Collateralized reinsurance involves a reinsurer fully collateralizing the risk, providing secured capacity against catastrophic losses, while industry loss warranties (ILWs) are parametric contracts triggered by predefined industry-wide loss thresholds. Both tools enable risk transfer in the insurance and reinsurance markets, offering different mechanisms for capital efficiency and loss protection. Explore how these financial instruments impact risk management in insurance portfolios.

Why it is important

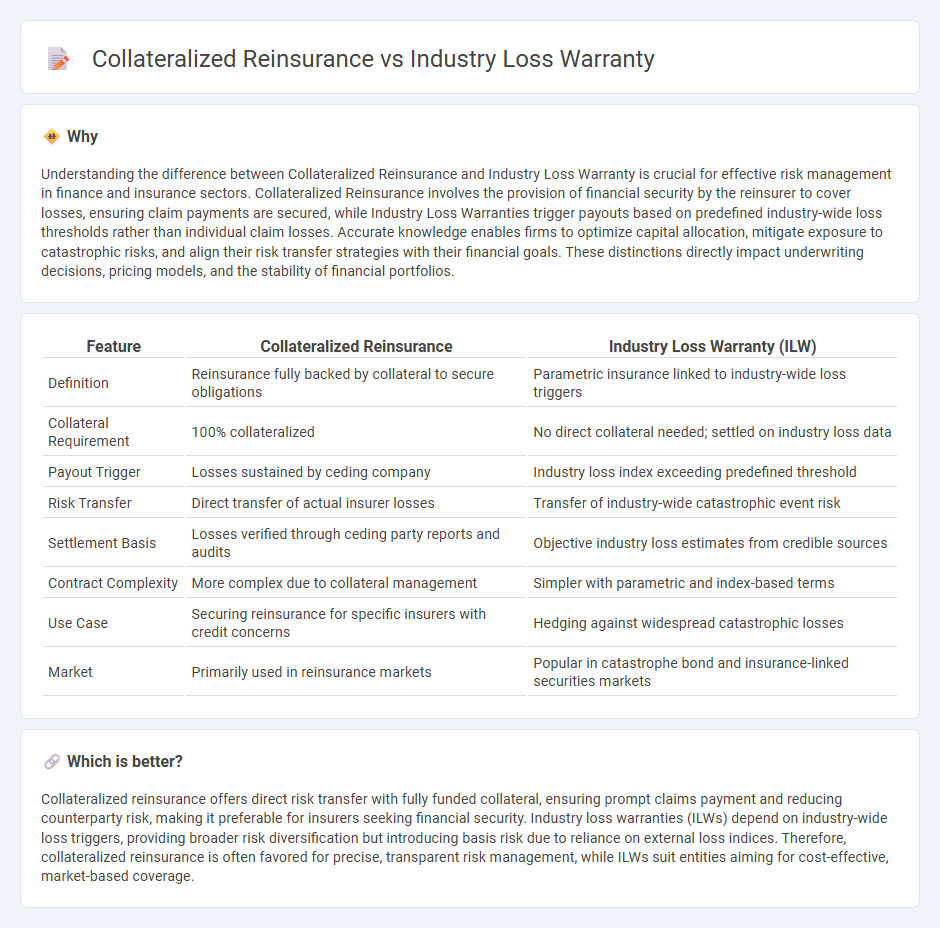

Understanding the difference between Collateralized Reinsurance and Industry Loss Warranty is crucial for effective risk management in finance and insurance sectors. Collateralized Reinsurance involves the provision of financial security by the reinsurer to cover losses, ensuring claim payments are secured, while Industry Loss Warranties trigger payouts based on predefined industry-wide loss thresholds rather than individual claim losses. Accurate knowledge enables firms to optimize capital allocation, mitigate exposure to catastrophic risks, and align their risk transfer strategies with their financial goals. These distinctions directly impact underwriting decisions, pricing models, and the stability of financial portfolios.

Comparison Table

| Feature | Collateralized Reinsurance | Industry Loss Warranty (ILW) |

|---|---|---|

| Definition | Reinsurance fully backed by collateral to secure obligations | Parametric insurance linked to industry-wide loss triggers |

| Collateral Requirement | 100% collateralized | No direct collateral needed; settled on industry loss data |

| Payout Trigger | Losses sustained by ceding company | Industry loss index exceeding predefined threshold |

| Risk Transfer | Direct transfer of actual insurer losses | Transfer of industry-wide catastrophic event risk |

| Settlement Basis | Losses verified through ceding party reports and audits | Objective industry loss estimates from credible sources |

| Contract Complexity | More complex due to collateral management | Simpler with parametric and index-based terms |

| Use Case | Securing reinsurance for specific insurers with credit concerns | Hedging against widespread catastrophic losses |

| Market | Primarily used in reinsurance markets | Popular in catastrophe bond and insurance-linked securities markets |

Which is better?

Collateralized reinsurance offers direct risk transfer with fully funded collateral, ensuring prompt claims payment and reducing counterparty risk, making it preferable for insurers seeking financial security. Industry loss warranties (ILWs) depend on industry-wide loss triggers, providing broader risk diversification but introducing basis risk due to reliance on external loss indices. Therefore, collateralized reinsurance is often favored for precise, transparent risk management, while ILWs suit entities aiming for cost-effective, market-based coverage.

Connection

Collateralized reinsurance involves the ceding insurer posting collateral to secure the reinsurance obligation, ensuring prompt payment in the event of a loss. Industry Loss Warranties (ILWs) serve as financial derivatives triggered by the magnitude of industry-wide losses, providing coverage based on predefined loss thresholds. Both instruments mitigate risk by transferring exposure to third parties and rely on quantifiable loss metrics, linking their roles in managing catastrophic event financial impacts within the insurance and reinsurance sectors.

Key Terms

Trigger Event

Industry loss warranty (ILW) triggers payments based on the magnitude of a publicly recognized industry loss, typically measured by benchmark losses from catastrophic events such as hurricanes or earthquakes. Collateralized reinsurance relies on predefined individual loss thresholds specific to the ceding insurer's portfolio rather than industry-wide benchmarks, requiring collateral to cover potential claims. Explore deeper distinctions and applications to optimize risk transfer strategies.

Collateral

Collateralized reinsurance involves posting collateral to secure obligations, ensuring prompt payment of claims and reducing counterparty risk compared to traditional Industry Loss Warranties (ILWs). Unlike ILWs, which rely on specific industry loss triggers, collateralized reinsurance provides direct financial backing, enhancing trust among reinsurers and cedents. Explore further to understand how collateral enhances risk transfer efficiency in reinsurance agreements.

Payout Structure

Industry loss warranties (ILWs) offer payouts triggered by broad industry-wide losses exceeding predetermined thresholds, providing a straightforward parametric trigger based on third-party industry loss indices. Collateralized reinsurance involves direct funding from the reinsurer, with payouts depending on specific losses ceded by the insurer, often requiring detailed loss verification and collateral held in trust to secure obligations. Explore more about the comparative benefits and applications of these payout structures in risk management.

Source and External Links

Industry loss warranty - Industry loss warranties (ILWs) are reinsurance contracts where protection is purchased based on the total losses to the insurance industry from a catastrophic event exceeding a predefined trigger, rather than on the buyer's own losses; payouts occur if industry losses surpass this trigger amount.

What are industry loss warranties (or ILW's)? - ILWs function as insurance or derivative contracts triggered by total industry losses above a threshold, often used to hedge exposure during or after catastrophe events, with different types such as Live Cat (traded during an event) and Dead Cat (traded post-event).

Industry Loss Warranties (ILW) - ILWs are insurance-linked securities designed to cover infrequent catastrophic risks like hurricanes or earthquakes, with pay-outs tied to industry-wide loss indices and contract trigger thresholds, structured either on a single occurrence or aggregate event basis.

dowidth.com

dowidth.com