replicate asset performance without direct ownership. This knowledge helps investors assess liquidity, leverage potential, and market exposure accurately. Mastery of these distinctions enables informed decision-making in financial markets and optimizes investment strategies.

Comparison Table

| Aspect | Synthetic Assets | Real Assets |

|---|---|---|

| Definition | Financial instruments simulating real asset performance via derivatives | Physical or tangible assets like real estate, commodities, and equipment |

| Examples | Options, futures, swaps, tokenized synthetic stocks | Property, gold, oil, machinery |

| Liquidity | High liquidity, easily tradable on financial markets | Generally lower liquidity; selling may take time |

| Ownership | No direct ownership of underlying asset | Direct ownership with physical control |

| Risk | Counterparty and market risk linked to derivatives | Market risk plus physical risks like damage or theft |

| Valuation | Valued using underlying asset price and derivative pricing models | Based on market value, appraisal, or replacement cost |

| Regulation | Heavily regulated derivatives markets | Regulated through property rights, zoning, and ownership laws |

| Income Potential | Depends on derivative contract terms, may include premiums | Generates income through rent, dividends, or commodities |

Which is better?

Synthetic assets offer enhanced liquidity and flexibility by replicating the value of real assets through financial derivatives, enabling investors to gain exposure without owning the physical asset. Real assets, such as real estate or commodities, provide tangible value and serve as effective hedges against inflation and market volatility. Investment decisions should weigh the benefits of synthetic assets' ease of trading against the stability and intrinsic value of real assets.

Connection

Synthetic assets replicate the value and performance of real assets through financial instruments such as derivatives, enabling investors to gain exposure without owning the physical asset. These synthetic constructs are closely linked to real assets like stocks, commodities, or real estate, as their prices are derived from the underlying asset's market value. This connection allows for increased liquidity, risk management, and diversification opportunities in financial markets.

Key Terms

Tangibility

Real assets, such as real estate, gold, and infrastructure, possess intrinsic tangibility, providing physical substance and inherent value. Synthetic assets, created through financial engineering like derivatives and tokenized securities, lack physical form but replicate real asset exposure using underlying contracts or algorithms. Discover the key differences and implications of tangibility in real versus synthetic assets.

Derivatives

Real assets represent tangible investments like real estate or commodities, offering intrinsic value and physical ownership. Synthetic assets in derivatives mimic the payoff of real assets through financial contracts without owning the underlying, enabling leveraged exposure and hedging strategies. Explore the nuances of derivatives to understand how synthetic assets replicate real asset performance in diverse market conditions.

Underlying value

Real assets, such as real estate and commodities, possess intrinsic value derived from their physical properties and scarcity, providing tangible security and inflation hedging. Synthetic assets replicate the performance of real assets through derivatives or blockchain-based tokens, lacking physical backing but offering enhanced liquidity and customizable exposure. Explore how underlying value influences investment choices between real and synthetic assets in dynamic markets.

Source and External Links

On solid ground: foundations of real assets investing | Nuveen - Real assets include real estate, infrastructure, and commodities, providing portfolio diversification, inflation hedging, and income through investments linked directly to physical assets like properties, pipelines, and commodities, which often maintain long-term value better than traditional stocks and bonds.

Real Assets vs. Financial Assets | Difference + Examples - Real assets are tangible resources such as land, infrastructure, and commodities, whose intrinsic utility supports inelastic demand and low correlation to stocks and bonds, making them valuable for portfolio diversification and protection against inflation.

Master of Science in Global Real Assets - Georgetown University - Real assets are broadly defined as raw materials and structures driving economic growth including real estate, infrastructure, and energy sectors, and specialized education programs in this field focus on combining real estate, infrastructure, finance, and sustainability to prepare students for evolving market dynamics.

dowidth.com

dowidth.com